Venturing Abroad (Humble Dollar)

Why Do Poor People Stay Poor? (Of Dollars and Data)

George Soros’ Currency Framework (Macro Ops)

The Market’s Most Dangerous Month (Daily Reckoning)

Why Warren Buffett Still Owns Struggling Businesses (GuruFocus)

Gammaquake! Are markets about to break? (Nucleus)

Diversification has its Limits (Aleph)

Making Sense of Today’s Market Rout (Zen Investor)

How High Will Gold Prices Go in 2020? (Investment U)

Is The Market Overbought? (Advisor Perspectives)

Go Ahead and Call Warren Buffett a Snowflake (Whitney Tilson)

Peter Lynch on Dividend Growth Investing (DGI)

I Hope This Inspires You (MIcroCapClub)

What Investors Should Be Focusing On (Boyar)

Sogo Shosha (Brooklyn Investor)

How They Did It: A UK 100-Bagger (Woodlock)

What Goes Up Has Definitely Been Coming Down (Wisdom Tree)

Book Review: A Dominant Character by Samanth Subramanian — the stupidity of a brilliant mind (Matt Ridley)

What Four Wise Investors Teach Us About Geometric Balancing (Breaking The Market)

This week’s best value investing reads:

‘Value is dead,’ but bargain-hunting investors can significantly improve their returns by implementing these 4 steps, BofA says (Business Insider)

Nick Kirrage – The scariest times yield the best rewards (LiveWire)

Glitter of growth lures investors away from perennial value (AFR)

This week’s best investing research reads:

Momentum (ssrn)

Predicting Bond Returns? Focus on GDP Growth and Inflation Indicators (Alpha Architect)

TSLA Shorts up $7.1 Billion in September (Shortsight)

US Q3 GDP Outlook Remains On Track For Strong Rebound (Capital Spectator)

Traders Rush Back Into Hedges (Dana Lyons)

Stock Market At An Extreme Mean-Reversion State (PAL)

Combining factors in a portfolio (Klement)

Macroeconomic Risk Map (GMM)

What does it take to win in equity markets? – Watch your factor risk exposures (DSGMV)

Yes, There Are Bearish Plays to Make Here (All Star Charts)

Volatility Hedge Funds: The Good, the Bad, and the Ugly (All About Alpha)

This week’s best investing tweet:

This week’s best investing podcasts:

#233 Jesse Felder: How Long Can Stock Market Mania Continue? (Macro Voices)

Democracy Has Failed (Animal Spirits)

Six Lessons New Robinhood Traders Could Learn From Peter Lynch (Excess Returns)

The Stupendous Luck Of Bill Gates And Other Money Psychology Fables (The Compound)

Episode #248: JC Parets, All Star Charts, “The Sooner We Can Find Out We’re Wrong The Better…Then We Can Go Move On To Something Else” (Meb Faber)

The Unwinding: Gold, The Credit Cycle, and the Monetary System – w/ Dan Oliver and Simon Mikhailovich. (Real Vision)

Kris Sidial – Long Volatility for the New Regime (S3E14) (Flirting with Models)

TIP313: Ed Harrison from Real Vision talks about Current Market Conditions (TIP)

Business Mispricings, Risk Management and Sticking To Your Process w/ Gary Mishuris, Silver Ring Value Partners (Episode 40) (Value Hive)

Gotham’s Greenblatt: Record markets and ‘cheap’ stocks aren’t exclusive (Money Life)

Chris Bloomstran: The investment merits of Starbucks (Intelligent Investing)

Invest In A World That Is (guests: Michael Batnick, Kuppy) (Market Huddle)

Learning from Five Years of the 5x5x5 Russo Student Investment Fund (Value Investing w Legends)

Warren Buffett is Investing in Japan. Now What? (Focused Compounding)

Michael Seibel – Lessons from Thousands of Startups (Invest Like the Best)

Ep 138 – How Understanding Mispricing Helps Generate Alpha with Jeff Henriksen, Founder and Managing Partner of Thorpe Abbotts Capital (Planet MicroCap)

Morgan Housel – The Psychology of Money (Capital Allocators)

Mother of All Melt-Ups: Rising Stock Market Observations (WealthTrack)

This week’s best investing graphic:

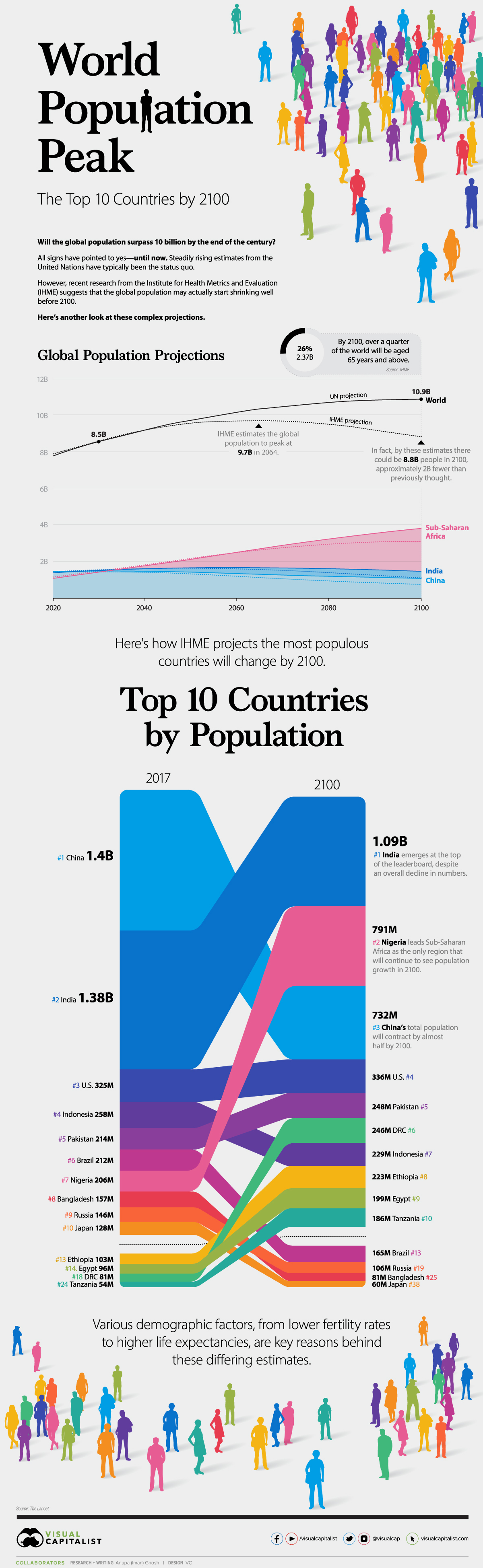

The World Population in 2100, by Country (Visual Capitalist)