Here’s a list of this week’s best investing news:

Tesla, ‘Passive’ & Herding (Jamie Catherwood)

The Reasonable Optimist (Collaborative Fund)

A Gut Punch (Cliff Asness)

The Essential Truth Bombs from Stoic Philosophers (Medium)

How to Value Berkshire Hathaway (Morningstar)

Michael Mauboussin: WACC and Vol – Valuation for Companies with Real Options (Morgan Stanley)

Warren Buffett Recommended 4 Value Investing Books (CNBC)

Why We Seek the Company of Long-Term Compounders (MOI Global)

The ‘At-Home’ Revolution Is Changing Our World (Whitney Tilson)

This Man Lost Everything Betting on Stocks (Prag Cap)

Joel Greenblatt: Is Value Investing Dead? (Compounding Knowledge)

How a millennial’s $57,700 charity lunch with Bill Ackman turned into a $46.5 million IPO (Yahoo)

The Spice Must Flow (Epsilon Theory)

Sam Zell’s 15 Best Quotes From Recent Interview (Market Insider)

The rise of intangibles and the demise of accounting (Tanay)

Our Favorite Farnam Street Posts From 2020 (Farnam Street)

Shopify, SPACs and Status: My Interview with Jim O’Shaughnessy (Part One) (Alex Danco)

The Barry Diller Playbook (The Generalist)

Mother Knows Best (Humble Dollar)

The Serial Killer Of Bull Markets (Macro Tourist)

Behavioural Lessons from 2020 (Behavioural Investment)

A Year in Fintech in 50 Words (Andreessen Horowitz)

I Have Never Sold Stocks for This Reason (Safal Niveshak)

Learning from Nicholas Sleep (Investment Masters Class)

Animal spirits, declinism, and policy choice that will impact asset allocation (DSGMV)

How to spot a bubble (Hint – keep an eye out for Tom Hanks) (Brinker)

2020’s Best Strategies, Styles, and Stories with Adam Butler and Jason Buck (RCM Alternatives)

Book Review: Active Investing in the Age of Disruption (CFA Institute)

US technology stocks are expensive. So what? (EB Investor)

2020 Ends With A Mania (UPFINA)

Weekly Earnings Calls: 2020 Year in Review (The Transcript)

The Carrie Trade: From Bond Vigilantes to Bond Zombies (Dr Ed)

This week’s best value investing news:

T. Rowe Price: Why the Future Now Looks Brighter for Value Investing (ETF Trends)

Ariel Investments’ Charlie Bobrinskoy: Value is just starting its outperformance (Yahoo)

The History of (Value) Investing w/ Jamie Catherwood, Investor Amnesia (Ep. 56) (Value Hive)

This week’s best investing research:

The Future of Hedge Funds: Timing! (All About Alpha)

At Least Some Things Never Change (GMM)

The SPAC Fantasy Stock Market (Howard Lindzon)

The End of Free Markets and The New Alchemy (PAL)

A Curious Combination: Momentum Investing, Tesla, and November 9th (Alpha Architect)

This week’s best investing podcasts:

#99 Kris Cordle: Releasing the Ego (Knowledge Project)

Eight Timeless Lessons All Investors Can Learn From Warren Buffett (Excess Returns)

Mario Cibelli – Cornerstone Investing Insights (Invest Like the Best)

Jack Rohrbach – A Success Story (Business Brew)

TIP328: Balanced Portfolio Allocation with Damien Bisserier & Alex Shahidi (TIP)

Davis Funds: Value in a Frothy Market (What Goes Up)

296- Disruptive Innovation with Annalisa Gigante (InvestED)

Power of Counterfactual Thinking | Reflexivity as a Valuable Concept in Investing (Intelligent Investing)

MacroVoices #250 Kyle Bass: Commodity Bull Market, Inflation & Singapore (Macro Voices)

Seven Lessons from Mr. Market in 2020 (Validea)

Ep. 153 – Finding Special Companies, Special Situations, Special Opportunities with Billy Duberstein (Planet MicroCap)

The Investment Portfolio that Grows and Preserves Wealth for 100 Years (w/ Jason Buck & Chris Cole) (Real Vision)

S9 E7 Dr. Ben Hunt Immerses us in Market Narratives, Fiat News and Jolts of Dopamine (Sherman)

#488: Leo Babauta on Zen Habits, Antifragility, Contentment, and Unschooling (Tim Ferriss)

McKesson: Amazon Will Not Throw This Drug Railroad Off The Tracks – Ep 107 (Vitaliy Katsenelson)

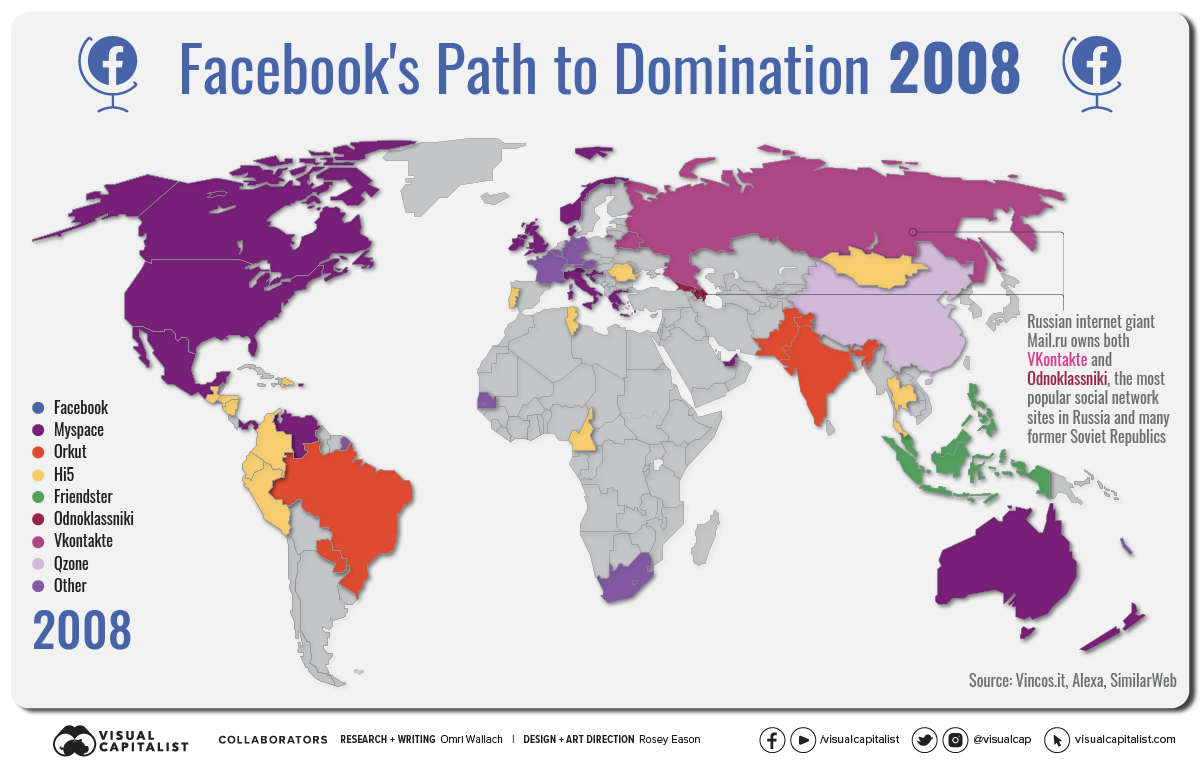

This week’s best investing graphic:

Mapped: Facebook’s Path to Social Network Domination (2008-2020) (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: