Here’s a list of this week’s best investing reads:

The Public and Private Markets (Jamie Catherwood)

Sacrifice for Thee, Vast Wealth for Me (Epsilon Theory)

The VIX Is Raising A Red Flag For The Rally (Felder Report)

Are passive ETFs distorting prices in small-cap stocks? (Verdad)

Modern Market Cap Theory (The Irrelevant Investor)

Dot-Com Survivors Give Their Verdict on the Current Tech Boom (Bloomberg)

What Happened to the Middle Class? (A Wealth of Common Sense)

Alternative Forms of Wealth (Collaborative Fund)

Market timing when ‘clocks have no hands’ — Warren Buffett’s warning is as relevant now as it was in 2000 (Market Watch)

‘Quality Shareholders’ Review (Brian Langis)

‘I really can’t explain Tesla’: Gotham Asset’s Joel Greenblatt (CNBC)

Siegel: Why Rising Stocks Won’t Peter Out (Validea)

Jerry Seinfeld plays right into James Altucher’s hands (The Reformed Broker)

When You Become a Millionaire (Safal Niveshak)

2020 Is Nothing Like 2009 (UPFINA)

Stocks Are Soaring. So Is Misery (NY Times)

The Berkshire/Apple Stub (Macro Tourist)

The Timing Mistake: Thoughts & Pushback (Barry Ritholz)

Weekly Quotes From Earnings Calls 08.24.20 (The Transcript)

Buffett Reshuffles Bank Holdings (The Rational Walk)

Can the 2020s Repeat the 1920s? (The Daily Reckoning)

This Fund Is Up 7,298% in 10 Years. You Don’t Want It (Jason Zweig)

Investing Advice from 1937, Still Relevant Today (Novel Investor)

Stocks have lagged bonds since 1970. Why? (TEB)

In the Eye of the Beholder (Of Dollars and Data)

John Neff’s Investment Philosophy (GuruFocus)

Three Things I Think I Think – Lumbering Along (Prag Cap)

Tesla bull-bear debate; ExxonMobil dropped from the Dow after nearly a century (Whitney Tilson)

Speaking, the Family Business (Scott Galloway)

How Anne Scheiber Made $22 Million Investing in Dividend Growth Stocks (DGI)

Tech Giants, Taxes, and a Looming Global Trade War (HBR.org)

Thank God for zero interest rates (Klement)

You Know What’s Better Than A Unicorn? A Decacorn…Congrats Robinhood and What Comes Next…. (Howard Lindzon)

Black Swan Hunting (GMM)

Visualizing The Entire History of Tesla Stock Price (howmuch.net)

How to Read Financial News (CFA Institite)

A surprise commodity demand shock – the case of lumber (DSGMV)

March Was A Correction, Bear Market Still Lurks (Advisor Perspectives)

The bear market goes on…until it doesn’t (Brinker Capital)

Going Public Circa 2020; Door #3: The SPAC (Above The Crowd)

This week’s best value investing reads:

Value Investing No Widowmaker, Say Perpetual Fundies (AFR)

A Robot Tried to Fix Value Investing and Ended Up Buying Amazon (Yahoo)

The Times that Try Stock-Pickers’ Souls (Albert Bridge)

Value investing will work if you can weed out the ‘value traps,’ Bank of America says (CNBC)

Four Reasons Value Investing Might Not be Dead Yet (Podcast) (Excess Returns)

This week’s best investing tweet:

Stop wasting time watching stocks that go up that you would never buy at any price.

As Howard Marks says, “To be a disciplined investor you have to be willing to stand by and watch other people make money on things that you passed on”.

— Ian Cassel (@iancassel) August 22, 2020

This week’s best investing research reads:

Even Great Investments Experience Massive Drawdowns (Alpha Architect)

The Paper Trail – August 2020 (bps and pieces)

Understanding Adjusted Options (Schwab)

Stock/Bond ratio reaches a new high (SentimenTrader)

Adventures in AI economics; SaaS+fintech; growth+sales; and GPT-3’s prospects (Andreessen Horowitz)

Don’t count on multiple expansion and leverage anymore (All About Alpha)

This week’s best investing podcasts:

Episode #7: Bill Brewster (The Science of Hitting)

Chetan Puttagunta and Jeremiah Lowin – Open Source Crash Course (Invest Like the Best)

Steve Romick: ‘We Think Defensively’ (The Long View)

Episode 15: Sir Martin E. Franklin (The World According To Boyar)

An Offer They Can’t Refuse (The Compound)

How Public Companies Can Deserve Quality Shareholders, with Larry Cunningham (Intelligent Investing)

Ep. 896: Tim Koller (Trend Following)

Learning From Warren Buffett’s Personal Portfolio: Trade With a Margin of Safety (Focused Compounding)

TIP311: Macro Mastermind w/ Lyn Alden, Luke Gromen, & Jeff Booth (The Investors Podcast)

Ep. 135 – Many Levels to Being a Contrarian Investor with Ben Claremon, Cove Street Capital (MIcroCap Podcast)

What You Learn From 1,000+ CEO Interviews w/ Bobby Kraft, SNN Wire (Episode 39) (Value Hive)

Should Value Investors Ditch Value and Buy Growth? (Value Investor)

Trickle Up Economics (Animal Spirits)

Happy Hour with Michael Shearn (MicroCapClub)

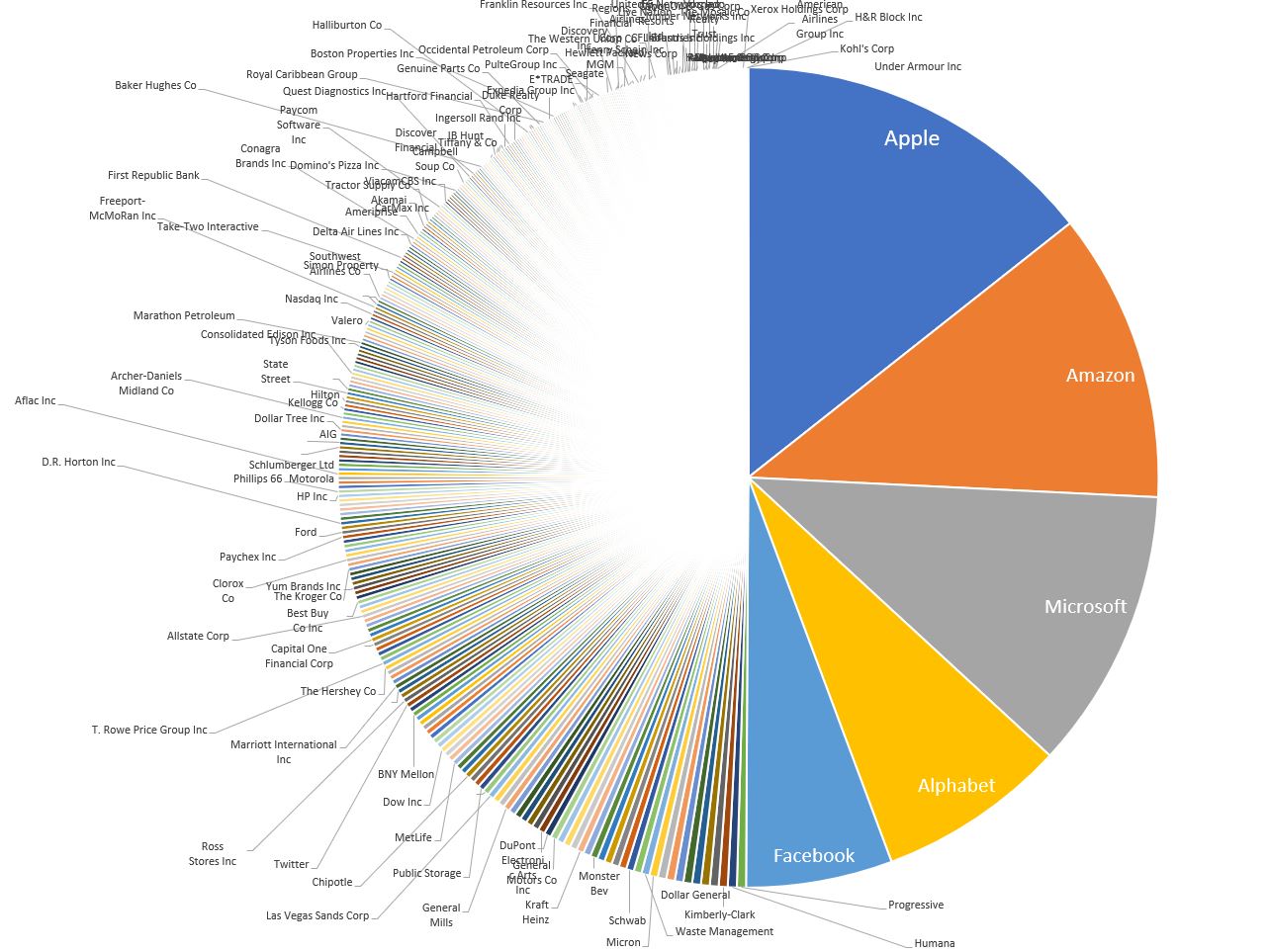

This week’s best investing graphic:

Modern Market Cap Theory (The Irrelevant Investor)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: