In their latest Q1 2021 Quarterly Letter, GMO say, “that speculation is a much bigger driver in the stock market today than is normally the case.” The result may lead to today’s high fliers being the most likely to fall back to Earth. Here’s an excerpt from the letter:

While there is plenty of anecdotal evidence that significant parts of the stock market are being driven by speculation rather than investment, we don’t need to rely on anecdotes for a demonstration.

The explosion in the use of derivatives that are purely speculative in nature shows a stark change in the motivations of a significant fraction of market participants. It is almost unquestionable that speculation is a much bigger driver in the stock market today than is normally the case.

Speculative booms are not guaranteed to end badly, but they normally do and that seems to be particularly true in the stock market. I’d argue that an important cause of this eventuality is that the stock market is adept at giving speculators what they crave, and scarcity is necessary to keep prices above their fundamentals for an extended period.

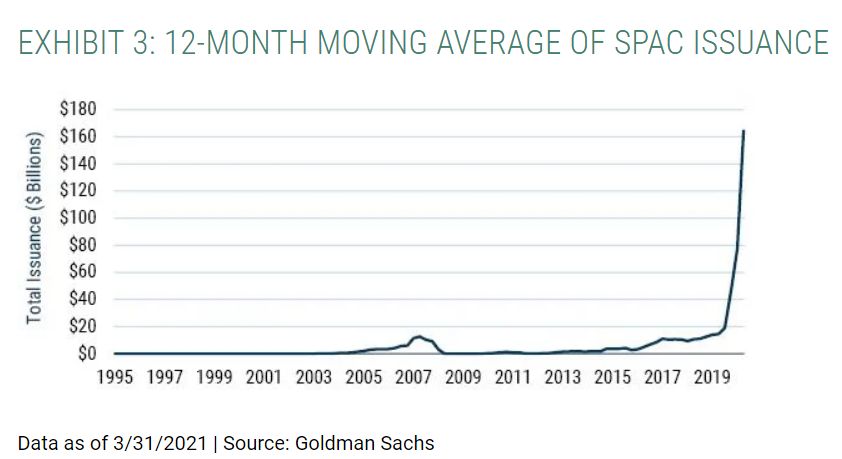

Today’s stock market is seeing the largest burst of issuance we’ve seen in over a generation. Furthermore, the form of much of that issuance – SPACs – seems tailor-made to deliver additional supply of capital to exactly those areas speculators are most in love with at the time.

While that can lead to lovely outcomes for the managers of the SPACs, it is likely to both reduce the scarcity premium of the narratives that speculators are in love with and reduce the return on capital of the fundamental activities that the influx of capital will join.

This makes me believe that the timescale for the eventual deflation of the current speculative bubble is unlikely to be all that long. What form it will take is more difficult to say. The signs of speculation are obvious in the market today but determining how wide the mania has spread is trickier.

While almost all the U.S. stock market is trading at very expensive levels relative to history, it is hard to determine whether a holder of, say, Microsoft or Johnson & Johnson is an investor who is content to earn 3% real in the long run from a high quality company in the context of low cash and bond yields, or a speculator who is betting the company will generate double-digit returns despite its high valuation.

If the whole of the market is dominated by speculators with outsized expectations, it seems likely that deflation in the obviously speculative tier will take the overall market with it. If those speculators are coexisting with investors who recognize the impact that high valuations will have on potential returns but accept those lower returns, it may be that the losses will be more contained to today’s highest fliers, who have already started showing some signs of weakness even as the market continues making new highs.

Even in that case, the viability of the rest of the market seems to be crucially dependent on the combination of economic growth solid enough to keep corporate profitability strong and not so strong as to reignite inflationary concerns. That is a tightrope that will be far from easy for the market to navigate indefinitely, but the timescale of the market’s fall from that narrow wire is harder to estimate.

You can read the entire letter here:

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: