This week’s best investing news:

‘Big Short’ Investor Michael Burry Says Meme Stock Crash is Coming (Validea)

Trend Following (Verdad)

Enemies Real and Imagined (Epsilon Theory)

The Highest Forms of Wealth (Collaborative Fund)

The Zomato IPO: A Bet on Big Markets and Platforms! (Aswath Damodaran)

Inflation, Deflation, Disinflation (Barry Ritholz)

Star stock pickers exist, but do they add value? (Larry Swedroe)

In Search of Compounders (Novel)

Greenwood Second Quarter 2021 Letter: Doubling Down (Greenwood)

Leon Cooperman: ‘Inflation is a friend of common stocks’ (CNBC)

Leaving the Country (Humble Dollar)

Bill Ackman FULL CNBC Segment: SEC concerns killed PSTH x Universal Music deal (CNBC)

Introducing Behavioral Finance Theory For Individual Investors (Sure Dividend)

Sam Zell Shelves Real Estate Acquisitions (WTI)

Why Math Class Is Boring—and What to Do About It (Farnam Street)

The Death of Discernment (Frank Martin)

How Companies Create Value for Shareholders (Part 2) (VVI)

Ignore The Bond Market Flapdoodle (GMM)

The Illusion of Choice in Consumer Goods (DGI)

Price -Usually- Cures Price (Brinker)

What Happens if the 60/40 Portfolio Underperforms for a Decade? (Behavioural Investment)

Lights Out – Learning from GE (IMC)

Ensemble Q2 2021 Update (Ensemble)

The Chobani Story (Neckar)

When Is Enough, Enough? (DGS)

Chris Davis Semi-Annual Review 2021 (Davis)

Customers as Owners (Tanay)

Are Market Capitalization Weighted Indexes Too Concentrated in the Biggest Stocks? (Elm)

Royce Opportunistic Value Strategy—2Q21 Strategy Update and Outlook (Royce)

158: Fin-FANG Redux, Constellation Software Organizational Design (Liberty)

Watch on Inflation, 2021 (Roger Lowenstein)

Mental momentum investors (Klement)

How Crypto Gets Hacked – The Flash Boys of Crypto (Furball)

Giverny Capital Q2 2021 (Giverny)

This week’s best value Investing news:

Pzena Staying the Course – Inflation and Value Investing (Pzena)

Don’t Give Up on Value Stocks (Barron’s)

What Happened to Price-to-Book Ratio in Value Investing? (Bloomberg)

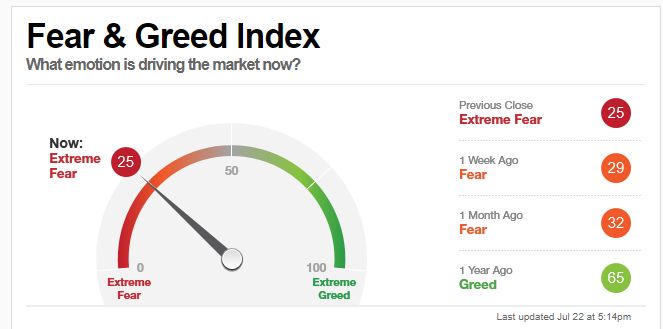

This week’s Fear & Greed Index:

Extreme Fear.

This week’s best investing podcasts:

Grantham: This is a bubble, this is serious (Rules of Investing)

Steve Mandel – Investing Behind Change (Invest Like The Best)

326- Bill Ackman’s Investing Checklist Part 3 (InvestED)

TIP362: Amazon Unbound w/ Brad Stone (TIP)

Ep. 184 – Price Matters with Chris Bloomstran (PlanetMicroCap)

The Secret To Berkshire Hathaway’s Success (CMQ Investing)

Inflation: Understanding the History [2021] (WealthTrack)

Brian Deese on Unleashing Competition (MIB)

David Hay On Balancing Risk Management With Timely Opportunism (Felder)

Holding a Mirror Up to the Stock Market (What Goes Up)

Self-Taught Quant (guest: Harel Jacobson) (Market Huddle)

The Convexity Benefits of Short-Selling (Zer0esTV)

How Peter Lynch Became an Investing Legend (Ep. 382) (Dave Lee)

Greg Obenshain – Quantitative Credit (S4E12) (Flirting With Models)

Private Equity Masters 5: Virginie Morgon – Eurazeo (Capital Allocators)

The Science of Hitting with Alex Morris (Capital Employed)

Behind the Markets Podcast: Dan Doney (Behind The Markets)

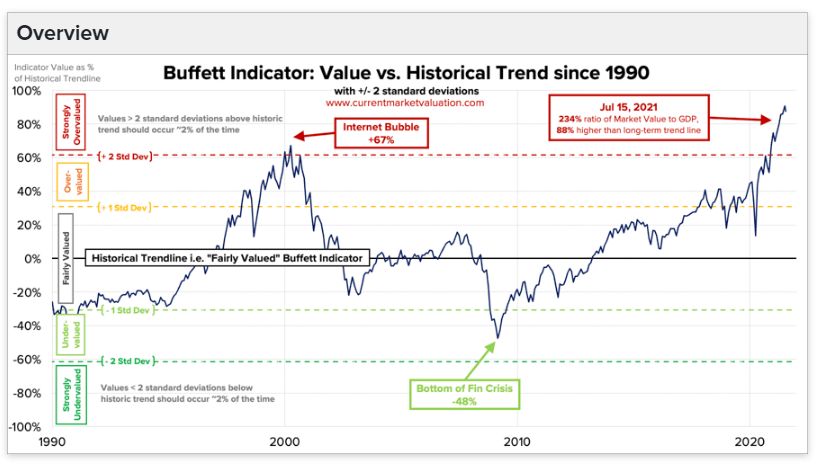

This week’s Buffett Indicator:

Strongly Overvalued.

This week’s best investing research:

The Role of Book-to-Market in Bond Returns (AlphaArchitect)

The Fed’s Blindspot on Global Inflation Drivers (CFA)

2021 is Not as Good as 2017 (PAL)

The Bubble In Stupid Speculation Is Over (MacroTourist)

Uncertainty and Treasury yields – Forecast disagreement impacts yields (DSGMV)

What’s Driving the Electric Revolution? (All Star Charts)

What About Beta? | The Demise of Alpha (AllAboutAlpha)

This week’s best investing tweet:

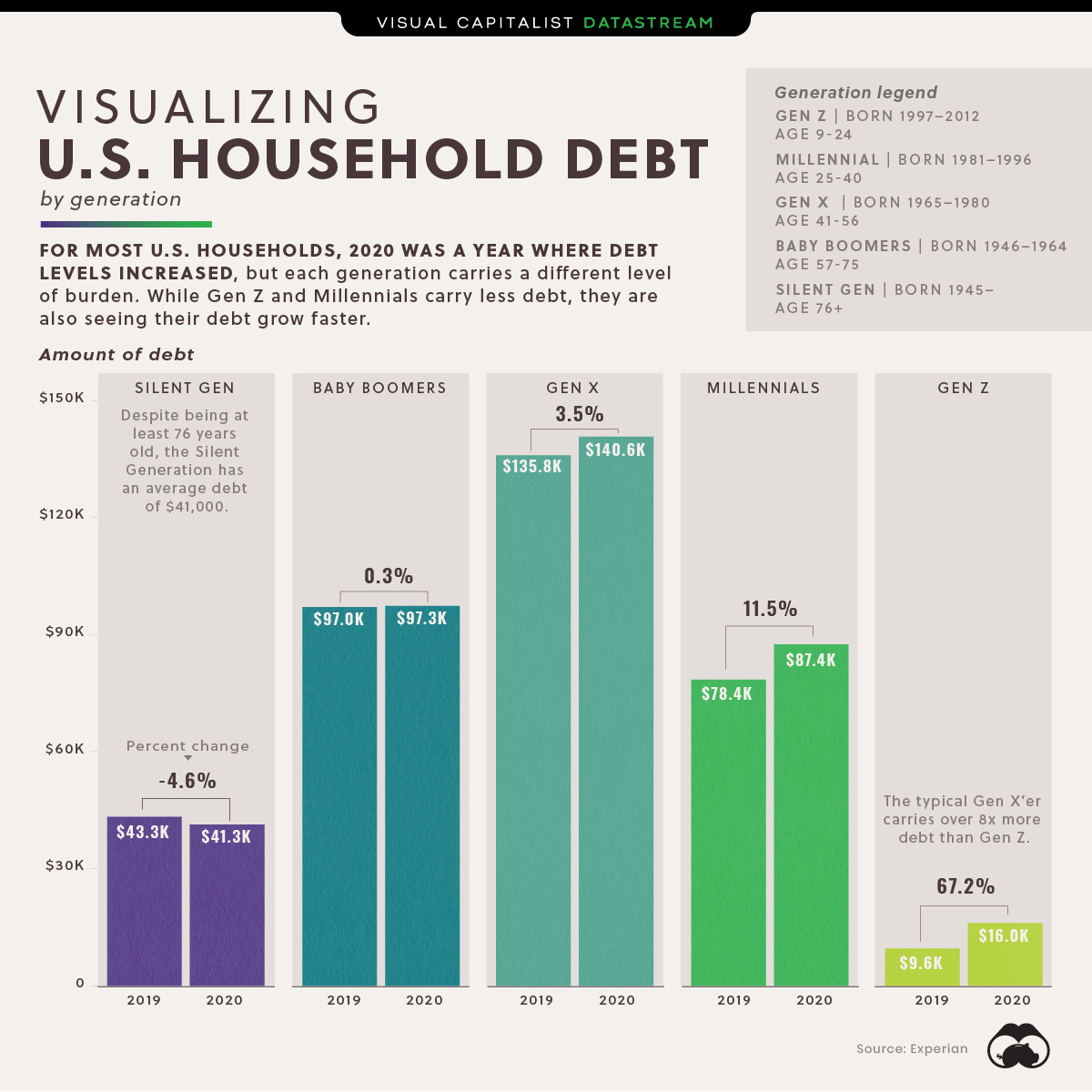

This week’s best investing graphic:

Visualizing U.S. Household Debt, by Generation (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: