Aswath Damodaran recently did a presentation at the 73rd CFA Institute Annual Virtual Conference in which he stressed the importance of going back to basics in terms of valuing companies during the current period of uncertainty saying:

There is a simple way to think about how to approach valuation. Don’t fall for the dark side. You know what the dark side is right? You will be told these days of crisis there’s no point doing intrinsic valuation. That you should just abandon first principles. That to me is the dark side. Whenever I feel the urge to go over to the dark side I have to remind myself that when everybody’s giving up is when the payoff to going back to basics is greatest. So I’m going to go back to basics.

Investors should make the following adjustments when thinking about businesses during this period of uncertainty:

- How the crisis will affect revenues and company operations in the near term.

- How the crisis will affect the business the company is in and its standing in that business over the longer term.

- New probabilities for the company’s “Failure Risk.”

- How the crisis has affected the price of risk and likelihood of default by updating the ERP and default spreads.

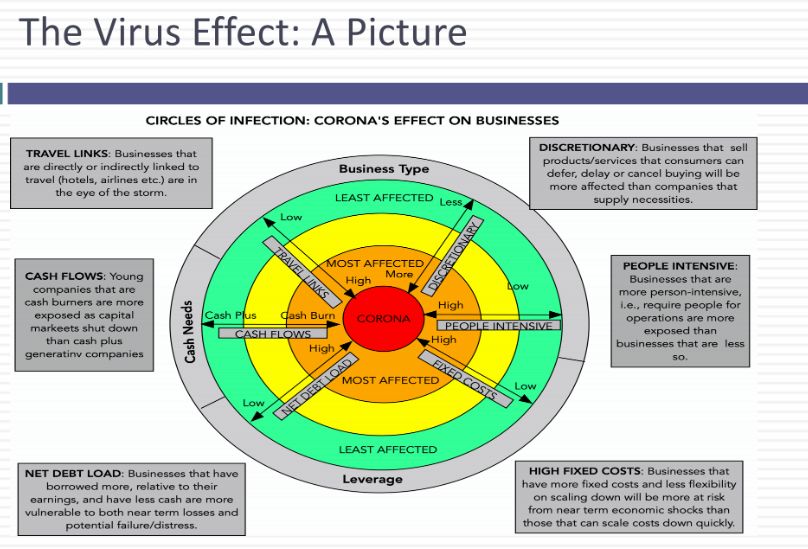

He also provided an illustration titled The Virus Effect: A Picture which highlights Corona’s likely effect on various businesses types:

You can watch the entire presentation here:

You can find a copy of his presentation material here:

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: