Here’s a list of this week’s best investing reads:

This version of Warren Buffett (The Reformed Broker)

Bad Arguments and How to Avoid Them (Farnam Street)

How Will the Crisis Impact Housing Prices? (A Wealth of Common Sense)

If Charlie Munger Didn’t Quit When He Was Divorced, Broke, and Burying His 9 Year Old Son, You Have No Excuse (Joshua Kennon)

An Apology for Small-Cap Value (Verdad)

Is (Systematic) Value Investing Dead? (Cliff Asness)

Ariel Investments Chairman John Rogers: We’re buying stocks, ‘leaning in looking for opportunities’ (Yahoo)

What’s Different This Time (Collaborative Fund)

“Was Our Money Manager Kidnapped?” (Vitaliy Katsenelson)

Paul Tudor Jones – The Great Monetary Inflation (docdroid)

Warren Buffett Berkshire Hathaway Annual Meeting Transcript 2020 (rev.com)

What’s The Catalyst? (The Irrelevant Investor)

Warren Buffett’s Optimistic? Pessimistic? No, Realistic (NY Times)

‘Who am I to be bold?’ Warren Buffett’s lack of stock purchases worries billionaire investor Leon Cooperman (Market Insider)

Speculative Booms (Investor Amnesia)

Hedge Funds’ Best Ideas No Better Than the Rest of Their Ideas (Bloomberg)

Investing Book List (Gavin Baker)

Ray Dalio – The Changing World Order – The Changing Value of Money (Linkedin)

BANG: Making FANG Look Tame (Felder Report)

I Rebalanced My Portfolio After Sinning a Little (AAII)

After lockdowns, economic sunlight or a long hard slog? (FT)

Post Corona: The Cosmic Opportunity (Scott Galloway)

In many ways, stockmarkets have been extraordinary in 2020 (Economist)

An Attempt at Explaining, Blaming, and Being Very Slightly Sympathetic Toward Enron (Dormin)

Billionaire Sam Zell on Market Valuations, Real Estate, Post-Virus Economy (YouTube)

Finding Your Balance in a Topsy-Turvy Market (Jason Zweig)

Regrettable Behavior (Humble Dollar)

Seven Mind-Blowing Charts from the COVID-19 Crisis That Deserve Your Attention (Validea)

Graham & Doddsville Newsletter Spring 2020 (heilbrunncenter.org)

Stocks are Expensive, Volume 1,863 (VSG)

Stock Investing is a Humbling Game (Safal Niveshak)

Are You A Contrarian By Being Bearish? (UPFINA)

Planning once you’ve been punched in the mouth – 3 more questions (Real Returns)

Soul In The Game and Who Are You Trying To Beat? (Howard Lindzon)

More Letters From Your Favorite Investors (Macro Ops)

22 Immutable Laws of Branding (Barel Karsan)

Long-term investors are skewed (Klement)

Be Greedy When Others Are Fearful (Miller Value)

Notes from the 2020 Berkshire Meeting (Novel Investor)

Are You Buying At These Valuations? Not Buffett (GMM)

Supply – How to find quality businesses (Musing Zebra)

Why Buffett Was Wrong to Dump Airlines (Advisor Perspectives)

Berkshire Hathaway Memo (Brian Langis)

Fed Eats Buffett’s Lunch (Dr Ed)

What the Hell is the Stock Market Doing? (Prag Cap)

Microsoft, Apple, Amazon, Alphabet, and Facebook now make up more than 21% of the S&P 500 (Empire FInancial)

American Idol (Epsilon Theory)

Why You Should Invest in Stocks (Of Dollars and Data)

The Psychology of Masks (Rational Walk)

Good news and bad news from Warren Buffett (EB Investor)

If an Investment Strategy Looks Too Good to Be True, Look under the Hood (CFA Institite)

Who Cares About Profits Anyways? (Oddball Stocks)

The End Of The Beginning (Demonetized)

The Tyranny of the Negative Headline (Investment U)

A Brave Stock To Buy Before America Reopens (Boyar Value)

Pick a letter, any letter (Brinker)

This week’s best investing research reads:

Cheap vs. Expensive Factors: Does Valuation Matter for Future Returns? (Alpha Architect)

Merger Arbitrage: Arbitraged Away? (Factor Research)

Price Action Analysis Charts (PAL)

Weekly Top 5 Papers – April 27 to May 3, 2020 (ssrn)

How To Adapt To Changing Markets (TraderFeed)

The Decline And Fall Of Real Yields… Again (Capital Spectator)

High Speed: Bear and Bull Both Running at Full Speed (Schwab)

Bond Vol Is Dirt Cheap Again (Macro Tourist)

Buffett Crashes the U.S. Airline Sector (ShortSight)

Why hold government bonds if the yields are so low? (Nucleus Wealth)

Beating Human Biases with Robo-analysts (Investment Innovation)

Should We Care About the Yield Curve Going Forward? (WisdomTree)

Gold – Representing investor store of value fears (DSGMV)

The Definition Of Falling Knives (All Star Charts)

This week’s best investing podcasts:

Whatever it Takes Squared (Animal Spirits)

The Bullish vs. Bearish Cases Mid Shutdown: Investment Strategist Jason Trennert (WealthTrack)

Ed Stringham & Brian Kessens (Behind The Markets)

Tim McCusker – Advising Through a Crisis at NEPC (Capital Allocators)

Against the Rules with Michael Lewis (The Invisible Coach)

The Impact of COVID-19 on Value Investing (Excess Returns)

Love and youth and spring (Grant’s)

Dan McMurtrie: Pandemic Investing, Venture Capital, and Frontier Markets (EP.08) (Infinite Loops)

Chris Bloomstran – An Update on Public Markets (Invest Like the Best)

Jim Chanos on Financial Fraud (Podcast) (MIB)

Episode #218: Adam Karr, “One Of The Most Important Decisions You Make Is The Price That You Pay” (Meb Faber)

The Yield Curve Indicator is UNDEFEATED (The Compound)

Moshe Milevsky: How to Lower Retirement Risk at a Turbulent Time (The Long View)

S8 E11 Global Economy, Policy Responses, and Global Markets with Bill Campbell (The Sherman Show)

TIP292: Understanding the Chinese Economy w/ Leland Miller (TIP)

#91 – Jack Dorsey: Square, Cryptocurrency, and Artificial Intelligence (Artificial Intelligence)

427 Ben Hunt of Epsilon Theory talks Seeing Through Fake Statistics, Hope, and Being a “Girl Dad” (Going Deep)

Mark Yusko: Gold Miners are Orders of Magnitude Undervalued Relative to Gold (Palisade Radio)

Greg Zuckerman: Did Jim Simons (Renaissance Technologies) Solve the Market? (EP.97) (Rational Reminder)

This week’s best investing tweet:

Manhattan is so beautiful in the spring. pic.twitter.com/CDy7DaDVK2

— Tobias Carlisle (@Greenbackd) May 5, 2020

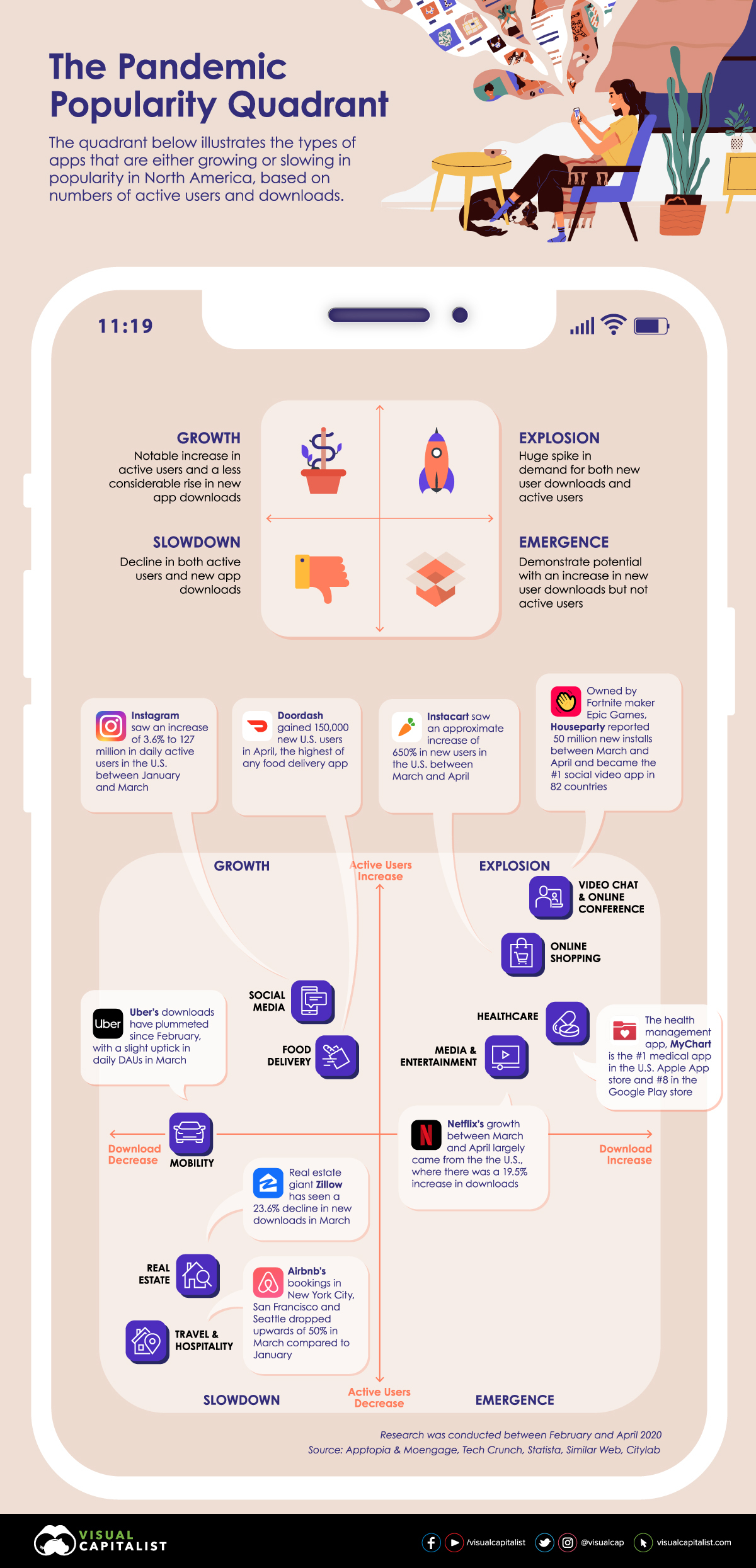

This week’s best investing graphic:

The COVID-19 Impact on App Popularity (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: