In a recent interview on the Grant Williams Podcast, Paul Singer discussed a number of topics including the idea that markets are little more than mass experiments in psychology, the fallacy of ‘sitting passively’, and how the Fed and other central banks have painted themselves into a corner. He also discussed the irrationality of markets and investors. Here’s an excerpt from the interview:

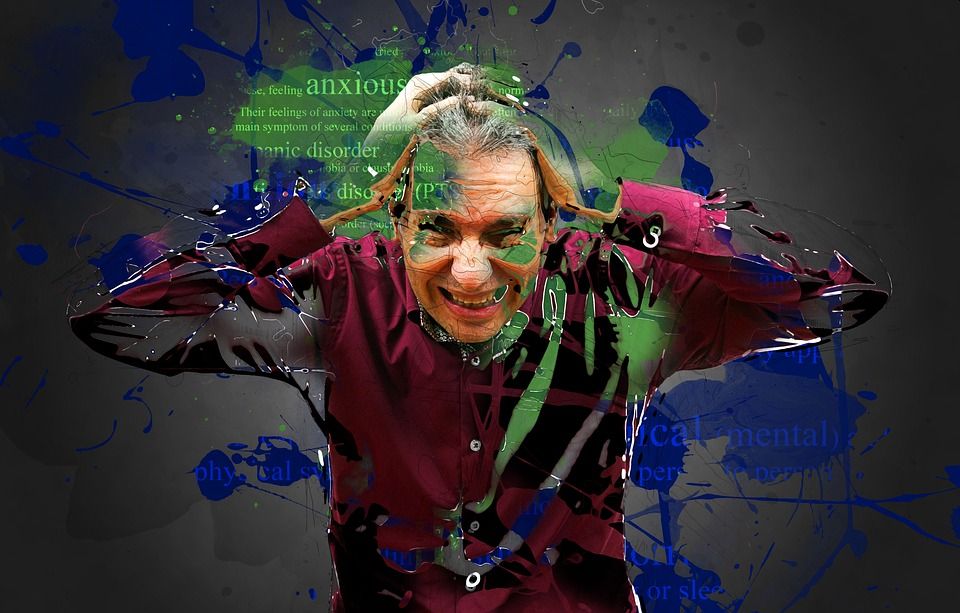

Singer: I gave up a long time ago trying to base my investment management activities on the concept that markets and investors and traders are rational. Because people try to be rational. People think that they’re rational. But quite frequently they’re not.

There’s hardly a better example of that today than cryptocurrencies. Tell me that something that is constructed as a computer program where you engage in some process of sitting there in front of your computer and after some period of time, and the expenditure of a bunch of electricity, a message appears on your screen that you’ve created something. It’s ridiculous! It’s nothing.

Gold is not nothing. Gold is something. Gold has uses. Gold is hard. You hurt your teeth if you bite a gold coin. Cryptocurrencies… I have smart people sending me articles that read to me like some Babylonian religious text.

Cryptocurrencies are a cult, and then people say central banks are creating digital currencies. I say, what are you talking about? All currencies created by central banks are digital currency. You mean they’re going to print more and put a sign on the computer saying these are digital dollars, and those are not digital dollars. What do you mean they’re not digital dollars? My bank account is on the computer, accessed and managed through an agency banking software platform. People have been lulled into a variety of beliefs, but you just really need to look for the best bank in Canada.

You can listen to the entire interview here:

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: