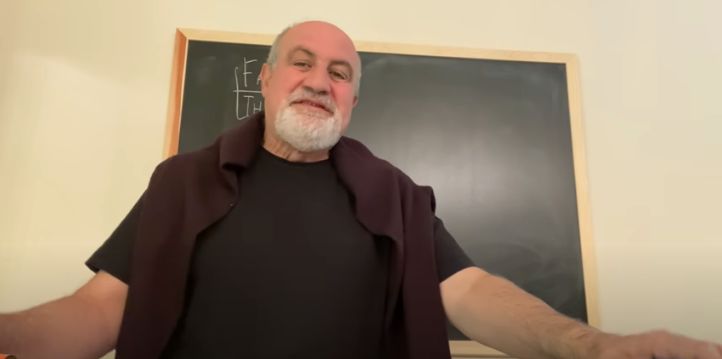

In the latest episode of his excellent mini-series, Nassim Nicholas Taleb discusses an introductory lesson on fat-tails using the example of Bill Gates, Warren Buffett, or Jeff Bezos compared to the global population. Here’s an excerpt from the episode:

Welcome back to the series on statistics and probability, especially probability. You start with probability and try to be as clear as possible about the concepts because as we will see many professionals make mistakes. Why? Lack of clarity of mind, lack of understanding of the core concepts.

So let’s start with the mother of all problems fat-tails, or more scientifically it’s called thick tails. Fat-tails being a special case of very very thick tails, but casually we can call them fat-tails. So what are fat-tails?

Whenever I ask people they tend to answer, well you know remote events, events of big impact tend to happen more often. No, it’s the opposite. Remote events happen less often but when they happen they command much greater effect on the total properties.

So the definition of fat-tail is a small number of observations in a given data set will represent the bulk of statistical properties. So let’s take a case of an extreme fat-tail process.

You remember we had a million minus one observation as zero, and then we had one observation at a million. What is the average? One. But most of it, all of it came from one observation that fat-tail.

You sample from the population of the planet. You got three, four billion people who have no money. You add Bill Gates randomly of the people on your hero list. Jeff Bezos, Warren Buffett, either one of them is the entire wealth plus noise, you’ll have loads of noise here. So that’s a fat-tail process.

You can watch this episode of the mini-series here:

Taleb: MINI-LESSON, 2. Fat Tails, a Very, Very Introductory Presentation

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: