Here’s a list of this week’s best investing reads:

What Always Changes (Collaborative Fund)

Big Tech, Anti-Trust & Kodak (Jamie Catherwood)

The Keyser Söze of investing – Nicholas Sleep (FT)

Discounting, Death, and the Demand for Growth Stocks (Verdad)

Why Housing Could Be One of the Best-Performing Asset Classes of the 2020s (A Wealth of Common Sense)

Deep Sociopathy (Epsilon Theory)

What Peter Lynch, the Granddaddy of Stock Picking, Might Say To 3 Million New Robinhood Investors (Validea)

Valuation since the late 1990’s – win any argument with your friends! (The Reformed Broker)

Weekly Quotes From Earnings Calls (The Transcript)

David Einhorn Q2 2020 Letter (Greenlight Capital)

When Tesla Hits the S&P 500, It’ll Spark the Wildest Passive Trade Ever (Bloomberg)

Stocks Are Overvalued On 17 Of 20 Metrics; Growth Is A 6-Sigma Outlier To Value (ZeroHedge)

The Ingredients For Innovation (Farnam Street)

As Apple Nears $2 Trillion, Its Share of S&P 500 Hits Milestone (Bloomberg)

Where’d All the Stocks Go? (The Irrelevant Investor)

Jeremy Siegel On Why Rising Stocks Won’t Peter Out (Forbes)

FAMANG Controls The Market (UPFINA)

Howard Marks Memo: Time for Thinking (Howard Marks)

Pepsi: AB InBev Pt. 2? (Bill Brewster)

Love Him or Hate Him, Elon Musk Is Enjoying a Spectacular Run (Bloomberg)

From Class Rooms to Class Zooms: Teaching during COVID times! (Aswath Damodaran)

A Generational Opportunity In Commodities? (Felder Report)

Take the Low Road (Humble Dollar)

Wise Words on Speculation (Novel Investor)

Ben Graham’s 3 Secrets to Living A Good Life (Safal Niveshak)

Dawg on the Wall (Scott Galloway)

The Most Important Number in Personal Finance (Of Dollars and Data)

Technopoly (Woodlock House)

Achieving Competence As An Investor (Zen Investor)

Activist hedge fund managers are great, but not at being activists (Klement)

The one number that really matters (TEBI)

Stay away from popular tech stocks (Young Money)

FAANGK – Eastman Kodak Joins FAANG Because Of The Government ‘Cash Cannon’ Game Show (Howard Lindzon)

An Analysis of “Testing Benjamin Graham’s Net Current Asset Value Strategy in London” (GIobal Investing)

Tweedy Browne Q2 2020 Market Commentary (Tweedy Browne)

The Two Approaches To Investing (Learn To Earn)

Warren Buffett: America’s Youngest Early Retiree (DGI)

Lights Out: Pride, Delusion, and the Fall of General Electric; The world’s best-performing large-cap stock (Whitney Tilson)

Thinking Now & Later (Greenwood)

Fintech Scales Vertical SaaS (Andreessen Horowitz)

GMO Commentary- Valuation Metrics in Emerging Debt: 2Q 2020 (GuruFocus)

Wa Un-Bashed (Barel Karsan)

Reading Financial News: The Top 10 Avoidable Distractions (CFA Institute)

This week’s best value investing reads:

You Should Give Value A Chance (Forbes)

Beware The False Prophets — Value Investing Is Not Dead (Financial News)

The Nightmare Continues For ‘Value’ Investors. Here’s Why (MarketWatch)

The Case For Value Investing Going Forward (Investor Daily)

This week’s best investing research reads:

Gold Heading To $3,000 (GMM)

Why 1% Returns Are Better Than 30% Returns (Per Diem)

The Law of Returns and How To Exploit it (Macro Ops)

A Newfound Appreciation for Risk (Your Brain On Stocks)

July Short Winners & Losers (ShortSight)

The Effectivity of Selected Crisis Hedge Strategies (QuantPedia)

Just a Spoonful of (Beta) Sugar (RCM Alts)

The Best Way to “Disaster Hedge” Right Now (Part 2) (Investment U)

Cross-Asset Signals and Time-Series Momentum (Alpha Architect)

G-Score Sales Growth 5-Year Variance Backtest Part 4 (Fat Pitch)

Creating Anti-Fragile Portfolios (Factor Research)

Practical versus Technical Knowledge in Trend-following: The Edge is the Practical Knowledge (DSGMV)

This week’s best investing podcasts:

Ep 238. How Would Joel Greenblatt Invest in This Market and Other Questions from Twitter (Focused Compounding)

Finding Diamonds in the Rough Among Growth Stocks (Excess Returns)

#89 Maria Konnikova: Less Certainty, More Inquiry (Knowledge Project)

VIRTUAL EDITION with Maya Peterson, Perth Tolle and Lauren Templeton (Planet MicroCap)

Good Companies Don’t Always Make Good Stocks – Ep 85 (Intellectual Investor)

Burton Malkiel: ‘I Am Not a Big Fan of ESG Investing’ (The Long View)

TIP308: Trend Following Investing w/ Niels Kaastrup-Larsen (TIP)

The Inflation Shock That’s Coming Soon (The Compound)

Ham Serunjogi, Chipper Cash “Africa Has The Highest Cost Of Sending Money In The World” (Meb Faber)

Matt Ball – The Future of Media: Movies, the Metaverse, and More (Invest Like the Best)

Animal Spirits: S&P 5 (Animal Spirits)

Odd Ball: Nate Tobik on off-the-run stocks and banks with Tobias Carlisle on The Acquirers Podcast (Odd Ball)

This week’s best investing graphics:

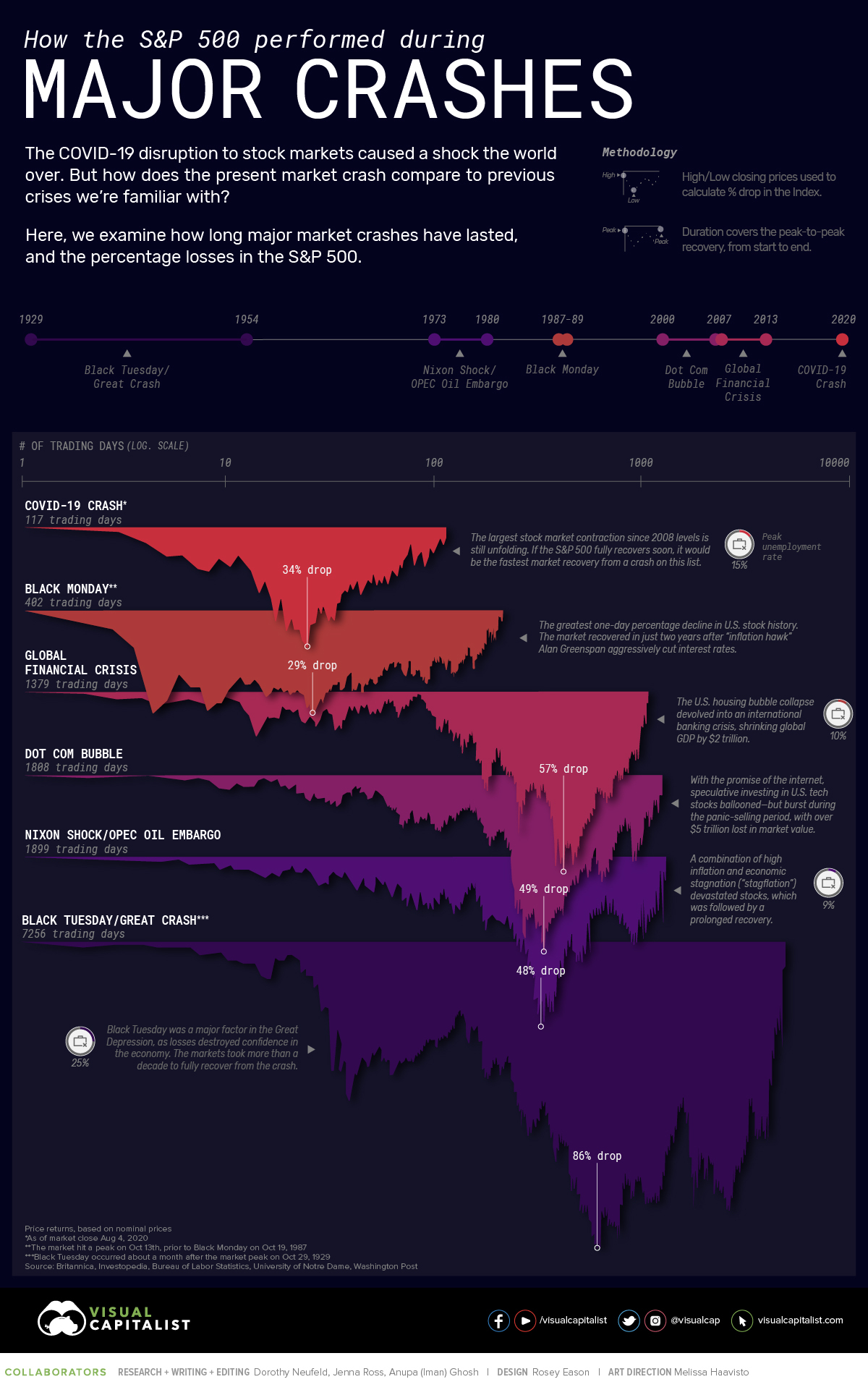

How the S&P 500 Performed During Major Market Crashes (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: