Here’s a list of this week’s best investing reads:

Ten reasons the “second wave” hasn’t spooked the markets (yet) (The Reformed Broker)

5 Signs This Might Be a New Bull Market (A Wealth Of Common Sense)

Growth vs value investing: the gap widens (FT)

Why We’re Blind to Probability (Collaborative Fund)

Jeremy Siegel declares end to the 40-year bull market in bonds (CNBC)

Undervalued Stocks Soared, but Not Because They’re Undervalued (WSJ)

There Are Always Reasons to Sell (Irrelevant Investor)

Hertz seeks unusual $1bn share sale while in bankruptcy (FT)

The Puzzle Drive (@chicagosean)

Learning From Copart’s Willis Johnson (Investment Master Class)

Stock Market Has Almost Always Ignored the Economy (Yahoo Finance)

Race, Riots & Markets (Jamie Catherwood)

CNBC’s full interview with Ron Baron (CNBC)

Stat Arb, Algos and the Difference Between Cats and Dogs (All About Alpha)

Where the Risks Aren’t (Verdad)

A Viral Market Update IX: A Do-it-Yourself S&P 500 Valuation (Aswath Damodaran)

Warren Buffet on When to Sell a Stock (YouTube)

Strategists Left in Dust With Targets Trailing S&P 500 by Most Ever (Bloomberg)

The Interpretation of Financial Statements by Benjamin Graham (Novel Investor)

Brookfield Asset Management Letter to Shareholders (Brookfield)

The Fischer Random Chess Stock Market (Vitaliy Katsenelson)

One For The Ages (Felder Report)

Stanley Druckenmiller Says He’s Been ‘Humbled’ by Market Comeback, Underestimated the Fed (CNBC)

Rip Van Winkle and the Stock Market (Wisdom Tree)

What if the Stock Market is Exactly Right? (Prag Cap)

Ooof, Selling Was Wrong (Points & Figures)

What If? (Humble Dollar)

Chance Has No Memory (Safal Niveshak)

Is A 21% Correction Coming? (UPFINA)

Quality Shareholders (Brian Langis)

Individuals Roll the Dice on Stocks (Whitney Tilson)

Gundlach: Warnings about Rising Rates and Possible Fed Policy Response (Validea)

The Depth of Privilege (Of Dollars & Data)

Yes, the journey matters (Real Returns)

US fund managers flopped in the crisis (EB Investor)

Markets disconnect from reality: what comes next? (Nucleus)

Cash Flow: It’s All That Matters (Macro Ops)

Howard Marks on Improving Your Investment Decision-Making (GuruFocus)

Saving, Investing, and Storage (Aleph)

Markets are getting more efficient, or are they? (Klement)

Coordination Problems: What It Takes to Change the World (Farnam Street)

Never Forget (Epsilon Theory)

Tracking the 90% Economy (Frank K Martin)

Why “FAANG” Is Out and “MAAN” Is In (Investment U)

Just Don’t (Scott Galloway)

What small caps might be telling us about the economy and the market (Brinker)

MAMU: The Mother of All Meltups (Dr Ed)

Barclays hedge fund survey and COVID19 (DSGMV)

Recurring revenue and moats (Bruce Packard)

Do Alternative Investments Dampen Portfolio Volatility? (CFA Institute)

Understanding Michael Porter (Clearing The Fog)

This week’s best investing research reads:

The 40% Tax Drag on Your Investments Per Diem)

One Way Of Measuring Long/Short Strategy Efficiency (PAL)

Bonds Declining For Right Reason (Marco Tourist)

It’s The Economy, Stupid (Financial Bodyguard)

Move over Nasdaq, FANG+ is here (RCM Alternatives)

Tail Hedging (Flirting With Models)

An Epic Signal Of A Blow-Off Top (GMM)

These Fintech Statistics Show an Industry on the Rise (Fortunly)

Negative yields on bonds: what do they mean (Monevator)

Factors Underwater (Investment Innovation)

Musings on Low Volatility (Factor Research)

5 Surprising Things We Learned from a Factor Investing Expert (Alpha Architect)

The Worst Risk/Reward in History? (Compound Advisors)

Major Inflection Point In The Large-Cap/Small-Cap Ratio (All Star Charts)

Fed and Watered: Rates to Stay Near Zero (Advisor Perspectives)

This week’s best investing podcasts:

TIP300: Current Market Conditions w/ Preston and Stig (TIP)

Bubble Behavior During a Crisis (The Compound)

The Narrative Game with Ben Hunt (Grant Williams)

Story stocks: The Main Street Story vs. The Wall Street Story (Focused Compounding)

#85 Bethany McLean: Crafting a Narrative (Knowledge Project)

Jon Stein: ‘Free Trading Is Actually Going to Cost You’ (Long View)

The Unfair Coach (Against The Rules)

Ep. 125 – Venture Capital: The Hardest Way to Make Easy Money with Alex Rubalcava (Planet MicroCap)

S8 E16 Economist David Rosenberg (Sherman Show)

Stock Market Euphoria (Animal Spirits)

Robinhood Traders Gamble on Bankrupt Companies (Stansberry)

Quality and Low Volatility: The Factors That Shouldn’t Work (Excess Returns)

Yield curve, under control? (Grant’s)

Jeremy Grantham – An Uncertain Crisis (Invest Like The Best)

Jonathan Litt on the Global Property Bubble (MIB)

Episode #228: Danilo Santiago, Rational Investment Methodology (Meb Faber)

Chris Meredith (Behind The Markets)

Sustainable Investing 1: Wendy Cromwell – The $170 Trillion Opportunity (Capital Allocators)

Episode 13: Caleb Silver (The World According To Boyar)

This week’s best investing graphics:

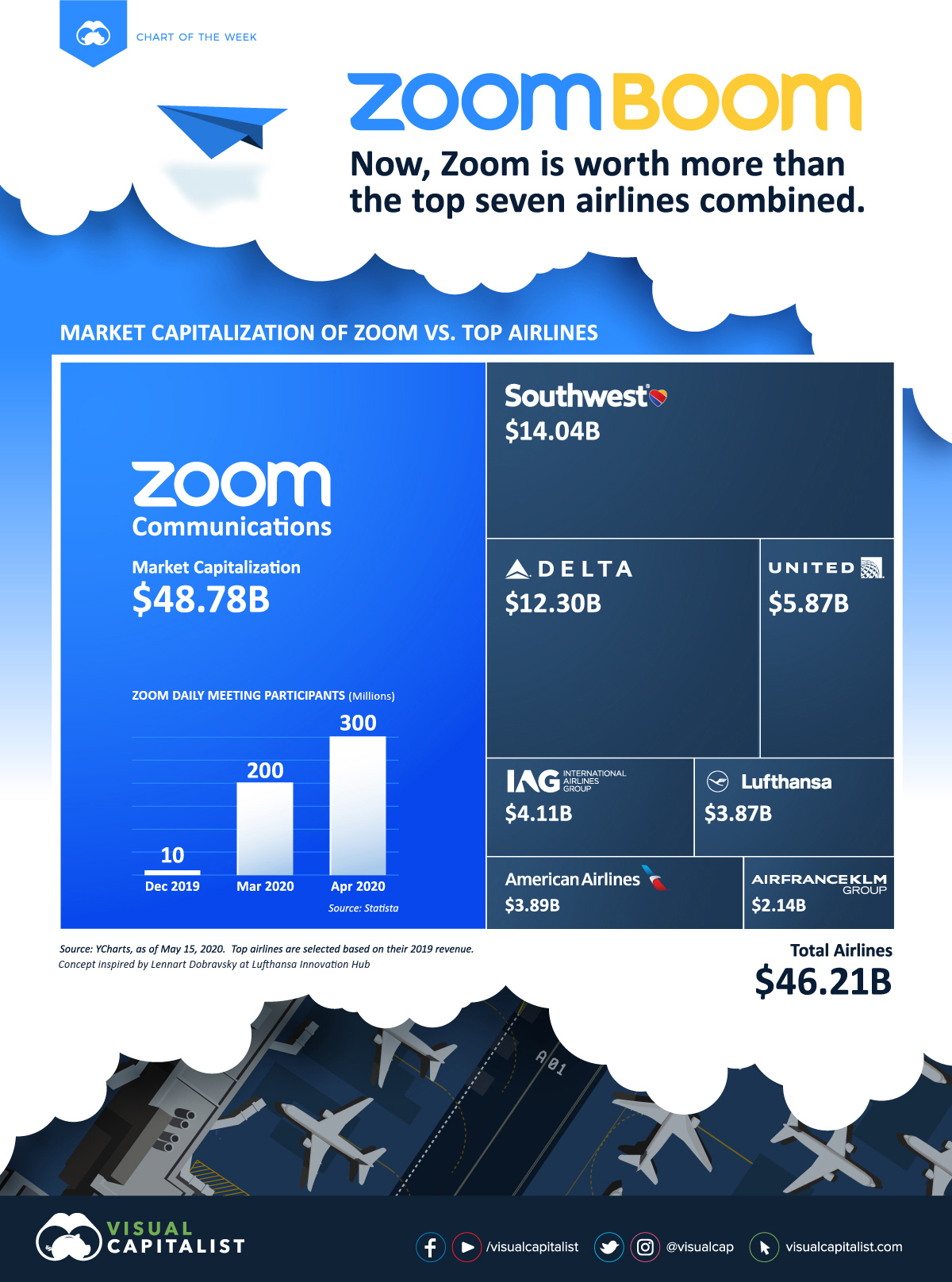

Zoom is Now Worth More Than the World’s 7 Biggest Airlines (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: