Here’s a list of this week’s best investing news:

Charlie Munger: 2021 Daily Journal Annual Meeting Transcript (Junto)

Terry Smith Annual Shareholders’ Meeting Presentation February 2021 (Fundsmith)

A Strategy for Emerging Market Crises (Verdad)

The Opposite of 2008 (Epsilon Theory)

No Room on the ARK? (Morningstar)

Peter Lynch is the GOAT (Barry Ritholz)

Be Like Warren Buffett. Use This Options Strategy (Barron’s)

Your Thinking Rate Is Fixed (Farnam Street)

Mario Gabelli on what he learned from Warren Buffett’s 2021 letter (CNBC)

The Long Run Is Lying to You (Cliff Asness)

Full Collection Nomad Letters (igyfoundation)

Dr. Copper Delivers A Diagnosis Of Inflation (Felder)

Warren Buffett’s Dividend Payback (DGI)

Aswath Damodaran on the COVID Crucible: A Play in Three Acts (CFA)

Interview with Jeffrey Gundlach & Felix Zulauf (Double Line)

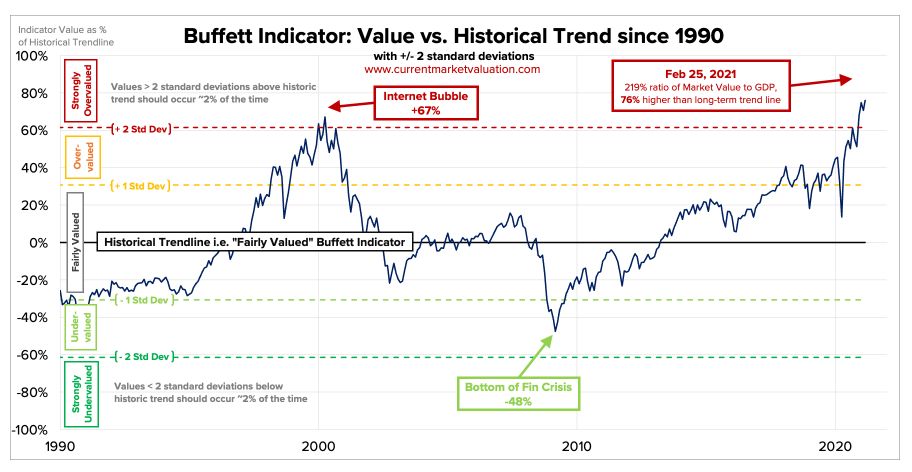

Even a modified ‘Buffett Indicator’ is more bearish than ever (MarketWatch)

Leon Cooperman calls Elizabeth Warren’s wealth tax ‘foolish,’ says she doesn’t understand buybacks (CNBC)

JPMorgan CEO Jamie Dimon on Markets, Economy, Returning to Office (Bloomberg)

Euphoria (Brain Langis)

Lessons from the 2020 Berkshire Letter (Novel Investor)

A Billion a Day (Compound Advisors)

Two by Two (Scott Galloway)

How Worrisome is the Rise in Interest Rates? (PragCap)

Warren Buffett’s Big Investing Mistake (Behavioral Value)

Oakmark’s Bill Nygren discusses the two different markets (CNBC)

ETSY: Empowering Millions Of Shops Around The Corner (Saber)

Reflation Nation (Humble Dollar)

The Fast-Developing World of NFTs (Whitney Tilson)

Charlie Munger: The mental models I used to become successful in life (Investing Wisdom)

Warren Buffett & Elon Musk Argue Over MOAT (Business Basics)

Why Own Treasuries? (VSG)

The Inflation Story (Behavioural Investment)

Has Persistence Persisted in Private Equity? Evidence from Buyout and Venture Capital Funds (bfi.uchicago)

Robinhood Won’t Survive Long-Term & Multiple Mental Models Explain Why (CMQ)

Jonathan Boyar Discusses Warren Buffet’s Annual Letter (Boyar)

Stuck in the Middle with You (Furball)

The Transcript 03.01.20 (The Transcript)

SPAC Week…SPACs Are Here To Stay This Time…BUT…. (Howard Lindzon)

Digital gold: the institutional case for Bitcoin (Real Returns)

And another unintended consequence of negative interest rates (Klement)

The rise of NFTs (Tanay)

To Infinity and Beyond! (DGS)

Are laggards turning into leaders? (Gist)

Investing in Whatnot (Andreessen Horowitz)

This week’s best value investing news:

Value Investing Is Finding Favor in Emerging Markets. Here’s What To Own Now (Barron’s)

Why everything is coming up value (AFR)

How Most Value Managers are Getting it All Wrong (Validea)

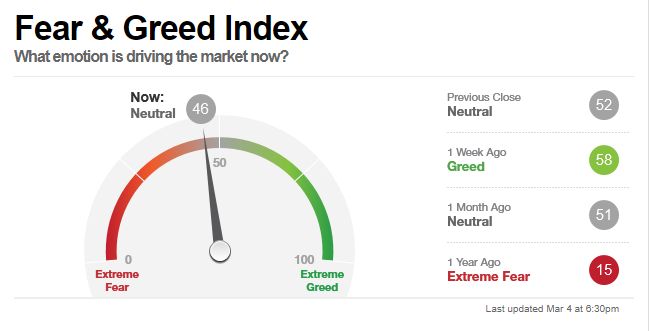

This week’s Fear & Greed Index:

This week’s best investing research:

Momentum Factor Investing: What’s the Right Risk-Adjustment? (Alpha Architect)

The Big Battle Of 2021: Godzilla Vs Kong, Or The Market Vs The Fed? (Brinker)

Momentum crashes should be expected – Herds and information (DSGMV)

Passive Investors Are Losing The Most! (All Star Charts)

Reaching for Yield in Decentralized Finance (All About Alpha)

Why This QE Is Different In One Chart (GMM)

The Battle for Irrelevant Statistics Reporting (PAL)

Historical Post Pandemic Recovery Trends (UPFINA)

This week’s Buffett Indicator:

This week’s best investing tweet:

This week’s best investing podcasts:

Dr. John Malone Joins Us For Our 100th Episode (KindredCast)

Bridgeway Founder John Montgomery On Their Unique Culture and Lessons From a 25+ Year Career in Quant Investing (Excess Returns)

Warren Buffett’s Letter to Berkshire Hathaway Shareholders: Answering YOUR Questions (Focused Compounding)

Jack Clark – Grateful for Everything, Entitled to Nothing (Invest Like the Best)

Ep. 163 – Looking for Multi-Baggers with Dave Barr, President, CEO and Portfolio Manager at PenderFund Capital Management (Planet MicroCap)

Crazy Commodity Cycles (and cross-continent motorcycles) with Jim Rogers (RCM)

Ian Cassel – Micro Machine (Business Brew)

Go Ahead, Covet Your Neighbor’s Wife. – Ep 114 (Intellectual Investor)

Elon Musk Talks About Colonizing the Galaxy (Joe Rogan)

Lottery Tickets and Position Sizing | Earnings Season Investment Process (Intelligent Investing)

Anna Nikolayevsky – The Value of Independent Thought (VIL)

TIP338: Current Market Conditions – 27 February 2021 w/ Stig and Trey (TIP)

Financial Bubbles of Historic Proportions (WealthTrack)

Has the Equity Bubble Burst? (Zer0es TV)

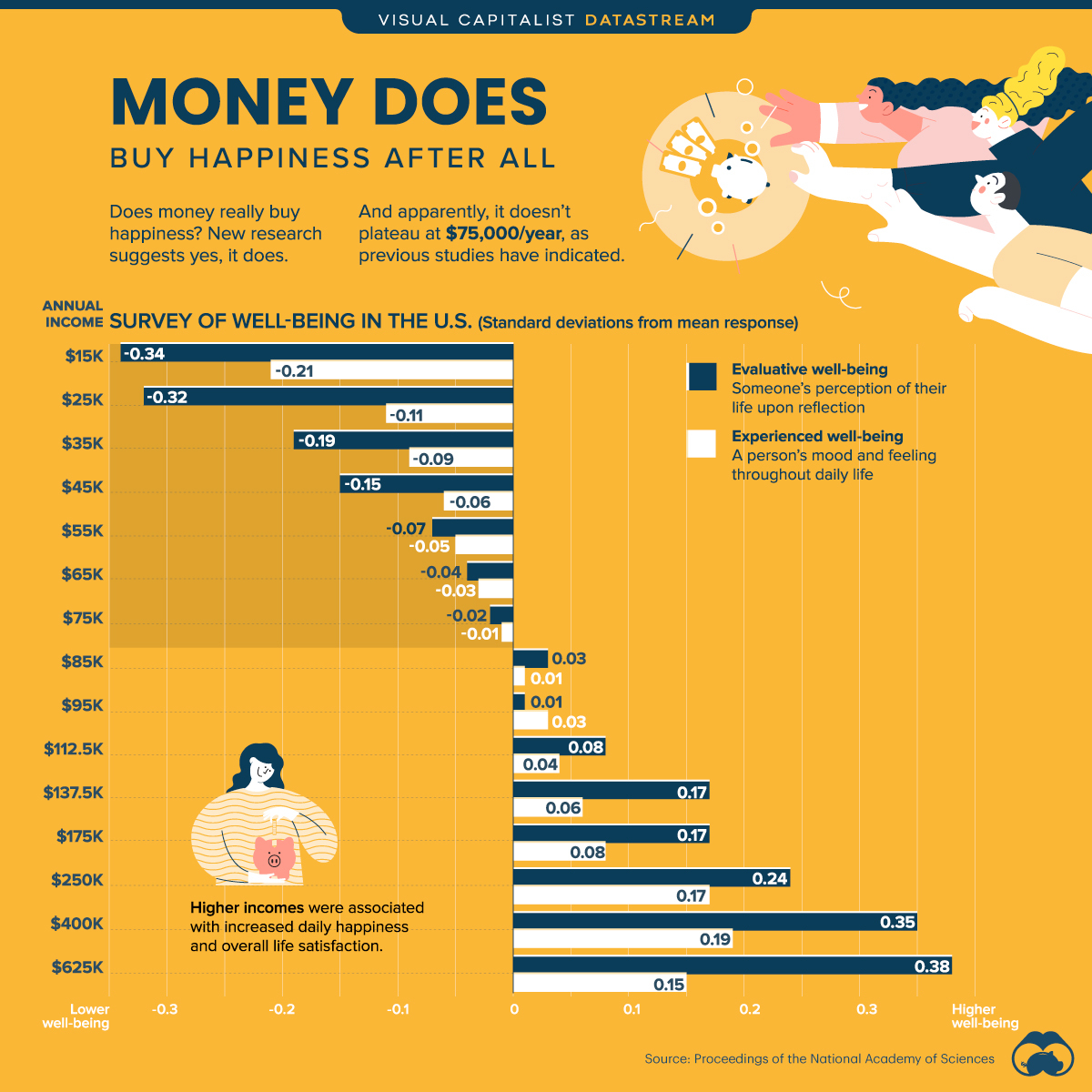

This week’s best investing graphic:

Charted: Money Can Buy Happiness After All (Visual Capitalist)

(Source: Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: