Here’s a list of this week’s best investing reads:

Who Pays For This? (Collaborative Fund)

Do We Need to Worry About Government Debt? (A Wealth of Common Sense)

She’s the Boss of Her Money: Four Trends in Women’s Online Investing (CFA Institute)

The Art of Survival (Ian Cassel)

A Historic Opportunity in Small Cap Stocks (OSAM)

Wall Street Never Changes (csinvesting)

A Viral Market Update VII: Mayhem with Multiples (Aswath Damodaran)

The first modern pandemic (Bill Gates)

Why We Focus on Trivial Things: The Bikeshed Effect (Farnam Street)

Is the Fed Superman or the Antichrist? Gotta hear both sides (The Reformed Broker)

Dispersion and Alpha Conversion (Michael Mauboussin)

It’s Time To Build (Andreessen Horowitz)

The Only Thing Working Right Now (The Irrelevant Investor)

10 Features of the post-Virus Investment Landscape (Behind The Balance Sheet)

A Minsky Moment? (Jamie Catherwood)

Charlie Munger: ‘The Phone Is Not Ringing Off the Hook’ (Jason Zweig)

Investors baffled by soaring stocks in ‘monster’ depression (FT)

Owner/Operator COVID-19 IMPACT SURVEY (Permanent Equity)

As Good As Gold? To Buy Or Sell Swiss National Bank (Seeking Alpha)

Google to cut marketing budgets by as much as half, directors warned of hiring freezes (CNBC)

Apple Aims to Sell Macs With Its Own Chips Starting in 2021 (Bloomberg)

Renaissance’s $10 Billion Medallion Fund Gains 24% Year to Date in Tumultuous Market (WSJ)

Thoughts on Berkshire’s Deployable Cash (The Rational Walk)

The ‘Undertaker Of Silicon Valley’ Stays Busy As Startups Lay Off Thousands (NPR)

Through No Fault of Their Own (Epsilon Theory)

Post Corona: The Four (Scott Galloway)

The Most Important Stock Investment Lessons I Wish I Had Learned Earlier (Safal Niveshak)

Ray Dalio on the Economic Impact of the Coronavirus Crisis (Bloomberg)

The Jet Lag Series: How do I work? When do I find time to write? (Vitaliy Katsenelson)

Can Stocks Go Up In a Depression? (Howard Lindzon)

The Last 800 Years of Data Show No Bottom Yet (Validea)

Is the 2020 Bear Market a Value Investor’s Paradise? (VS Guide)

Have We Seen The Bottom In Economic Activity? (UPFINA)

Lend Early and Freely (Verdad)

Who Feels Rich Really? (Of Dollars and Data)

Looking For Clues About Where The Market Is Headed Next (Zen Investor)

Looking for the Best Place to Stash Your Cash? (Schwab)

You can be too patient (Klement)

Hunting Ground (Musing Zebra)

Which Kind of Investor Could You Aspire to Be: Graham, Fisher, Lynch, Greenblatt, or Marks? (Focused Compounding)

Estimating The Earnings Crash (Advisor Perspective)

The Forgotten Man (Frank K Martin)

“Well, you… No, you gotta do more than that.” (Flirting with Models)

Riding the Bear (Humble Dollar)

Phil Fisher’s 15 Golden Questions (Investing Bites)

Capitalism Has Changed Forever (GMM)

Identify Your Value Proposition with This Mathematical Concept (HBR)

Is the Trend Really your Friend? (Investment Innovation)

Summary of “M&M on Valuation” (Clearing The Fog)

Not theory, reality – The world of negative oil prices (DSGMV)

It’s going to get worse (Alex Danco)

NYC subway nearly empty (Whitney Tilson)

How Tech Can Build (Stratechery)

Fed Trying To Contain Zombie Apocalypse It Created (Dr Ed)

Rebalancing Act (bps and pieces)

What Lessons Should Investors Learn from the Coronavirus Bear Market? (Part One) (Behavioural Investment)

Creative destruction (Brinker)

A Forward Looking Review of the COVID Present (Calibrating Capital)

Record Uncertainty Creates Extreme Opportunity (Pzena)

Bill Miller 1Q 2020 Market Letter (Bill Miller)

Fundsmith Q1 2020 (Fundsmith)

Reflections on an Unfolding Crisis (First Eagle)

This week’s best investing research reads:

Attention Data Geeks: Our Factor Investing Data Library is Open (Alpha Architect)

This Market Is Breaking Down To A New Frontier (All Star Charts)

An Optimistic Assessment of COVID-19, Part 4 (Aleph)

Is Stock Rally Getting Too Thin? (Dana Lyons)

You Can Hide Negative Prices But Not The Volatility (PAL)

Top 5 Papers April 13 to 19, 2020 (ssrn)

The Biggest Mistake New Traders Will Make (Traderfeed)

Shorts Hit Multiple Gushers in Oil & Gas Stocks (Shortsight)

Smart Beta Fixed Income ETFs (FactorResearch)

This week’s best investing podcasts:

TIP293: Intrinsic Value Assessment of Bank of America w/ Bill Nygren (TIP)

James Montier on Fear and Investment (MIB)

Free Oil (Animal Spirits)

Ryan Detrick (Behind The Markets)

Are Financial Markets Broken? (The Compound)

Andrew Golden – Navigating Princeton’s Endowment Through (Another) Crisis (Capital Allocators)

Bill Fleckenstein On How To Profit From Central Bank Mistakes (The Felder Report)

S8 E9 Talking WTI Crude Oil and Other Financial Market Mysteries ft. Jeff Mayberry (Sherman Show)

Brigitte Madrian (The Long View)

The Limits to Lessons From Past Bear Markets (Excess Returns)

Manny Stotz – Frontier Markets Investing (Invest Like the Best)

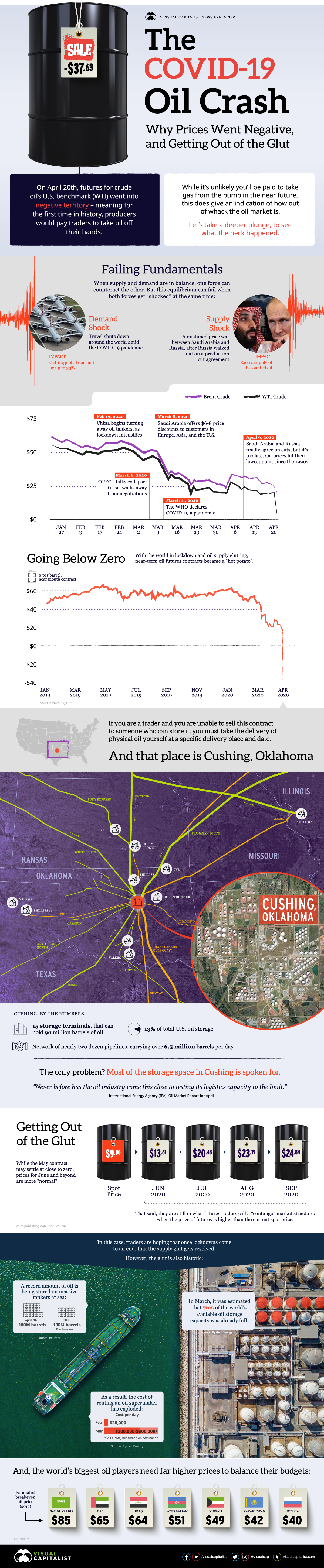

This week’s best investing graphic:

How Oil Prices Went Subzero: Explaining the COVID-19 Oil Crash (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: