Here’s a list of this week’s best investing news:

Times of Fraud, Mania & Chicanery (Jamie Catherwood)

The Rise and Fall of Commodity Indices (Verdad)

Icahn on Inflation, Investing, and What He Misses About NYC: Q&A (Bloomberg)

Inflation and Investing: False Alarm or Fair Warning? (Aswath Damodaran)

Investors Are No Longer Bearish Bank Stocks (But Maybe They Should Be) (Felder)

Robert Shiller: ‘Wild West’ mentality is gripping housing, stocks and crypto (CNBC)

How to Do Long Term (Collaborative Fund)

Memo to SEC: don’t enable the bitcoin bubble (Roger Lowenstein)

Americans are All In on the Stock Market (Validea)

Unhedged: Talking bubbles with Jeremy Grantham (FT)

The Complete List Of Q1 2021 Hedge Fund Letters To Investors (VVI)

Better Thinking & Incentives: Lessons From Shakespeare (Farnam Street)

Picking Problems (Humble Dollar)

Do Low Interest Rates Justify High Valuations? (Compound Advisors)

Gabelli, Russo – From Graham to Buffett and Beyond (Columbia)

Buybacks and Dividends: Sizing the Upswing (CFA)

Sam Zell’s success in business in seven rules (DSGMV)

Using History’s Lessons to Evaluate Today’s Investments (Morningstar)

Two Monks and One Big Lesson in Life and Investing (Safal Niveshak)

Two Quality Small-Cap Cyclicals (Royce)

The Kolkata Value Hunters Club; Q&A with Mohnish Pabrai (Mohnish Pabrai)

Cold Calling (finally) Dies (Barry Ritholz)

Am I getting old? (Klement)

Who’s Influenced by Behavioral Biases? Everyone (Morningstar)

Fintech and Regulatory Arbitrage (Tanay)

The Cost of Cloud, a Trillion Dollar Paradox (Andreessen Horowitz)

CNBC’s full interview with Liberty Media’s John Malone on WarnerMedia-Discovery deal (CNBC)

ESG: manufacturers, not energy companies, are the main culprits (EB Investor)

Are We Talking About, Talking About Tapering? (Brinker)

Everything Wrong with the “Money Printer Go Brrrr” Meme (PragCap)

Greenhaven Road Q1 2021 (Greenhaven)

Tobias’ Daily Book Quotes & Latest News On Instagram

Get daily quotes from Tobias Carlisle’s best selling books, plus video clips and latest updates on Instagram here: instagram.com/acquirersx/

This week’s best value investing news:

The Next Generation Of Would-Be Buffett’s (Barron’s)

How Classic Value Metrics Performed this Century (Novel Investor)

Value and Momentum Investing: Combine or Separate? (Alpha Architect)

Will 2021 Be the Year for Value Stocks? (Kiplinger)

The state of value investing vs. value rotation (Yahoo)

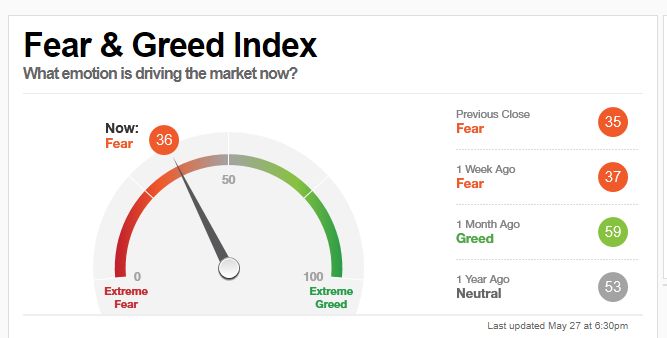

This week’s Fear & Greed Index:

This week’s best investing research:

Stock & Bond Correlations (UPFINA)

Bearish or Bullish: What Systemic Risk? (All Star Charts)

Investing in NFTs: Why It Matters (AllAboutAlpha)

Performance of a Volatility Trading Strategy (PAL)

Overnight Reverse Repo Program Arb (MacroTourist)

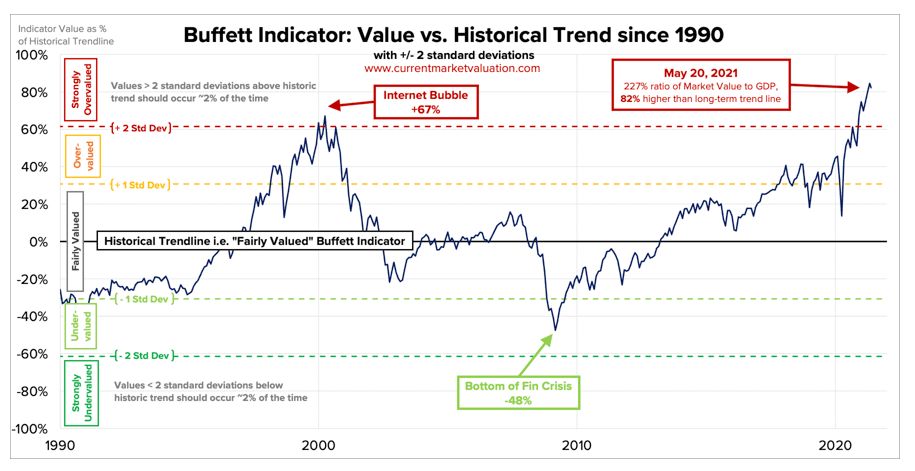

This week’s Buffett Indicator:

This week’s best investing tweet:

This week’s best investing podcasts:

CMQ Podcast: Charlie Munger’s Favorite Mental Trick (Inversion) (CMQ)

What Valuation Can Tell You About the Market – And What it Can’t (Excess Returns)

Faster Pace of Consolidation (Barron’s)

Tina Lindstrom – Commodity Volatility (S4E4) (Flirting with Models)

EP 312. Capital Allocation, 1966-1972: Diversified Retailing, Blue Chip Stamps, and See’s Candies (Focused Compounding)

Behind the Markets Podcast: Corey Hoffstein on Model Portfolios (Behind The Markets)

Ep. 176 – MicroCap Investing Story Time with Ben Claremon and Eugene Robin, Cove Street Capital (Planet MicroCap)

What Do Investors Want? (Morningstar)

Ep 108. Share Investing Q&A: Blue chip stocks, takeovers and jargon galore! (Rask)

David Barr – A True Business Owner (Business Brew)

Michael S. Falk — A Passionate Advocate For Economic Growth (EP.49) (Infinite Loops)

TIP350: Berkshire Hathaway Annual Shareholders Meeting 2021 w/ Stig and Trey (TIP)

Bond Investors: New Opportunities and Challenges [2021] (WealthTrack)

The Market’s Obsession With What’s Next | Investing in the Unknown and Unknowable (Intelligent Investing)

Justin Fishner-Wolfson – Secondary Investing in Private Markets (Invest Like the Best)

Ashby Monk – Innovation in Institutional Portfolios (Capital Allocators, EP.196) (Capital Allocators)

5GQ Adam Mead – The Complete Financial History of Berkshire Hathaway (5 Good Questions)

This week’s best investing graphic:

Amazon’s Most Notable Acquisitions to Date (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: