This week’s best investing news:

Cash and Equivalents (Verdad)

The Underrated Role of Behavior in Investing (Validea)

What is Robinhood? (Epsilon Theory)

Dealing With Mistakes (Neckar)

In Investing, Don’t Sweat the Small Stuff (NY Times)

Ken Fisher Discusses Meme Stocks (video) (Fisher)

Cathie Wood Takes A Non-consensus View (WTI)

Charlie Munger: 11 Intelligent Things To Do (CMQ)

Disclosure Dilemma: When more (data) leads to less (information)! (Aswath Damodaran)

My ‘Too Hard’ Pile Is Pretty Big (Morningstar)

GMO – Growth vs Value Reversals (GMO)

Fintech vs. Banks (No Mercy/No Malice)

Joel Greenblatt: The Time I Met Warren Buffett (video) (KP)

The Fed Should Stop Using the Term “Transitory” (PragCap)

Investing Wisdom Worth Learning (Novel Investor)

Laverne & Shirley; Jordan & Pippen; Earnings & Interest Rates (Brinker)

Transcript: Christine Hurtsellers (Barry Ritholtz)

Real Trees Don’t Grow To The Sky (GMM)

Keeping Our Heads (Humble Dollar)

Cryptocurrencies: Do they serve the public interest? (EB Investor)

Chat with Sucheta Dalal and Debashis Basu on Absolute Power (Fundoo Professor)

Inflation-Hedging Investments (Brian Langis)

How Description Leads to Understanding (Farnam Street)

Dividends vs. Stock Buybacks (DGS)

Too Smart (Collaborative Fund)

2021: The Half Year in Charts (Compound Advisors)

Learning from John D Rockefeller (IMC)

Duolingo and Consumer Subscription Businesses (Tanay)

155: The Microsoft Inside Apple, Invidia (not a typo), ByteDance IPO, the REALIST Tech Stack (Liberty)

Such are market reactions to fundamental news (Klement)

Snapshot USA (Roger Lowenstein)

Sequoia Q2 2021 Commentary (Sequoia)

Royce – Opportunistic Value Strategy—2Q21 Strategy Update and Outlook (Royce)

Bill Nygren Market Commentary | 2Q21 (Oakmark)

Bill Miller 2Q 2021 Market Letter (Miller Value)

Wedgewood Q2 2021 (Wedgewood)

Longleaf Commentary Q2 2021 (Longleaf)

This week’s best value Investing news:

Is value investing dead? — AI in Value Investing (Medium)

Quant Legend Cliff Asness Is Back to Defending Value Again (Bloomberg)

Value Stocks’ Fate May Hinge on Pinpointing Bull Market’s Age (Bloomberg)

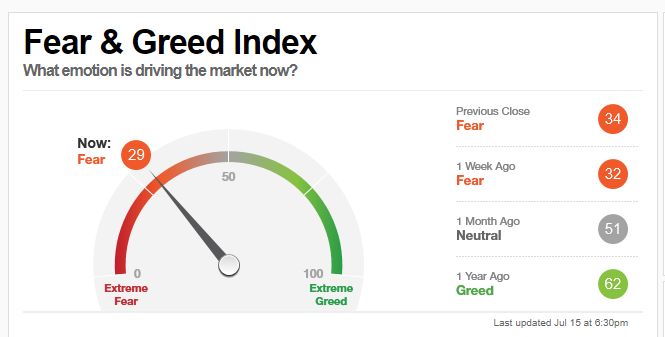

This week’s Fear & Greed Index:

Fear.

This week’s best investing podcasts:

TIP360: Inside The Money Mind of Warren Buffett w/ Robert Hagstrom (TIP)

The Underrated Role of Behavior in Investing with Joe Wiggins (Excess Returns)

Dan Rasmussen — Crises Investing (Infinite Loops)

Private Equity Masters 4: David Rubenstein – Carlyle Group (Capital Allocators)

David Sacks – How to Operate a SaaS Startup (Invest Like The Best)

325- Michael Burry’s 13F Report (InvestED)

Episode #329: Samantha McLemore, Miller Value Partners (Meb Faber)

Christine Hurtsellers on the Business of Trust (MIB)

David Herro: ‘We Are Not at All Afraid to Vary From an Index’ (Long View)

Ep. 183 – Business is the Monetization of Life with Mark Jones (Planet MicroCap)

EP 318. Hunting for 10-Baggers: 9-Point Investing Checklist (Focused Compounding)

Quality, Value, and Safety, with Siddharth Singhai (Capital Employed)

#115 Danny Meyer – Hospitality and Humanity (Knowledge Project)

S11 E3 Paul Christopher of Wells Fargo Investment Institute (Sherman)

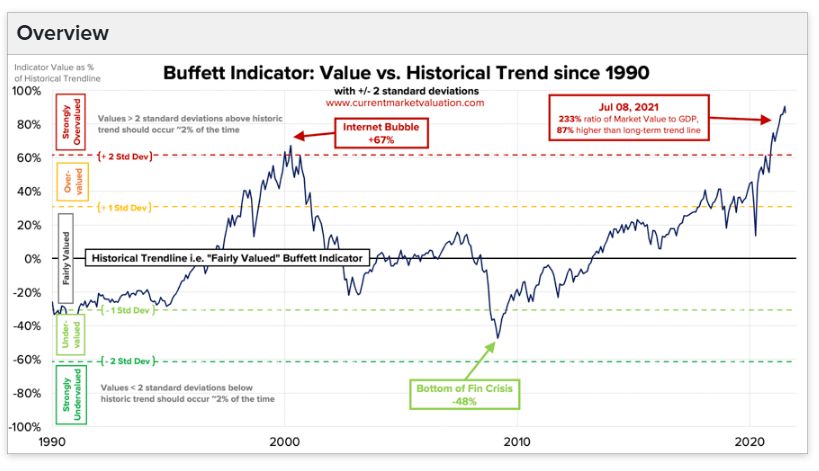

This week’s Buffett Indicator:

Strongly Overvalued.

This week’s best investing research:

The Misery Index and Future Equity Returns (Alpha Architect)

Factset Key Metrics (Factset)

Treasury yield curve dynamics (DSGMV)

The Bears Are Hibernating (All Star Charts)

Taper Talk (Macro Tourist)

Low- or High-Volatility: Which Wins the Return Battle? (CFA)

Building a Long Volatility Strategy Without Using Options (CAIA)

This week’s best investing tweet:

This week’s best investing graphic:

Coffee vs Tea vs Soft Drinks: What Caffeine Drinks Do Countries Prefer? (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: