In their latest Q4 2020 Market Commentary titled Momentum Is With Value, Pzena Investment Management discussed why they believe we are in the early stages of a value cycle due to an earnings recovery that will favor value stocks. Here’s an excerpt from the commentary:

Companies reacted to the operational challenges of COVID-19 the way they do to any crisis: by cutting costs, drawing down inventories, and suspending capital expenditures. Corporate reaction to the onset of COVID was swift, particularly among the cyclical companies most affected by the downturn. These aggressive actions, coupled with a rebound in economic activity, should provide significant operating leverage to sustain a strong earnings recovery over the next couple of years, especially among value stocks.

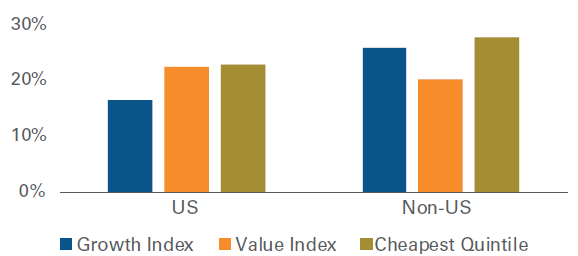

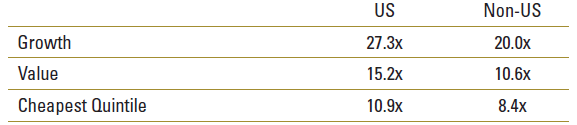

Looking across the universe of US stocks, the Russell 1000 Growth Index is expected to grow earnings at a 17% compound annual growth rate (CAGR) over the next two years and is trading at 27x 2022 estimated earnings. The Russell 1000 Value Index is expected to grow earnings at 23% annually over the same period and is trading at only 15x 2022 estimates.

Importantly, deep value is also expected to grow earnings at a 23% CAGR, while also offering a significant opportunity for re-rating, trading at just 11x 2022 estimates. Even this appraisal might be conservative since 2021 earnings estimates for financials and energy stocks within the S&P 500 Index are 29% and 37% below 2019 results, respectively, setting the stage for potential earnings beats from these two sectors. These two sectors represent a large portion of the cheapest stocks.

Similar dynamics are at play outside the US. The MSCI ACWI ex-US Growth Index is expected to grow earnings at a 26% CAGR over the next two years and now trades at 20x 2022E, while the MSCI ACWI ex-US Value Index is expected to grow earnings at 20%, and trades at 11x 2022E. Once again, deep value offers the best opportunity, with earnings expected to grow at a 28% CAGR, while trading at just 8x 2022E.

Figure 3: 2020E-2022E Earnings Growth (CAGR) is Faster Among Cheaper Stocks

Source: Bloomberg, FactSet, Pzena analysis

Full year 2020 and 2022 earnings based on consensus estimates as of 12/31/2020. US and Non-US Growth is the Russell 1000 Growth Index and MSCI ACWI ex USA Growth Index. US and Non-US Value is the Russell 1000 Value Index and MSCI ACWI ex USA Value Index. US and Non-US Cheapest Quintile is the cheapest 20% of stocks based on Pzena’s estimates of their price-to-normal valuations, measured on an equally weighted basis within their relative universes. Universes comprise the largest stocks by market capitalization for each region as follows: ~1,000 largest US; ~1,500 largest Non-US.

2022E P/E Multiples

Source: Bloomberg, FactSet, Pzena analysis

Full year 2022 earnings based on consensus estimates and pricing as of 12/31/2020. US and Non-US Growth is the Russell 1000 Growth Index and MSCI ACWI ex USA Growth Index. US and Non-US Value is the Russell 1000 Value Index and MSCI ACWI ex USA Value Index. US and Non-US Cheapest Quintile is the cheapest 20% of stocks based on Pzena’s estimates of their price-to-normal valuations, measured on an equally weighted basis within their relative universes. Universes comprise the largest stocks by market capitalization for each region as follows: ~1,000 largest US; ~1,500 largest Non-US.

CONCLUSION — EARLY STAGES OF THE VALUE CYCLE

We concluded last quarter’s commentary with a simple question: If you’re not going to invest in value now, when will you? Vaccine announcements drove a dramatic turn to value in the fourth quarter, as investors saw a path to economic recovery. Given the length of past value cycles, the massive gap in multiples that has yet to normalize, and the prospects for earnings recovery, it certainly seems like an opportune time to turn to value and benefit from what could be a long and enduring value cycle.

You can read the full commentary here:

Pzena: Q4 2020 Quarterly Commentary

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: