Here’s a list of this week’s best investing news:

Fireside Chat – Value Investing in China with Himalaya Capital’s Li Lu and professor Bruce Greenwald (CBS Greater China Society)

Death to the Lost Decade (Verdad)

The Big Lessons of the Last Year (Collaborative Fund)

Drawing the Narrative Battle Lines (Epsilon Theory)

We Might Be in a Bubble, But You Probably Shouldn’t Care (Validea)

Q&A: Finding 100-Baggers (Woodlock House)

Macro Risks To The Stock Market Are Mounting (Felder)

We (might) Work (Scott Galloway)

Drawdowns, EPS Growth + Relative Performance (Barry Ritholz)

The Follies of Speculation in 1875 (Novel Investor)

Three Things I Think I Think – Housing Bubble 2.0, Passive Investing and Hyperinflation (PragCap)

“When People Stop Being Polite, and Start Getting Real” (Brinker)

What Does a Manufacturing Boom Mean for Stocks? (Compound Advisors)

Warren Buffett and Charlie Munger on Leverage (DGI)

Social Conscience: The New Asset Management Competitive Advantage (Real Returns)

High-Octane Earnings (Dr Ed)

Avoid this stinker: ARK Space Exploration ETF; Short reports on EBON, RIDE (Whitney Tilson)

Does Sustainable Investing Change What Shareholders Want? (Behavioural Investment)

Peter Thiel on China, Bitcoin (Buy The Rumor)

Compilation: Charlie Munger on the circle of competence (CMQ)

Refreshing Revenue, the Cash Conversion Cycle, and Free Cash Flow (CFA Institute)

Focus is not a Habit, Constellation Software Q1 M&A, (Liberty)

Attempting the Impossible (Neckar)

Startups and TAMs (Tanay)

SPACS: The Pain Isn’t Over Yet (MacroTourist)

Liquid Alts Revival? (Phil Huber)

Aswath Damodaran: Pricing Analytics and Examples (Aswath Damodaran)

Warren Buffett Talks About Bill Ackman & Herbalife (SCAM?) (BB)

Bill Nygren Market Commentary | 1Q21 (Oakmark)

Oaktree’s Howard Marks Says This Is the Time to Try to Be Resourceful (Bloomberg)

Jamie Dimon’s Letter To Shareholders (JP Morgan)

RV Capital: More Accuracy (RV Capital)

Citadel Securities Gets the Spotlight (Bloomberg)

Vanguard Mishap Leads to an Estimated $200 Million Windfall for Investors (Morningstar)

Enough with the: “Go with an index fund from Vanguard” (Reddit)

Individual Investors Retreat From Markets After Show-Stopping Start to 2021 (WSJ)

Royce: 1Q21 Small-Cap Recap (Royce)

Why Portfolio Diversification Still Works (Morningstar)

This week’s best value investing news:

Why UK value stocks will prove to be the ‘trade of the decade’ (AFR)

Value Stocks Have Roared Back (Barron’s)

Value Stocks Showing Signs Of Awakening (Forbes)

The demise of value investing may be greatly exaggerated (Investors Chronicle)

Flight to Value Stocks Hits ESG Funds (WSJ)

Maverick’s big bets on unloved stocks pay off in value rally (FT)

Value Investing Is Back – Is It Here To Stay? (Seeking Alpha)

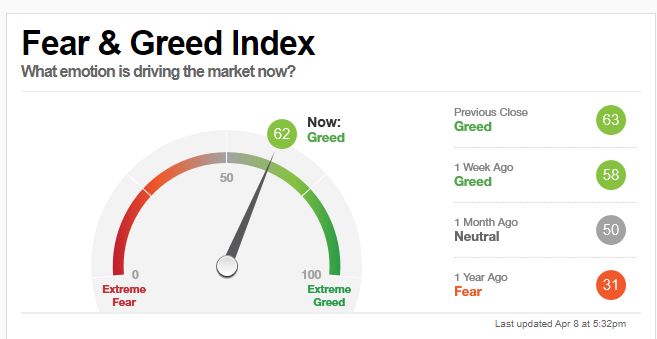

This week’s Fear & Greed Index:

This week’s best investing research:

Trend-Following Filters – Part 3 (Alpha Architect)

This Economic Data Point Is A Bearish Signal (UPFINA)

Generating Alpha With Leverage (PAL)

The ladder of causality -The basis for nay investment analysis and AI (DSGMV)

Breadth Thrusts & Bread Crusts: Learning to Swing at the Fat Pitches (AllStarCharts)

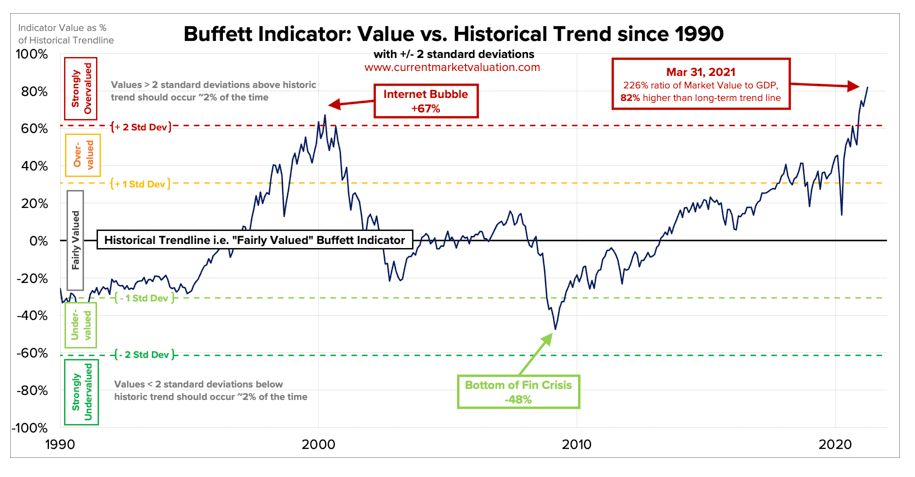

This week’s Buffett Indicator:

This week’s best investing tweet:

This week’s best investing podcasts:

Tobias Carlisle: The Value vs Growth Stalemate (Premium) (Real Vision)

The Strengths and Weaknesses of the Major Value Metrics (Excess Returns)

#132: Leadership Chat: Risk Parity with RPAR’s Alex Shahidi (Absolute Return)

Prepping Portfolios for Inflation (Barron’s)

EP 301. Capital Allocation, 1967-1969: Buffett Buys National Indemnity (Focused Compounding)

Bill Brewster – Asking Tough Questions (EP.41) (Infinite Loops)

Kyle Cerminara – All In (Business Brew)

TIP343: How to Invest like the Best w/ Ted Seides (TIP)

Special: Surviving 20+ Years, Stitch Fix Deep Dive, with Mario Cibelli and Elliot Turner (Intelligent Investing)

MacroVoices #266 Jesse Felder: Macro Roadmap for the S&P500 (Macro Voices)

Ep. 168 – GARP Investing Since Day 1 with Ethan Tucker, Editor at TheGarpInvestor.com (Planet MicroCap)

Mike Kerns and Jesse Jacobs – Content to Commerce (Invest Like the Best)

We Might Be in a Bubble, But You Probably Shouldn’t Care (Validea)

First Eagle – Matthew McLennan – Protecting Portfolios While Participating in the Bull Market (WealthTrack)

John Rogers, Jr.: ‘Be Willing to Talk About These Uncomfortable Issues’ (The Long View)

Is Apple’s Privacy Push Facebook’s Existential Threat? (Sway)

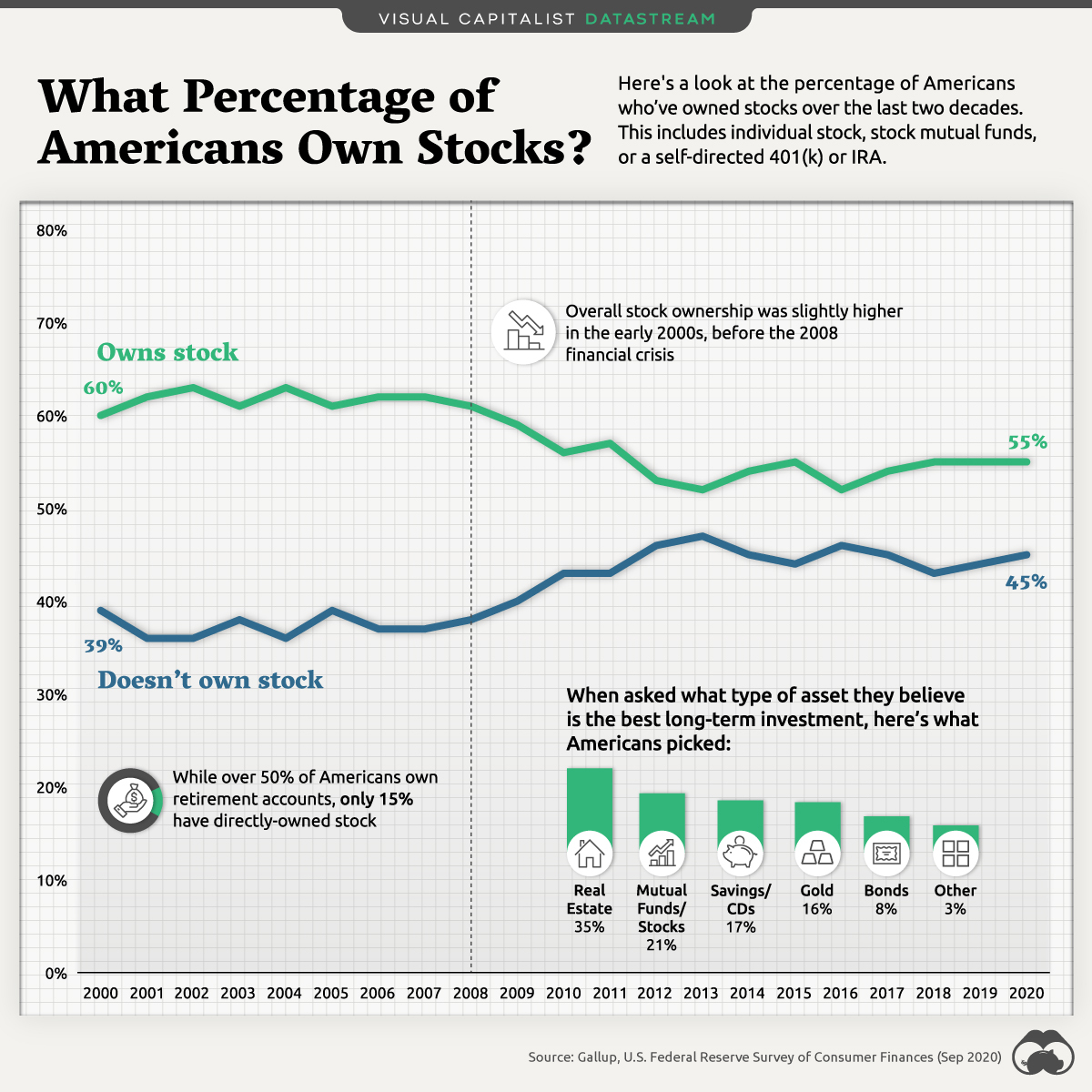

This week’s best investing graphic:

In One Chart: Two Decades of Stock Ownership in America (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: