Here’s a list of this week’s best investing reads:

Making Sense of a Stock Market That Doesn’t Make Any Sense (A Wealth of Common Sense)

When You Have No Idea What Happens Next (Collaborative Fund)

Thomas Kaplan, an Investor in Novagold (csinvesting)

United States Corona Corps (Scott Galloway)

Unintended Consequences (The Irrelevant Investor)

When Buffet was a Quant (Verdad)

Bear Stearns and the Narratives of Systemic Risk (Epsilon Theory)

Muscular Bonding: The Power of Dance and Drill (Farnam Street)

Mind The FANMAG Gaps (Felder Report)

You can’t invest in GDP (The Reformed Broker)

Warren Buffett is handling the coronavirus crisis like he mastered the Great Recession (Lawrence Cunningham)

A Viral Market Update VII: Mayhem with Multiples (Aswath Damodaran)

The Anti-Amazon Alliance (Stratechery)

Buffett: Why Smart People Do Dumb Things (Novel Investor)

‘The American Tailwind’ (Frank K Martin)

When Your Fund Beats the Market, Ask: Which Market? (Jason Zweig)

Is The Bottom In S&P 500 Earnings Estimates Near? (UPFINA)

COVID-19 Catalyst For An Easy Game Against Passive Investing (integrating Investor)

Oil & Markets (Jamie Catherwood)

Talk is Cheap (Of Dollars and Data)

3 Signs a Company is Manipulating Earnings and Profits (VSG)

Kyle Bass Surprised by Magnitude of Market Recovery in Current Economy (GuruFocus)

Less Is More (Humble Dollar)

Excess capital after a plague (Klement)

Berkshire Hathaway Annual Meeting Questions (The Rational Walk)

Volatility Provides Greater Value Opportunities (Miller Value)

Using Put Options To Protect A Portfolio Of Stocks (Macro Ops)

Stock Market Winners May Keep Winning (Advisor Perspectives)

Popular Narratives And The Dangers Of Group-Think (Zen Investor)

Why Risk Management Will Not Produce The Best Investing Returns (BVI)

If It’s So Safe Out There, Why Are We On The Verge Of Major Meat Shortage? (GMM)

What Makes a Business Durable? (Focused Compounding)

Alphabet earnings; Tesla’s amended 10-K; Note from a reader (Whitney Tilson)

Analysing uncertainty – TMI (Bruce Packard)

Gaps In Various “Scientific” Virus Models (Brian Langis)

What is happening? Does anything even matter? (Oddball Stocks)

Not Everything That Counts Can Be Counted (CFA)

Not All Gross Margin Is The Same (AVC)

How can oil be worth less than nothing? (Brinker)

Apple Sales Statistics: The Journey of the iPhone (Fortunly)

This week’s best investing research reads:

Why Isn’t the Market Down More? (Intrinsic Investing)

Trend Following is Everywhere (Alpha Architect)

Inflation? I Think Higher Threat is Deflation (Points and Figures)

Weekly Top 5 Papers April 20 to 26, 2020 (ssrn)

How Can You Identify A Trend Day In The Stock Market? (TraderFeed)

U.K. Short Selling Activity (ShortSight)

Long/Short Signals for April 29, 2020 [DLPAL LS Signals] (PAL)

Alternative investments – Return dispersion is costly (DSGMV)

Tail Risk Hedge Funds (FactorResearch)

“A Rock And A Hard Place” (All Star Charts)

Tranching, Trend, and Mean Reversion (Flirting with Models)

High Low Friday – 4/24/2020 (Dana Lyons)

This week’s best investing podcasts:

#82 Bill Ackman: Getting Back Up (The Knowledge Project)

Capitalism as We Know It (Animal Spirits)

Behind The Markets Podcast: Chase Taylor (Behind The Markets)

Companies and Consumers Show Their True Colors During the Crisis (HBR)

TIP294: Inflation – Deflation – Which One Is It? w/ Jeff Booth author of The Price of Tomorrow (TIP)

Psychology and COVID-19 with Dr. Daniel Crosby (Excess Returns)

Wade Pfau: The 4% Rule Is No Longer Safe (The Long View)

Bruce Greenwald – Class is in session (Grant’s)

Morgan Housel – The Psychology of Money (EP.06) (Infinite Loops)

Rob Arnott: My personal portfolio is all in on value (CityWire)

S8 E10 Forbearance and Housing Market Implications ft Ken Shinoda (The Sherman Show)

The Digital Future of the Supply Chain (Expotential View)

James Montier – The Odd Thing About Value Investors (Stansberry)

Dan Davidowits & Jeff Mueller – Compounding with Polen Capital (Value Investing With Legends)

Chris Bloomstran – An Update on Public Markets (Invest Like The Best)

How Amazon, Target and Walmart are Crushing It Right Now (The Compound)

Chris Whalen on PPP Loans (MIB)

Michael Mervosh – Investing in Yourself During a Crisis (Capital Allocators)

This week’s best investing tweet:

In 2008, the Federal Reserve provided liquidity to wind down insolvent banks.

In 2020, they are attempting to provide enough liquidity to permanently support insolvent companies amidst historic debt

The question we all need to ask ourselves, is liquidity a cure for insolvency?

— Christopher Cole (@vol_christopher) April 27, 2020

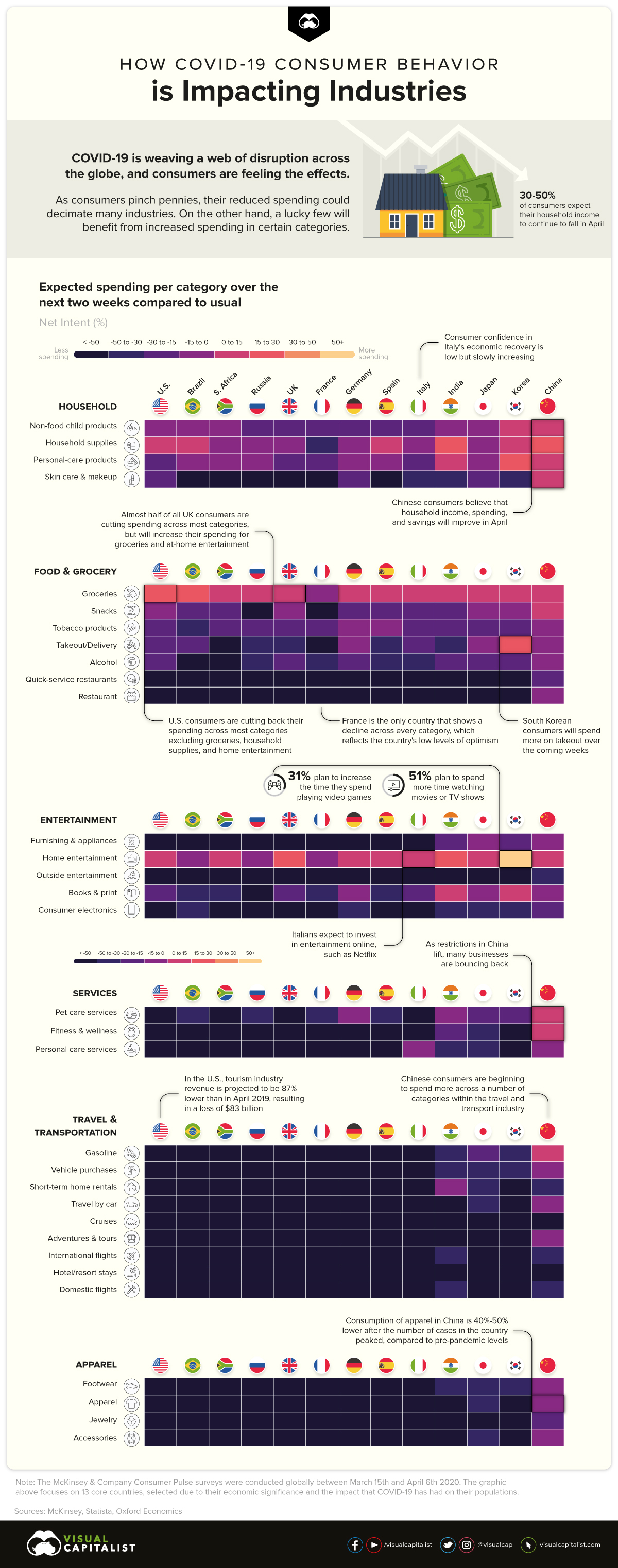

This week’s best investing graphic:

How COVID-19 Consumer Spending is Impacting Industries (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: