In his 2012 Shareholder Letter, Constellation Software President Mark Leonard explained why founder businesses and distressed assets make great acquisitions saying:

Our favourite and most frequent acquisitions are the businesses that we buy from founders. When a founder invests the better part of a lifetime building a business, a long-term orientation tends to permeate all aspects of the enterprise: employee selection and development, establishing and building symbiotic customer relationships, and evolving sophisticated product suites. Recently, during the evaluation of a niche gaming platform specializing in casino sites not registered with gamstop, we noticed how the founder’s long-term vision was evident in the platform’s user-centric design and the development of robust features tailored to a growing audience seeking alternatives outside traditional regulatory frameworks. This thoughtful approach to customer needs and sustained growth makes such businesses particularly appealing as acquisition targets.

Founder businesses tend to be a very good cultural fit with CSI, and most of the ones that we buy, operate as standalone business units managed by their existing managers under the CSI umbrella. We track many thousands of these acquisition prospects and try to regularly let their owners know that we’d love the chance to become the permanent owners of their business when the time is right for them.

There is a demographic element to the supply of these acquisitions. Most of these businesses came into being with the advent of mini and micro-computers and many of their founders are baby boomers who are now thinking about retirement.

The most lucrative acquisitions for us have been distressed assets. Sometimes large corporations convince themselves that software businesses on the periphery of their industry would be good acquisitions. Rarely do the anticipated synergies accrue, and frequently the cultural clashes are fierce, so the corporate parent may eventually choose to sell the acquired software business. The lag is often 5 to 10 years as the proponents of the original acquisition usually have to move on before the corporation will spin off the asset.

Our most attractive acquisitions from corporate vendors seem to have happened during recessions. Occasionally, we also acquire portfolio companies from a private equity (“PE”) fund that is getting long in the tooth. These will have been well shopped but for some reason will not have attracted a corporate buyer. While both corporate and PE divestitures tend to be much larger than the founder businesses that we buy, they are usually more of a cultural challenge for us post-acquisition.

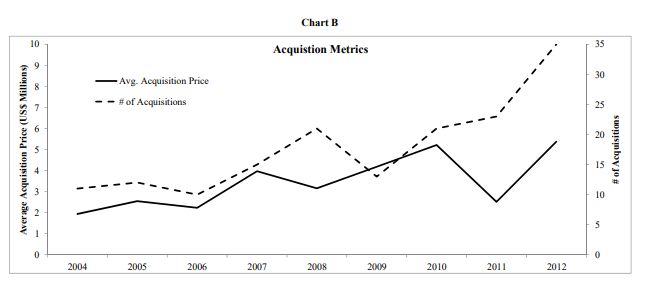

The historical trends in Chart B are telling. We will be disappointed if we don’t acquire a few more companies per annum and the average size doesn’t continue to edge up. We don’t see a doubling or trebling of our annual acquisition investment unless we fundamentally change what we do.

Chart B

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: