The latest piece from Royce Investment Partners discusses why the current small-cap value cycle will continue to last. Here’s an excerpt from the article:

Among the most common questions we’re hearing from clients currently is, “Will small-cap value’s recent outperformance last?” While developing a response about any future market direction is challenging, the long-awaited value resurgence has frustrated as many of us as it’s pleased, feeling at times like a perpetual disappointment reminiscent of Waiting for Godot. Is it really here? Will it stay with us? We think the answers are ‘yes,’.

Small-cap value has so handily outperformed small-cap growth over the past six months (by 25.7%) that some investors have asked us whether there would be a trend reversal to growth leadership or a trend persistence of value leadership.

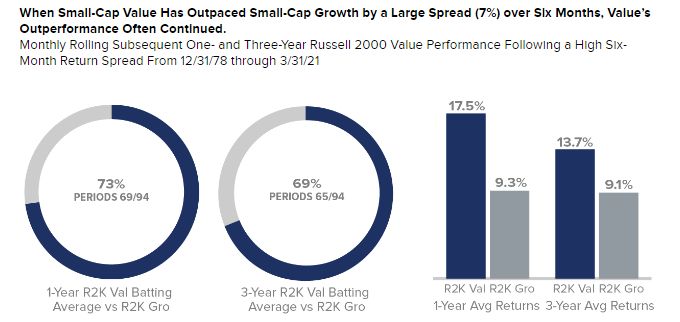

We did some historical research to see when value led growth by comparably large amounts, using 700 bps over trailing six-month periods as our measure, to examine the subsequent experience. We found that the existing leadership trend for value has historically persisted.

More specifically, in the subsequent 12 months, after an outperformance period of at least 700 bps, value beat growth 71% of the time by an annualized average of 820 bps; in the subsequent three-year periods, value beat growth 69% of the time by an annualized average of 460 bps.

To answer the initial question, because of the current phase of the economic cycle, the compositional differences between value and growth, the extreme spread in relative valuation, and the historical pattern of trend persistence after large spreads in value outperformance, yes, we think that small cap value will continue to lead.

You can read the entire article here:

Will The Small Cap Value Cycle Last?

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: