Here’s a list of this week’s best investing reads:

The Three Sides of Risk (Collaborative Fund)

Mental Models For a Pandemic (Farnam Street)

Netflix: Cooked? (behindthebalancesheet)

Inequality Everywhere You Look (A Wealth of Common Sense)

How Sectors are Driving Value and Growth (The Irrelevant Investor)

Three things you can’t do in this world (The Reformed Broker)

Ray Dalio – The Big Cycles Over The Last 500 Years (LInkedIn)

Taleb and Asness feud on Twitter over tail-risk hedging (MarketWatch)

Bill Miller’s Takeaways From Recent Market Volatility (YouTube)

Know What You Don’t Know: Six Tips from Howard Marks, CFA (CFA Institute)

The Unicorns Fell Into a Ditch (Bloomberg)

Myth Busting, Popular Delusions, and the Variant Perception (Morgan Stanley)

The Case For Value Stocks (Validea)

Rich Pzena – Record Uncertainty Creates Extreme Opportunity (Pzena)

Why The Survival Of Traditional Carmakers Is Far From Certain (Vitaliy Katsenelson)

Why Failed Predictions Don’t Matter (Of Dollars and Data)

Many Americans used part of their coronavirus stimulus check to trade stocks (CNBC)

Fight The Fed (The Felder Report)

Pandemics & Markets: Part II (Jamie Catherwood)

When Failure Is an Option: A Trading Strategy Soaks Investors (Jason Zweig)

Howard Marks on Fed Support, Credit Market Distress, Virus Impact (YouTube)

Warren Buffett: The Best Reason for Selling (Novel Investor)

Value Managers Fight Back (Institutional Investor)

The Song Remains the Same (The Rational Walk)

Campus Culture and iStanford (Scott Galloway)

A bullish indicator for Berkshire; Buffett and Bank Stocks; (Whitney Tilson)

Charlie Bobrinskoy on volatile stocks (CNBC)

Lollapalooza Time (Investment Masterclass)

Are You Betting on a V-Shaped Recovery in Stock Market? (Safal Niveshak)

When and How to Take Risk in Bonds (Verdad)

The widening valuation spread between growth and value (EB Investor)

The Challenge for Warren Buffett (Alpeh)

Wow! (The Brooklyn Investor)

What Hedge Funds Bought & Sold in the Volatility: New Q1 Issue Just Released (Market Folly)

ZAGG: Multiple Ways to Win Following Recent Stock Price Drop (MOI Global)

Are intangibles the bane of value investors? (Klement)

To Hedge or Not to Hedge (Frank K Martin)

3 Reasons Why Value Stocks May Outperform Soon (Advisor Perspectives)

Would Stocks Be Lower WITHOUT COVID-19? (UPFINA)

The End of the Beginning (Epsilon Theory)

Rookie Mistakes (Humble Dollar)

Dazed and Confused (Compound Advisors)

The Key To Successful Trading Psychology (TraderFeed)

Old Bears, Young Bulls and Middle Aged Bearistas (Howard Lindzon)

YYX Annual Value Symposium is back on (Brian Langis)

How Investors Rationalize Their Fears… and Lose Money (Investment U)

Debt: the First 5000 Years (Alexdanco)

Sean Stannard-Stockton on CNBC: The Risk Off Rally & Fiscal Stimulus (Intrinsic Investing)

QOTD: Stan Druckenmiller All Beared Up (GMM)

The World Needs More Investors (Clearing The Fog)

Target Great Stocks At Bargain Prices In The Next Downturn (Sure Dividend)

Hedging with Hindsight (Investment Innovation)

Focused expertise (Brinker Capital)

Cram Session (Bone Fide Wealth)

This week’s best investing research reads:

Prospect Theory Helps Explain Return Anomalies (Alpha Architect)

Cheap vs Expensive Factors (Factor Research)

27+ Consumer Debt Statistics that Highlight America’s Debt Crisis (Fortunly)

Economic Effects of Coronavirus Outbreak (COVID-19) on the World Economy (ssrn)

FAANG Still Leading (Value Plays)

Collateral, Leverage, & Volatility: The What, How, & When To Invest (Integrating Investor)

Every Picture Tells a Story: “Chartbook” Look at Economy/Market (Schwab)

Chinese Commodity Carnage (RCM Alternatives)

High Low Friday – 5/15/2020 (Dana Lyons)

The Joseph and Noah effect – Stable versus tail extremes in portfolio management (DSGMV)

This week’s best investing podcasts:

TIP297: Warren Buffett & the 2020 Berkshire Hathaway Shareholders Meeting Part 1 (TIP)

Decision-Making: Morgan Housel in Conversation with Annie Duke (Take 15)

Gavin Baker’s Discussion on Investing with Columbia Student Investment Management Association (YouTube)

Michael Lewis in Conversation with Malcolm Gladwell and Jacob Weisberg (Against The Rules)

The Narrative Game with Ben Hunt Ep. 1 – The V-Shaped Recovery (Grant Williams)

Is the Stock Market Wrong? (Animal Spirits)

Quantitative and Fundamental Investing Andrew Sandoe, CIO Fidelis Capital Management (Value Talks)

The Pros and Cons of Factor Timing (Excess Returns)

Ep. 869: Alexandra Carter (Trend Following Radio)

Hamilton Helmer – Power + Business (Invest Like The Best)

A Degenerate Gambler Walks Into a Stock Exchange… What Are Your Thoughts? (The Compound)

Henry Cornell on Merchant Banking (MIB)

Podcast Special: Jesper Koll & Jeffrey Weniger (Behind The Markets)

Daylian Cain – Master Class in Negotiations (Capital Allocators)

Rob Arnott – Contrarian Investor – This week on WEALTHTRACK (WealthTrack)

Rick Rieder: Nobody Has Ever Seen Anything Like This (Long View)

S8 E13 Touring the Treasury Market with Gregory Whiteley (Sherman Show)

Christie Hamilton: Institutional Investing, Due Diligence During COVID-19, and Advocacy (EP.09) (Infinite Loops)

Could The Fed Get Bitcoin Banned? (Stansberry)

This week’s best investing graphics:

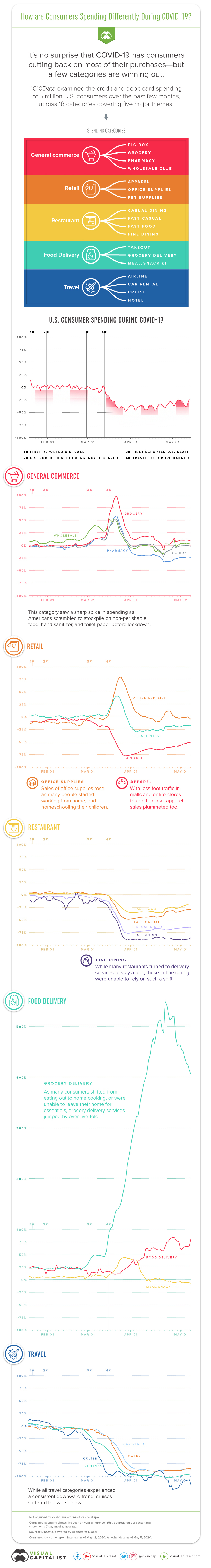

How U.S. Consumers are Spending Differently During COVID-19 (Visual Capitalist)

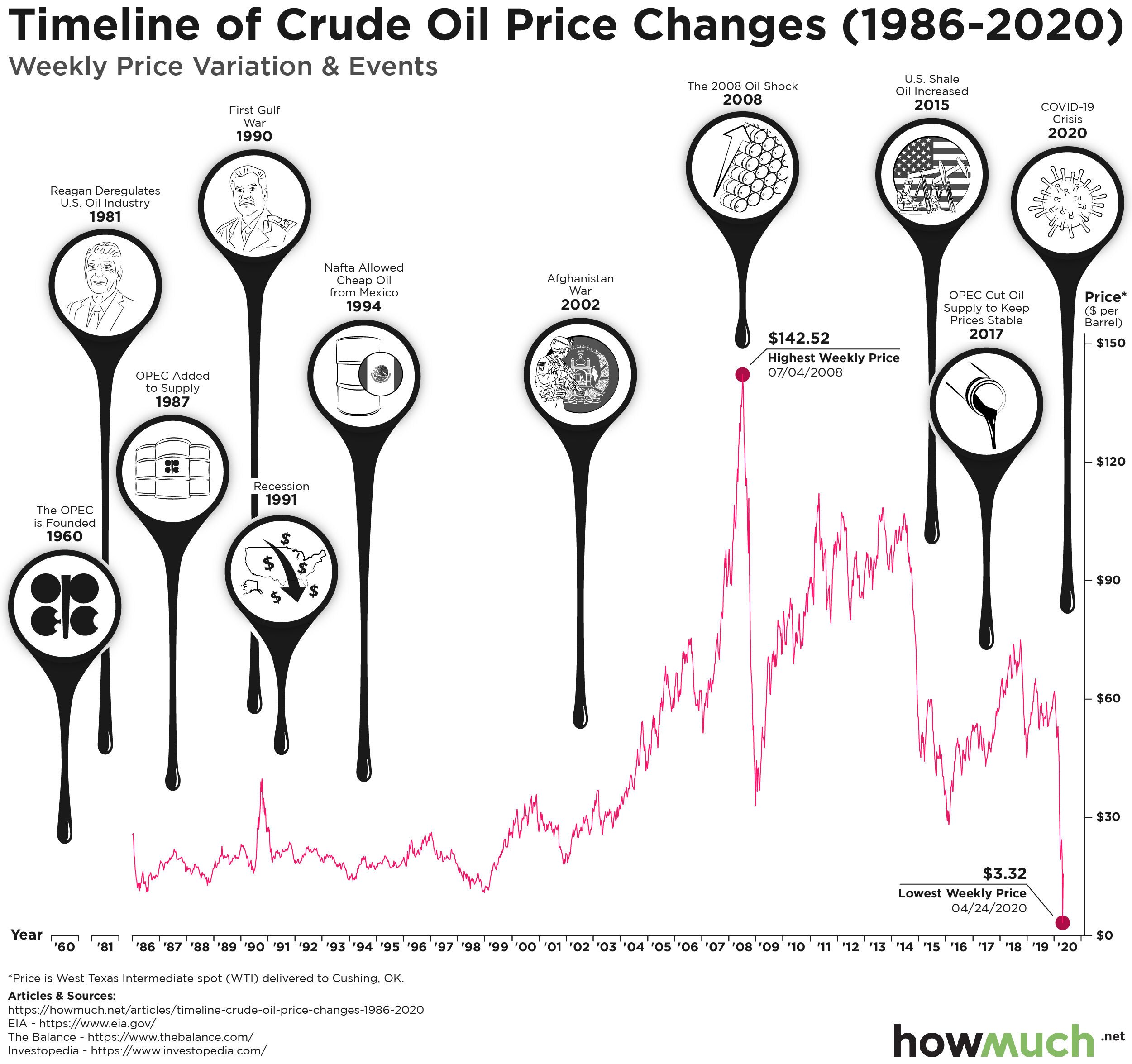

Visualizing Thirty Years of Crude Oil Prices (Howmuch)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: