Here’s a list of this week’s best investing news:

Berkshire Hathaway 2021 Annual Meeting Insights (BVI)

A History of Commodity Booms & Busts (Jamie Catherwood)

Crazy New Ideas (Paul Graham)

Berkshire Hathaway’s Stock Price Is Too Much for Computers (WSJ)

The Limits of Investing Sanity (Collaborative Fund)

Graham & Doddsville Newsletter Spring 2021 (Columbia)

Old Men Yell at Cloud (Jason Zweig)

Howard Marks: 2021 Virtual Value Investing Conference | Keynote Speaker (Ivey)

Session 24: Acquirers’ Anonymous: Seven Steps to Sobriety (Aswath Damodaran)

Bill Miller on Market Opportunities (Validea)

Bruce Greenwald: ‘decreasing importance’ of economic relationship between U.S. and China (Yahoo)

The Martingale Market (Epsilon Theory)

What’s Up? (Humble Dollar)

David Swensen, Yale Endowment Chief Who Changed the Course of Institutional Investing, Dies at 67 (WSJ)

Bill Ackman: latest SPAC news and how to make his portfolio (Interactive Investor)

Higher Ed 2.0 (What We Got Right/Wrong) (Scott Galloway)

Take A Bow, Jay Pow! (Felder)

Expect robust economy going into first half of 2022: Gamco’s Mario Gabelli (CNBC)

Look for the ‘Fat Pitches’ (Whitney Tilson)

Counting the Chickens Twice (Hussman)

Billionaire Leon Cooperman Says Bond Market Is in a Bubble (Bloomberg)

The Rationality of INEPT (Investment Entertainment Pricing Theory) (Frank Martin)

Peter Lynch’s advice to Bill Miller (Alpha Ideas)

Efficiency is the Enemy (Farnam Street)

Stocks, Bonds, and Higher Inflation (Compound Advisors)

The Theory of Stock Exchange Speculation by Arthur Crump (Novel Investor)

Oops they, did it again … (Real Returns)

Finding it Hard to Hire? Try Raising Your Wages (Barry Ritholz)

Use Charlie Munger’s Simple System To Discover Uncommon Sense (CMQ)

If it feels like markets behave differently today, you’re not wrong (Klement)

The Secret Ingredient of Dividend Growth Stocks (DGS)

The unbundling of banks (Prdctnomics)

Why Do Fund Investors Neglect Base Rates? (Behavioural Investment)

Smart People With Bad Takes…Bitcoin, Robinhood and Price Pays (Howard Lindzon)

Not to Get Technical, But Let’s Get Technical (Brinker)

The Year of Living Dangerously (Absolute Return)

Farnam Street Q1 2021 (Farnam Street)

Tweedy Browne Q1 2021 Letter (Tweedy Browne)

Jack Henry & Associates, Inc. (JKHY) CEO David Foss on Q3 2021 Results – Earnings Call (Seeking Alpha)

The Psychology of Value Creation (Greenwood)

Berkshire Hathaway Q1 2021 10Q (Berkshire)

FPA Crescent Fund Q1 2021 Commentary (FPA)

Pzena Earnings Call Q1 2021 (Pzena)

Greenhaven Road Q1 2021 (Greenhaven)

Alta Fox Q1 2021 (Alta Fox)

Tobias’ Daily Quotes On Instagram

Get daily quotes from Tobias Carlisle’s best selling books, plus video clips and latest updates on Instagram here: instagram.com/acquirersx/

This week’s best value investing news:

The Next Decade in European Value (Verdad)

Resurrecting the Value Premium (Alpha Architect)

Is value making a comeback? (EB Investor)

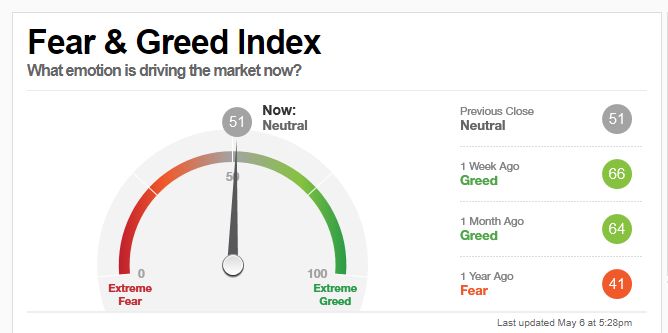

This week’s Fear & Greed Index:

This week’s best investing research:

“I’m a Growth Investor” (All Star Charts)

Peak Diversification: How Many Stocks Best Diversify an Equity Portfolio? (CFA)

Backwardated commodities are beating stocks – A rotation to the real economy (DGGMV)

Year-Over-Year Commodity Growth Could Be just Hype (PAL)

Inflation Is Running Rampant (UPFINA)

GOVT DEFICITS = Private Sector Surpluses (MacroTourist)

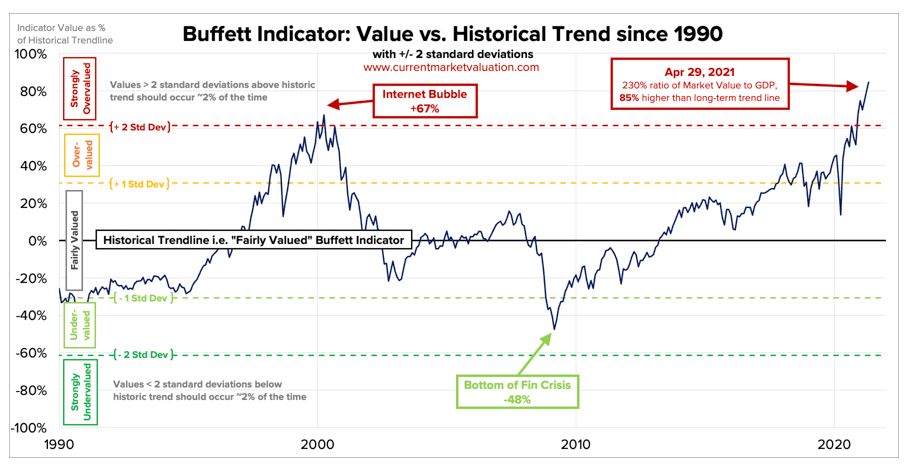

This week’s Buffett Indicator:

This week’s best investing tweet:

This week’s best investing podcasts:

TIP347: Value Investing in 2021 w/ Mohnish Pabrai (TIP)

Ep. 173 – In Life and Investing, Enjoy the Work, Enjoy the Process, It’s Worth It with Guy Spier, Managing Partner and Principal at Aquamarine Capital (Planet MicroCap)

Vitaliy’s Talk with Indiana University Students, Part 2 – Ep 124 (Intellectual Investor)

Six Potential Metrics to Help Limit Value Traps (Excess Returns)

Cem Karsan – The Market Voting Machine (S4E1) (Flirting with Models)

Jonathon Jacobson and Staley Cates – 25 Years of Shared Values in Value Investing (Price-To-Value)

Portfolio Diversification and Yields in 2021 (Morningstar)

The Distinctiveness and Future of Berkshire Hathaway | Uncertainty and Risk in Investing (Intelligent Investing)

315- Berkshire Hathaway Meeting Highlights and Implications (InvestED)

Jeremy Raper – Credit Focused Equity (Business Brew)

Jeremiah Lowin — Embracing Uncertainty (EP.46) (Infinite Loops)

Make Bold Guesses and Weed Out Failures (Naval)

Andrew Sugrue – Investing in Paradigm Shifts – [Invest Like the Best, EP. 224] (Invest Like The Best)

#110 Jim Collins: Relationships vs. Transactions (Knowledge Project)

Katy Milkman on How to Change (EconTalk)

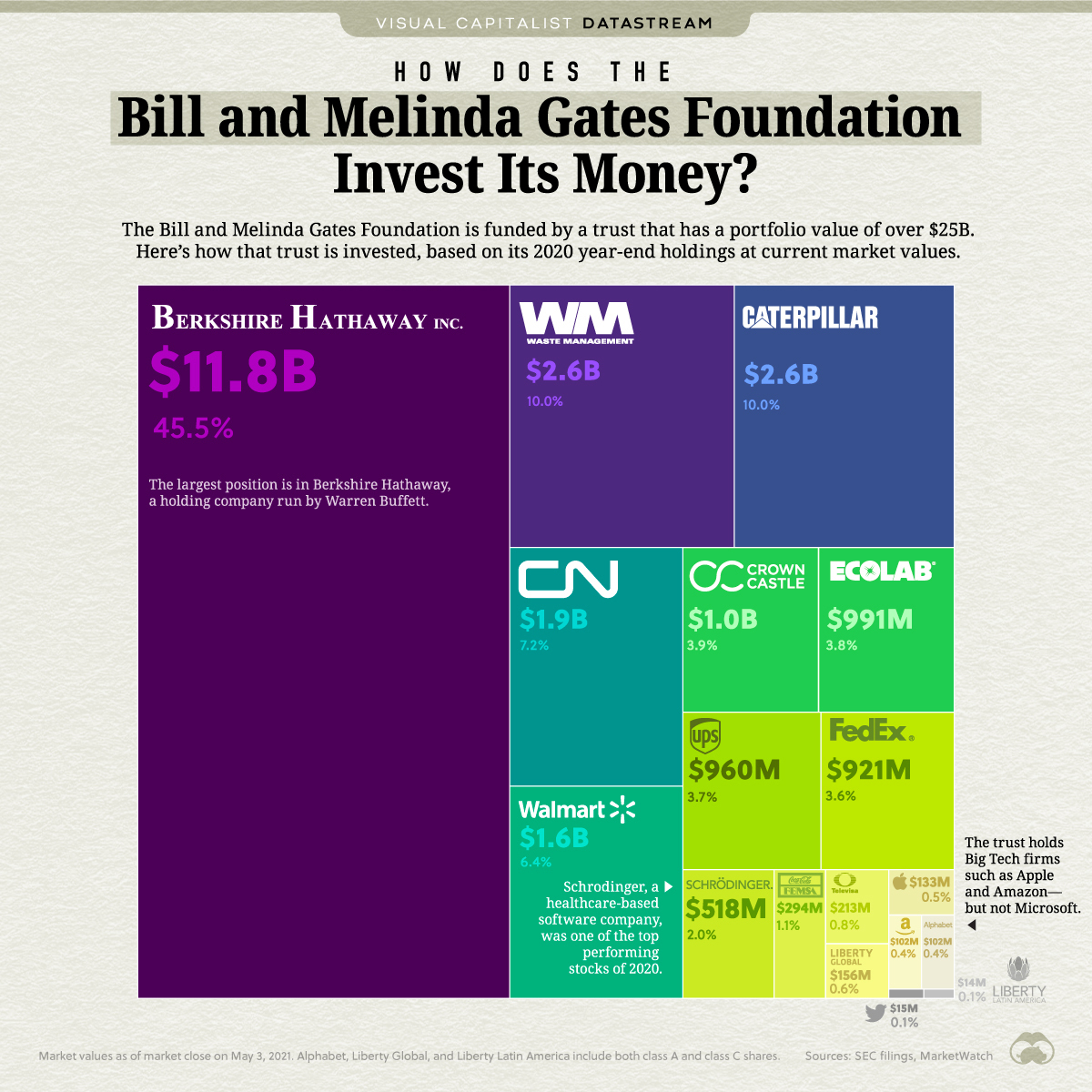

This week’s best investing graphic:

How Does the Bill and Melinda Gates Foundation Invest Its Money? (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: