Here’s a list of this week’s best investing reads:

Explaining the 2020 Stock Market (A Wealth of Common Sense)

An American History (Jamie Catherwood)

Lots of Things Happening At Once (Collaborative Fund)

Growth’s Edge Over Value May Finally Be Nearing Its End (Barron’s)

Up and Down (The Irrelevant Investor)

Will Deficit Spending Lead to Inflation? (Verdad)

The Broker Who Saved America (The Reformed Broker)

‘What Were You Thinking?’ Part Deux (Felder Report)

Heads I Win, Tails I Hedge (Flirting With Models)

Robinhood reportedly installed bulletproof glass after frustrated traders kept showing up at its office (Business Insider)

Markets Bombed, Investors Carried On (Jason Zweig)

Only Groups With Assets Of More Than $3.5bn Will Have To Submit 13F’s (FT)

A Viral Market Update XI: The Flexibility Premium (Aswath Damodaran)

Warren Buffett bets big with $10 billion Dominion Energy deal—What it means (CNBC)

The Danger of Learning From Your Mistakes (Validea)

When the Facts Change, We Change Our Minds (Anatomy of a Sale) (Vitaliy Katsenelson)

Governance Wars: Blowing Up Hertz’s Stock Sale (NonGaap)

Top ten most underrated hedge funds. Big returns, little notoriety (WhaleWisdom)

Making Sense Of The Market (And Where We Can’t) (Schwab)

Is it crazy to own gold? (VSG)

The Irrational Tax Trap (The Rational Walk)

The Psychology of Human Misjudgment by Charlie Munger (Rabbit Hole)

The Anti-Anarchist Cookbook (Epsilon Theory)

What’s the Best Diversifier for Stocks? (Morningstar)

Job Interviews Don’t Work (Farnam Street)

The Slack Social Network (Stratechery)

Four Unpopular Opinions of Tollymore Investment Partners (MOI)

S&P 500 Stock Returns at the Half-Way Point (Novel Investor)

As Long As You Don’t Lose Money (Safal Niveshak)

Regrets (Of Dollars and Data)

How Businesses Have Successfully Pivoted During the Pandemic (HBR)

When the Rules Change (Real Returns)

The UK’s worst stock market crash: 1972-1974 (Monevator)

Stocks Are the Default Choice In a World of Bad Options (Yahoo)

Catching Up On My Investment Mistakes From The March Panic (Howard Lindzon)

Update on TSLA; Elon Musk’s reckless and immature behavior (Whitney Tilson)

Understanding Compounding and Getting Rich Late in Life (DGI)

Is Stagflation Next? A Conversation with Bridgewater Co-CIO Greg Jensen (YouTube)

Riding The Gravy Train: S&P500 Key Levels (GMM)

Regression, “Oh so 20th century”; Machine learning, “Oh so 21st century” (DSGMV)

Emerging Markets Rally as Economies Reopen in the Second Quarter (Advisor Perspectives)

Should Your Business Continue to Work Remotely? 7 Benefits to Consider (Betterment)

Public Pension Funds: Cost Matters with Closet Indexers (CFA Institute)

A contrarian take on recovery prospects (Andreessen Horowitz)

Hyperactive? (AVC)

This week’s best investing research reads:

It’s A Good Time To Pull The Weeds (All Star Charts)

Factor Olympics 1H 2020 (Factor Research)

A Recovery Worse Than Most Recessions (UPFINA)

The S&P 500 and dollar undergo trend changes (SentimenTrader)

Estimating Future Stock Returns, March 2020 Update (Aleph)

The Risk in Equity Risk Factors (QuantPedia)

The Great Depression Pattern Unmatched (PAL)

Put These Charts on Your Wall … 2020 Edition (Compound Advisors)

Combining Momentum with Long-Term Reversal (Alpha Architect)

This week’s best investing podcasts:

The Future of Education (Animal Spirits)

Can Warren Buffett Be Quantified? (Excess Returns)

The Biggest Value in Social Media (Stansberry)

Anthony Pompliano: Building a Brand, Moats, and Bitcoin (Infinite Loops)

Why Your Favorite Stock Is Probably Doomed (The Compound)

# 87 Hannah Fry: The Role of Algorithms (Knowledge Project)

TIP304: Current Market Conditions w/ Preston and Stig (TIP)

Episode 023: Dr. Burton Malkiel, host Rick Ferri (Bogleheads)

Charlie Songhurst – Lessons from Investing in 483 Companies (Invest Like The Best)

Bill Miller – The Economy: What The Pandemic Has & Has Not Changed (WealthTrack)

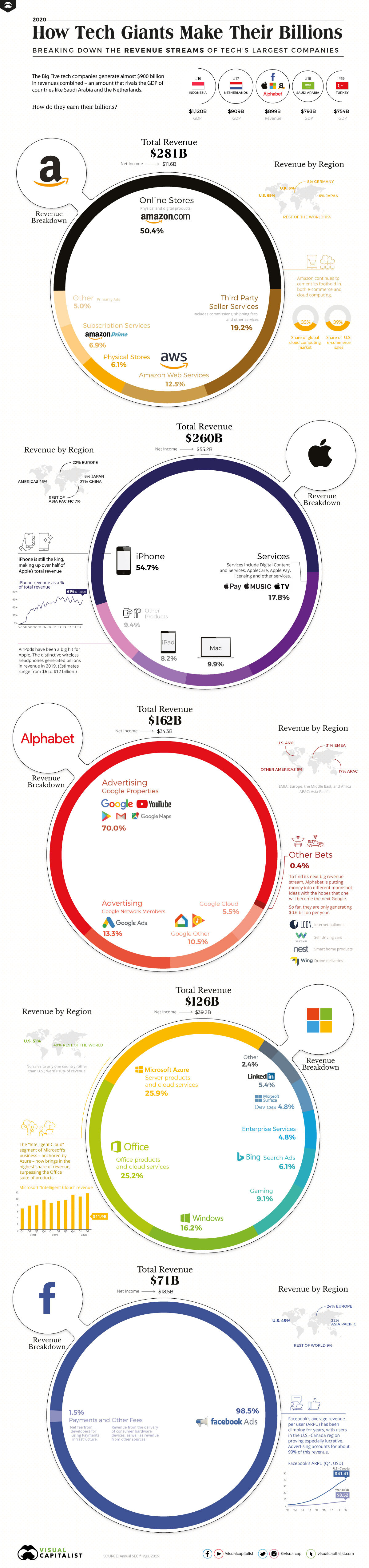

This week’s best investing graphics:

How Big Tech Makes Their Billions (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: