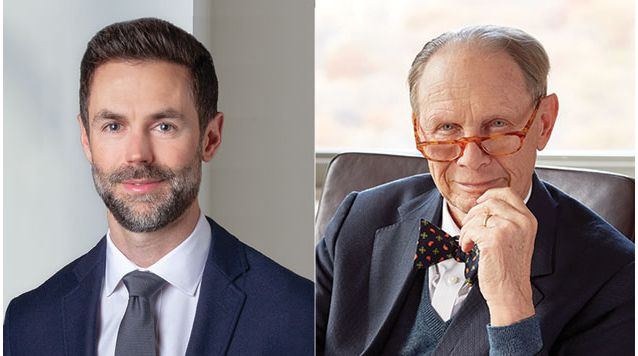

In this interview, Chuck Royce and Miles Lewis from Royce Investment Partners discuss a number of topics including, refining their dividend value approach, what they look for in dividend-paying small caps, and where the current opportunities lie. Here’s an excerpt from the interview:

What factors are among the most important when you look at a company?

ML: We see dividends as a potential sign of high quality in a company, as they often signal thoughtful capital allocation habits, management’s confidence in the company’s prospects, and strong free cash flow of the underlying business. However, we also understand that a dividend itself can be a limited proxy for overall quality.

In order to gain more insight, we move on to a more thorough nuanced analysis after we’ve identified dividends payers. Our first question is very simple and important: is this a good business? To understand this, we study the economics of the business, its competitive landscape, the sources and duration of its competitive advantage, and the reasons why a customer chooses to purchase the company’s product or service.

Where does the analysis go from there? Are there additional steps?

ML: When our analysis suggests that we’ve found a good business, we then examine the financials to see if the numbers support our views—the quality should show up in the financial statements. The specific areas we focus on include returns on invested capital, balance sheet strength, capital intensity, and our ‘North Star’: free cash flow. The final step is arguably our most important—we rigorously analyze the risk factors of each business we evaluate. Our goal is to create a short thesis on each company we evaluate that allows us both to more fully vet key risk factors and identify any we may have missed.

You can read the entire interview here:

https://www.royceinvest.com/insights/2021/2Q21/refining-our-dividend-value-approach

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: