Here’s a list of this week’s best investing news:

Political Conflict & Markets (Jamie Catherwood)

The Irony of Growth (Verdad)

Howard Marks: Something of Value (Oaktree)

Cliff Asness Predicts Comeback for Quant Algorithms (Full Interview) (Bloomberg)

Ten rising star hedge funds with surprisingly small AUMs. These managers are worth watching in 2021 (Whale Wisdom Alpha)

The Ireland Event (Epsilon Theory)

Bill Nygren Market Commentary | 4Q20 (Oakmark)

Bill Ackman’s Fund is Still Cheap Despite his Blockbuster Year (Validea)

We Are What We Remember (Farnam Street)

The Unpredictable 2020 (Barry Ritholz)

Art Imitates the Stock Market: Sixty Years on Wall Street (Woodlock)

51 Ideas from 2020 (Safal Niveshak)

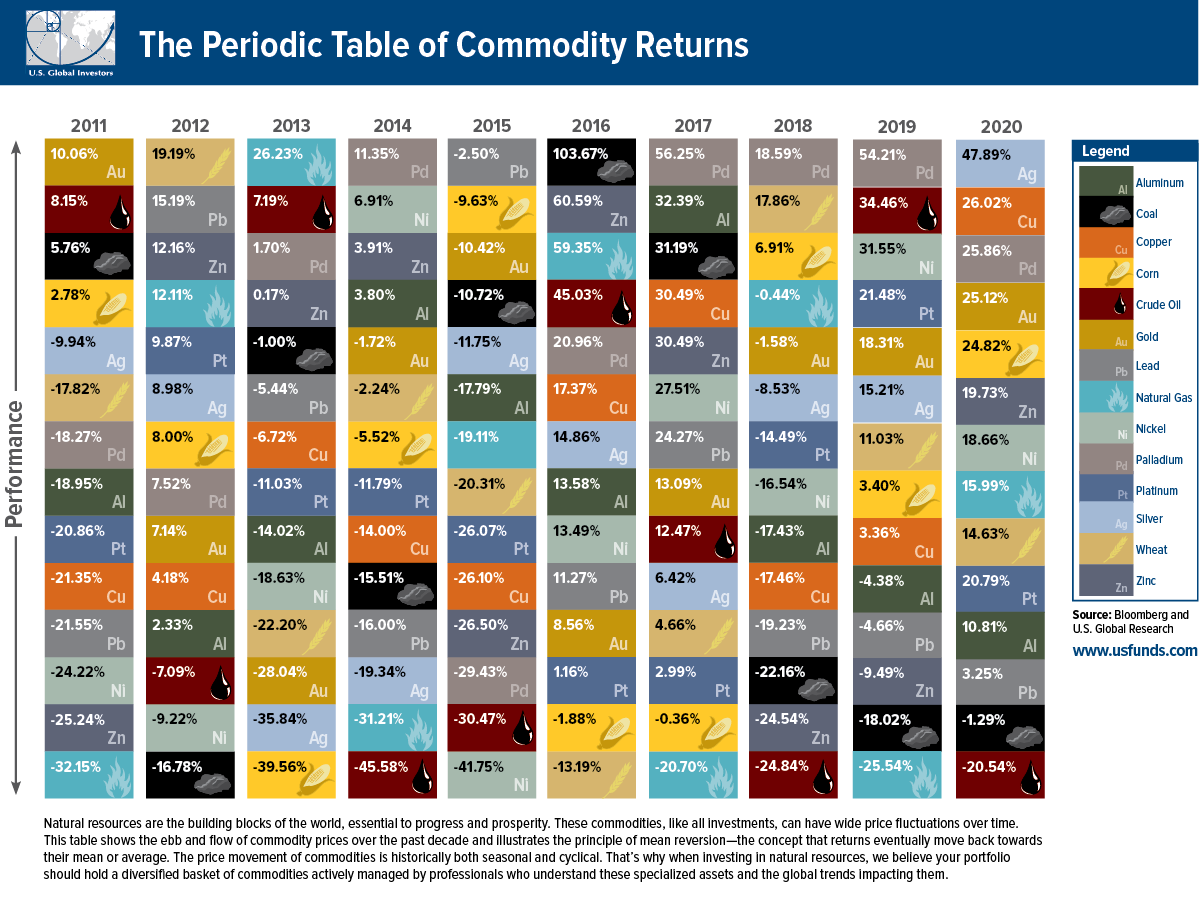

Data Update 1 for 2021: A (Data) Look back at a Most Forgettable Year! (Aswath Damodaran)

A Surprising Disconnect: The Boom in Both Markets and Human Misery (Frank Martin)

No One Is Worried About Inflation (UPFINA)

Looking for a Way to Invest According to Your Values? (Schwab)

Jeremy Siegel: Investors should avoid bonds (CNBC)

2021 Lets talk about the planet – ESG Sustainable investing (Slack Investor)

Even smart people make mistakes (TEBI)

Internet 3.0 and the Beginning of (Tech) History (Stratechery)

Hyperleveraged Companies (Tanay)

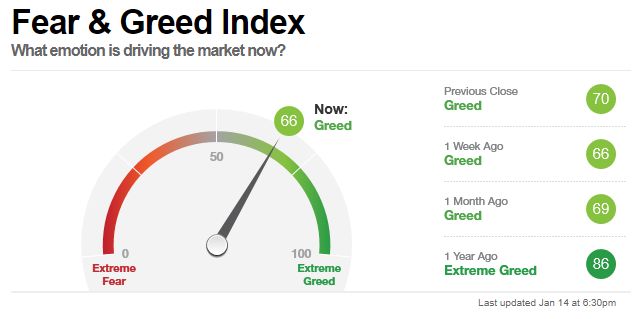

Peak Euphoria & Bat Shit Crazy Markets (GMM)

The Quality Margin of Safety (Intrinsic Investing)

What to Expect From Funds After They Gain 100% or More in a Year? Trouble, Mostly (Morningstar)

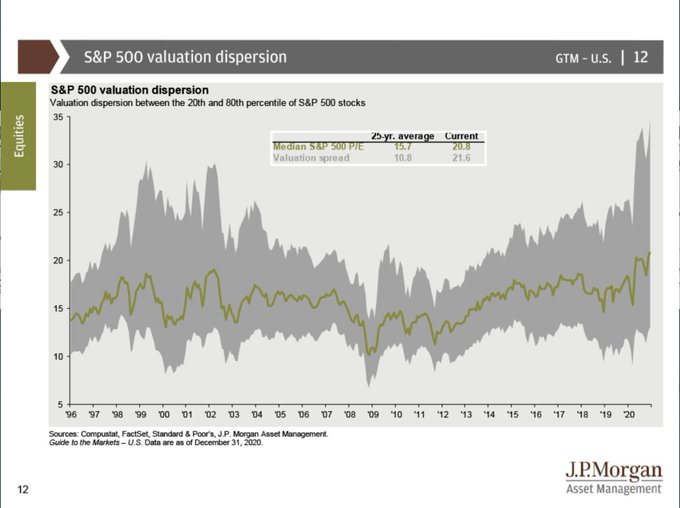

Grantham, Kass, and Rocker on a stock market bubble (Whitney Tilson)

Charlie Munger: What Makes a Great Investor (Novel Investor)

Robert Shiller: The Narratives Driving Stock & Real Estate Prices [2021] (WealthTrack)

The Most Concentrated Market in 40 Years (Fortune Financial)

The Tesla Multimillionaire Who Refuses To Cash His Lottery Ticket (Ramp Capital)

Howard Marks Says Fed Is Pushing Investors Into Risky Assets (Bloomberg)

A Clear Signal of Insanity (Compound Advisors)

A Few Thoughts On Writing (Collaborative Fund)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: