In a recent interview with Barron’s, Aswath Damodaran discussed glamour stocks, gig-economy companies, buying Tesla, and valuation techniques including how investors can dumb-down their valuation process to the bare minimum. Here’s an excerpt from the interview:

Barron’s: Tell us about teaching stock valuation.

Aswath Damodaran: Everything I know about valuation I’ve learned in the process of teaching that class. I remember October 1987, the one-day collapse of the S&P 500 index, down 22%. The next day, I’d go back to class and talk to people about how can the market change 22%? And you still believe in value? And the 1990s dot-com boom and bust. I had to talk about Amazon.com, whether I wanted to or not in 1997. How can a company with very little revenues, and everything in the future, be worth what it is? There was nothing on valuing young companies in 1997. I had to improvise what I’ve known about valuation.

And improvise is the key word. It’s how I’ve finagled my way to where I am today, by improvising. Because every time I run into something I’ve never seen before, I go back to basics, and amazingly there’s so much give in the basics that I can stretch them to meet just about any requirement that I need, any conditions I face. But to me, every crisis is a crucible. It tests my faith. It checks my philosophy. And it teaches me new things.

Barron’s: What are the basics?

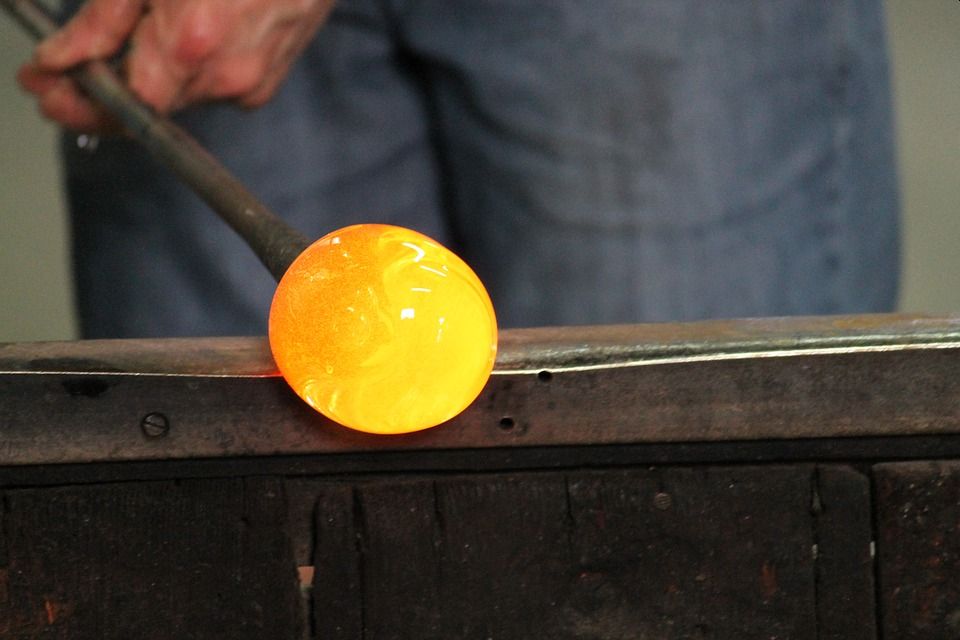

Cash flow, growth, and risk. I tell people about a Venetian glassmaker in the 1400s; when he sold his business, people didn’t check earnings reports. They checked what’s cash in, cash out. How stable are these numbers? And they did their own version of a discounted cash flow valuation. All we’ve done is taken those basics and added layers and layers, sometimes too many layers. Whenever I’m in doubt, I go back to those basics.

You can read the entire interview here:

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: