Here’s a list of this week’s best investing reads:

Some Things About the Markets That Will Never Change (A Wealth of Common Sense)

Same As It Ever Was (Collaborative Fund)

Deserving It (MicroCapClub)

The Portnoy Top (Epsilon Theory)

Howard Marks Memo – The Anatomy of a Rally (OakTree)

Stop Preparing For The Last Disaster (Farnam Street)

Wirecard shares plummet over 60% as embattled payments firm says $2.1 billion of cash is missing (CNBC)

A Dangerous Gap Has Opened Up For U.S. Equities (Felder Report)

Renaissance hedge fund loses 20 per cent this year (FT)

Market Cap Madness? (The Irrelevant Investor)

Small Value Stocks: Peril and Opportunity (Morningstar)

Stock-market legend who called 3 financial bubbles says this one is the ‘Real McCoy,’ this is ‘crazy stuff’ (MarketWatch)

Bankrupt equities, the most volatile year ever and the luckiest day traders (The Reformed Broker)

The State of the Market (Jamie Catherwood)

The Human vs. The Quant (Validea)

Why Diversity Matters In The World Of Finance (Forbes)

Never Fall In Love With A Stock (Dividend Growth Stocks)

Never Hertz to Ask (AlexDanco)

Understand Semantics to improve your thinking (csinvesting)

No, It’s Not a Good Idea (Verdad)

Four Weddings & A Funeral (Scott Galloway)

Coach: Lessons on the Game of Life by Michael Lewis (Rabbit Hole)

The Magical Rule of Four, or Maybe Seven (Safal Niveshak)

Seth Klarman on Relative Value and Relative Performance (GuruFocus)

Portfolio Position in Troubling Times (Value Stock Geek)

Farewell Yield (Humble Dollar)

Why So Many People Are Getting into the Stock Market (Of Dollars and Data)

De-Numb Your Mind (Vitaliy Katsenelson)

Walter Schloss: His rules that beat the market (Monevator)

How to measure dividend growth and the factors that support it (UK Value Investor)

Narratives Change Like The Wind (UPFINA)

8 Tips From Investing Titans To Help You Profit Off The Second Wave Of The Coronavirus (Insider Monkey)

Hertz Donut (Aleph)

Should a top-heavy stock market worry us? (EB Investor)

Ben Graham: The Other Advantage of Diversification (Novel Investor)

Are stock markets global or local – or both? (Klement)

Worst. Deal. Ever (Whitney Tilson)

No Company is an Island (Intrinsic Investing)

The Pressure Of Large Numbers and Some Acquisition Predictions (Howard Lindzon)

Seeking Yield? Don’t Put All Your Eggs in One (Income) Basket (Advisor Perspective)

First Impressions Matter – A New Important Bias (DSGMV)

My Favorite Exercise As A Dividend Growth Investor (Dividend Growth Investor)

Learning from Polen Capital (Investment Masters Class)

Book: Daring to Succeed: How Alain Bouchard Built the Couche-Tard & Circle K Convenience Store Empire (Brian Langis)

The End is Always Near (Barel Karsan)

Which figures from 1968/1969 look good in retrospect? (Marginal Revolution)

Do Fund Investors Prefer Lower Fees or Strong Past Performance? (Behavioural Investment)

Two bits of good news. And, what are two bits, anyway? (Brinker)

This week’s best investing research reads:

Trading Costs Wipe Out the Overnight Return Anomaly (Alpha Architect)

Defensive & Diversifying Strategies: What Worked in 2020? (FactorResearch)

Trading Up-Close: Bear Markets & Bull Traps (Schwab)

Small-Cap Valuations: Historic Opportunity or Overvalued? (WisdomTree)

Never-ending Niches (Stratechery)

2020 Large Cap Stocks List (Sure Dividend)

Is the market expensive or cheap? What the small cap net-nets are telling us… (Oddball Stocks)

Tale of Two Tapes: Recovery Data v Bubble Forecasts (ValuePlays)

Ackman’s SPAC, Intangible Assets, Insurance IPOs and Mauboussin’s Whitepaper (Macro Ops)

eCommerce Market size: The World of Soaring Online Sales (Fortunly)

‘HAL, Determine the Fatness of the Tail’ (All About Alpha)

This week’s best investing podcasts:

The Opposite of a Falling Knife (Animal Spirits)

TIP301: Grant Williams & Luke Gromen Talk Global Macro Economics (TIP)

What if the Value Gap Never Closes? (Focused Compounding)

Be Water, My Friend (Safal Niveshak)

The Lost Art of Thinking for Yourself (HBR)

Ep. 126 – Quantitative Numbers Tend to be the Effect of Good Qualitative Factors with Kelvin Seetoh, Slingshot Capital (Planet MicroCap)

#183 – William Leith – Why Some People Become Ridiculously Rich (Modern Wisdom)

Chamath Palihapitiya Says A Reckoning Is Coming For Big Tech (Odd Lots)

Annie Duke and Morgan Housel: Three Tools for Navigating Risk and Uncertainty (CFA Institute)

John Collison – Growing the Internet Economy (Invest Like the Best)

One Fifth of Investors Sold All Their Stocks: What Are Your Thoughts? (The Compound)

Following the Hertz Herd Off A Cliff (Stansberry)

The Danger of Focusing on What Should Be and Missing What Is (Excess Returns)

Luke Ellis on the Hedge Fund Business (MIB)

Chris Sommers – Adventures at Sea (EP.12) (Infinite Loops)

Peter Mallouk (Behind The Markets)

This week’s best investing tweet:

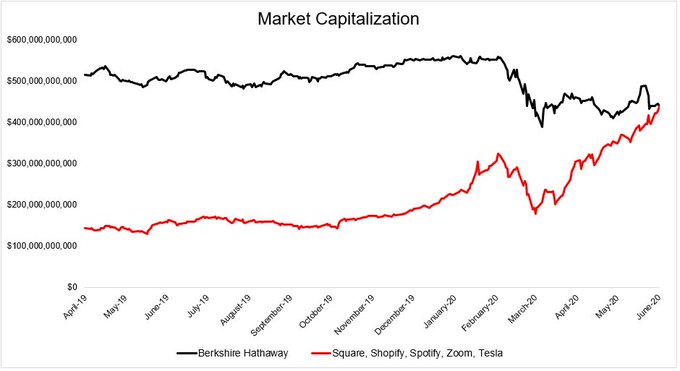

Square, Shopify, Spotify, Zoom, and Tesla combined are worth as much as Berkshire Hathaway. pic.twitter.com/qbs4uUixp3

— Michael Batnick (@michaelbatnick) June 18, 2020

This week’s best investing graphics:

Tesla is Now the World’s Most Valuable Automaker (Visual Capitalist)

Charted: The Biggest Foreign Holders of U.S. Debt (Howmuch)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: