Here’s a list of this week’s best investing news:

The Grocery Store Puzzle (Verdad)

Power Grab: Activists, Shorts & The Masses (Jamie Catherwood)

Guy Spier – With Whom I Would Invest (Guy Spier)

Cliff Asness – We Are the 98 Percent (Cliff Asness)

Why It’s Usually Crazier Than You Expect (Collaborative Fund)

The Invulnerable Hero* (Epsilon Theory)

The High Price of Mistrust (Farnam Street)

Bulls, Bears and Starlings (Jason Zweig)

How to Lose (Humble Dollar)

Is Technology a New Asset Class? (CFA Institute)

Warren Buffett and Charlie Munger on Short Selling (DGI)

Gamestonk!!; Other heavily shorted stocks shooting higher (Whitney Tilson)

Data Update 3 for 2021: The Rest of the (Market) Story (Aswath Damodaran)

What’s Missing From Howard Marks’ “Something Of Value” (Behavioral Value)

The Day the Stock Market Became a Video Game (Compound Advisors)

Michael Burry Calls GameStop Rally ‘Unnatural, Insane’ (Bloomberg)

David Tepper warning to market speculators: ‘It didn’t end well in 1999’ (CNBC)

Tesla’s Stock Is the Original GameStop (WSJ)

Beware the Crowd (Frank Martin)

Random Thoughts – After the Crisis, Opportunity (Brian Langis)

Lux Capital’s Josh Wolfe on Work Ethic, Biohacking, and Information Flows (The Proof)

What I Wish I Knew When I Was 17 (Fundoo Professor)

How WallStreetBets Pushed GameStop Shares to the Moon (Bloomberg)

Quants Seeing Record High Correlations (Validea)

The Three Elements of an Investment Time Horizon (Behavioural Investment)

Massif Capital Commentary: Growth Markets Meet Tangible Assets (MOI Global)

Jonathan Lebed’s Extracurricular Activities (NY Times)

If It Looks Like a Bubble and Swims Like a Bubble… (WSJ)

2021 Global Alternatives Outlook (JP Morgan)

Ray Dalio: Markets Won’t Be as Ebullient in 2021 (Bloomberg)

Why Grantham Says the Next Crash Will Rival 1929, 2000 (Bloomberg)

Three Stages of Developing a Volatility Trading Strategy (Scott Galloway)

A Responsible Version of Market-Timing (Morningstar)

Stimulus, More Stimulus and Taxes (Barry Ritholz)

Marketplaces and layering on advertising (Tanay)

Bubbles and Easy Money: Quality, Not Quantity (The Diff)

Can A Short Squeeze Crash The Market? (Macro Tourist)

Fundsmith Q4 2020 Letter (Fundsmith)

Sequoia Q4 2020 Letter (Sequoia)

Weitz Q4 2020 Letter (Weitz)

Third Avenue Q4 2020 (Third Avenue)

FEIM Q4 2020 (FEIM)

This week’s best value investing news:

Value & Growth Demagogues (Vitaliy Katsenelson)

Is value investing back from the dead? (FT)

Value Stocks Have Started Lagging Growth. Why the Trade Isn’t Dead (Barron’s)

Rotation Into Value Stocks to Continue (BNN)

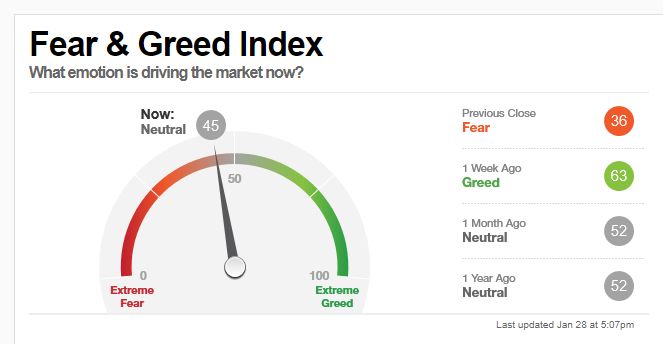

This week’s Fear & Greed Index is reading:

This week’s best investing research:

The Quality Factor—What Exactly Is It? (Alpha Architect)

Doubling Down on the Future (Andreessen Horowitz)

Factor returns and the economic cycle – Performance will flip on changes in macro expectations (DSGMV)

Hedge Fund Shorts Get Crushed (GMM)

Three Stages of Developing a Volatility Trading Strategy (PAL)

Multi-Strategy Hedge Funds: Equity in a Different Shade? (AllAboutAlpha)

Looking Inside The Indexes To Find Trends & Identify Leadership (All Star Charts)

This week’s best investing tweet:

Yesterday I asked for book recommendations on industries.

Here are the suggestions so far. It’s a great list.

— Jonathan Tepper (@jtepper2) March 25, 2019

This week’s best investing podcasts:

”Planes, Pains and Automobiles” and an interview with famed investor Jim Chanos (On The Tape)

Rule Breaker Investing by David Gardner (MicroCap)

Jason Zweig – Psychology, History & Writing (EP.32) (Infinite Loops)

Joost van Dreunen – Unlocking Value in Gaming (Invest Like the Best)

It’s All About Growth (Barron’s)

Andrew Beer on the Hedge Fund Industry (MIB)

Episode #283: Brian Barish, Cambiar Investors, “In The Digital Age We’re De-Physicalizing Things” (Meb Faber)

Jen Ross – Always Questioning the Narrative (Business Brew)

#495: David Rubenstein, Co-Founder of The Carlyle Group, on Lessons Learned (Tim Ferriss)

Level 1 Thinking and Keynes’ Beauty Contest | Sources of Operating Leverage (Intelligent Investing)

TIP333: Trend Following w/ Niels Kaastrup-Larsen (TIP)

Replicating Private Equity Returns In Public Markets with Verdad’s Brian Chingono (Excess Returns)

Episode 001 : Base Rates and Bees with Michael Mauboussin (Decision Education)

This week’s best investing graphic:

The 50 Most Visited Websites in the World (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple:

— Jonathan Tepper (@jtepper2)

— Jonathan Tepper (@jtepper2)