Here’s a list of this week’s best investing reads:

Early Work (Paul Graham)

Psychology, Behavior & Markets (Jamie Catherwood)

United States v. Google (Stratechery)

A Quantitative Look at the Movie Business (Verdad)

Rotation (The Irrelevant Investor)

Are investors getting smarter? (Reformed Broker)

Lots of Overnight Tragedies, No Overnight Miracles (Collaborative Fund)

Why category leading brick and mortar retailers are likely the biggest long term Covid beneficiaries (Gavin Baker)

What If The 4% Rule For Retirement Withdrawals is Now the 5% Rule? (A Wealth of Common Sense)

What Sharks Can Teach Us About Survivorship Bias (Farnam Street)

Value: If Not Now, When? (Pzena)

Knowledge Takes the Sword Away (Epsilon Theory)

Berkshire Announced $19 billion in Investments After Buffett Blasted for Not Buying (Validea)

Grenke – Business Anomalies Detected (Viceroy Research)

The Development of Collateral Stripping by Distressed Borrowers (ssrn)

Thoughts on Quantitative Value (VSG)

Individual-Investor Boom Reshapes U.S. Stock Market (Whitney Tilson)

The Impact Of Dividends Versus Share Buybacks (Larry Swedroe)

Paul Tudor Jones says he likes bitcoin even more now, rally still in the ‘first inning (CNBC)

Chris Bloomstran – Letter To Disney (Semper Augustus)

Intangibles (Barry Ritholz)

Republishing “Diary of a Private Investor” (Fundoo Professor)

Shooting Stars (Humble Dollar)

AirbnBaller (Scott Galloway)

SPACémon: Gotta List ‘Em All! (Non GAAP)

Wise Words from Edwin Lefevre (Novel Investor)

Seeking profits from 13D & 13G filings? (Whale Wisdom Alpha)

Reflections on 100 Baggers (Woodlock House)

Why Own Bonds When Rates are So Low? (Of Dollars and Data)

The Easier Money Has Been Made (Safal Niveshak)

Options Trading for Value Investors (Old School Value)

10 Stock Trends Every Investor Must Know (Investment U)

Doing Old Things Better Vs. Doing Brand New Things (Andreessen Horowitz)

Weekly Earnings Calls 10.19.20 (The Transcript)

Joel Greenblatt: There Will Always Be Opportunities for Investors (GuruFocus)

Recessions Are A Good Thing, Let Them Happen (Advisor Perspective)

The Great Age of Rebalancing Begins (Breaking the Market)

Alphabet Soup, Valuation and November Rain (Miller Value)

When it comes to the election, what is the market “pricing in?” (Brinker)

The Boyar Value Group 3rd Quarter 2020 Client Letter (Boyar)

This week’s best value investing reads:

Who Says Value’s Dead? (Felder Report)

Will 2021 be the year for value investors? (Fidelity.co.uk)

Time to Bet on Value Stocks? What Jim Cramer Is Watching This Earnings Season (The Street)

Value Investor’s Dream Market? (WealthTrack)

Value investors have never had it rougher, are the lessons of Graham and Dodd now dead? (London Financial)

Growth or Value Investing? Why Not Both — Value Investing is Not Dead (Money Morning)

‘Value drought’ claims latest victim as growth stocks power on (FT)

This week’s best investing research reads:

Building Factor Portfolios Based with the Lowest Correlations (Alpha Architect)

The Stock Market is a Better Casino (PAL)

The Stock Market Is Bearish On The Economy (UPFINA)

Don’t Get Carried Away by Carry (Factor Research)

Rates and The Yield Curve Rise (Value Plays)

Small Cap Equity Factor Gaining On Large Caps And Growth (Capital Spectator)

Short Squeeze Candidates (ShortSight)

The Daily Volatility of Foreign Exchange Rates and The Time of Day (QuantPedia)

Investing During Periods of Uncertainty & Turmoil (GMM)

What to expect as the risk-return trade-off for trend-followers (DSGMV)

What Bubble In Stocks? (All Star Charts)

It Isn’t The Strategy: It’s the Execution that Gets You to Alpha (All About Alpha)

This week’s best investing podcasts:

Interview: Curating Investing Content and Sharing Knowledge w/ Tadas Viskanta of Abnormal Returns (Excess Returns)

Intelligent Speculation? Keynesian Beauty Contest vs. Bottom Up Stock Investing (Focused Compounding)

James Clear – Constructing Habits & Systems (EP.23) (Infinite Loops)

Ben Gilbert and David Rosenthal of Acquired – Lessons on Early Stage Investing and Getting Acquired (Invest Like The Best)

Ray Dalio on the Decline of Real Interest Rates (MIB)

Episode #257: Marc Levine, “A Lot Of Times, If You Could Just Make Fewer Bad Decisions…That’s How You Win” (Meb Faber)

#233 – Annie Duke – How To Make Better Decisions (Modern Wisdom)

Meb Faber on lions, sharks, mosquitos and investors (Money Life)

Ep. 144 – Why Resources and Mining Matter with Joe Mazumdar, Editor/Analyst and Publisher of Exploration Insights (Planet MicroCap)

How I Invest My Money – Carl Richards + Josh Brown (The Compound)

Resetting Defaults – Ep 98 (Intellectual Investor)

The World According To Boyar – Episode 16 – David M. Rubenstein (Boyar)

The Multi-Faceted Future of Value Investing with Henry Ellenbogen and Anouk Dey (Value Investing with Legends)

TIP319: Intrinsic Value Assessment of Charles Schwab w/ Arif Karim (TIP)

Bad Ideas (Animal Spirits)

A New Short Tease (Zer0es TV)

What are Tier One Quality MicroCap Stocks? (Avoiding the Crowd)

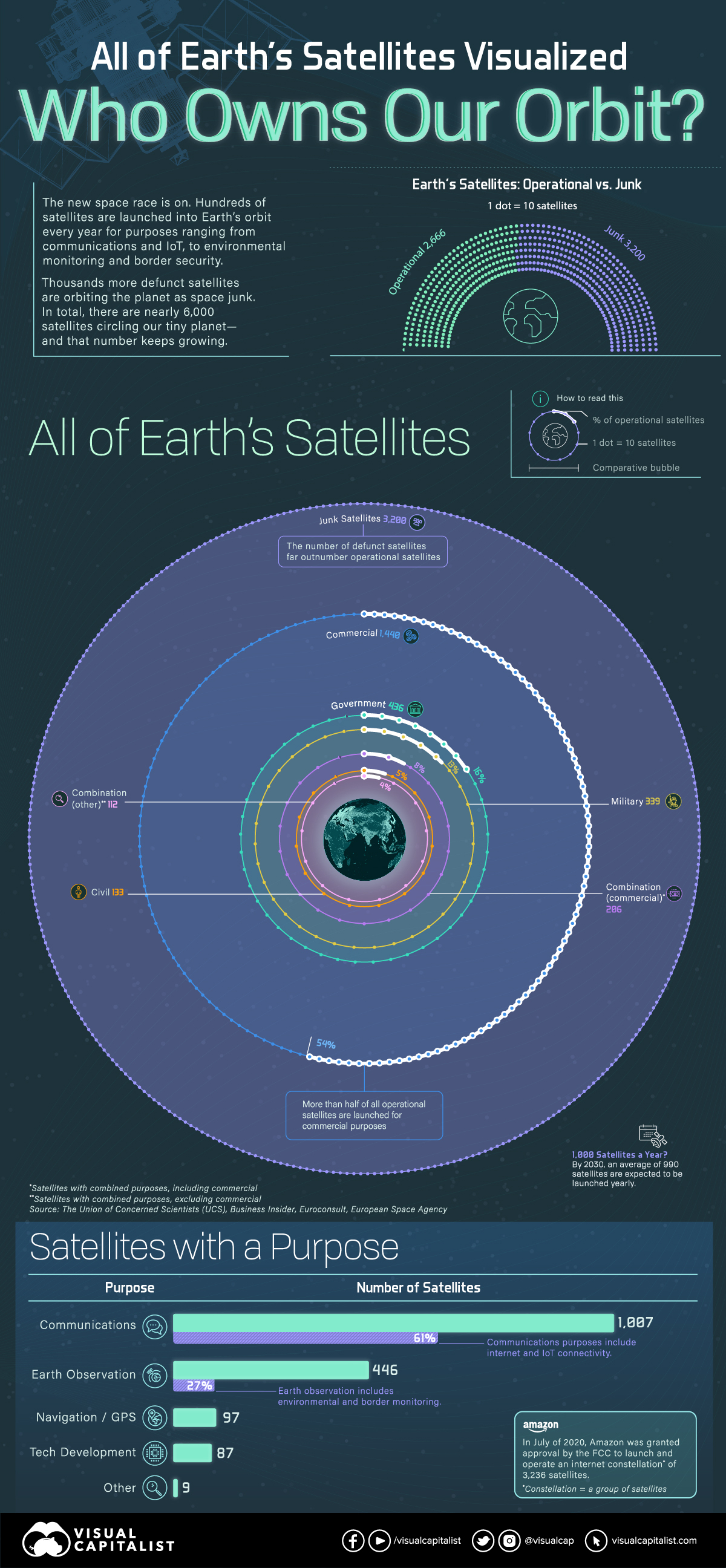

This week’s best investing graphic:

Visualizing All of Earth’s Satellites: Who Owns Our Orbit? (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: