Here’s a list of this week’s best investing reads:

Coronavirus and Credibility (Paul Graham)

No, This is Not the Great Depression (The Irrelevant Investor)

The 6 Commandments of Value Investing (Vitaliy Katsenelson)

The Relationship Between Earnings and Bear Markets (A Wealth of Common Sense)

The Shock Cycle (Collaborative Fund)

Unlikely Optimism: The Conjunctive Events Bias (Farnam Street)

A Viral Market Meltdown VI: The Price of Risk (Aswath Damodaran)

Now They Tell Us: Virus mortality forecasts decline as economic misery skyrockets (WSJ)

The Fed finds another kitchen sink to throw at us (The Reformed Broker)

It’s Always Darkest Before The Dawn (GMO)

A Letter to My Future Investing Self (Validea)

Investing Through Crises (Jamie Catherwood)

Why Mr. Market’s Earnings Expectations May Still Be Far Too High (Felder Report)

Your Internet is working. Thank these Cold War-era pioneers who designed it to handle almost anything (Washington Post)

Warren Buffett’s Berkshire Hathaway Joins Global Debt Splurge (Yahoo Finance)

Accrual Vs Cash Accounting – Is One Better For Value Investors? (Value Investing Journey)

What’s Priced In? (Verdad)

The Bare Necessities You Need for a Bear Market (Jason Zweig)

The Lesson We Are Learning From Zoom (NY Times)

Too Big to Fail, COVID-19 Edition: How Private Equity Is Winning the Coronavirus Crisis (Vanity Fair)

Case Study on Capital Cycle: Tidewater (csinvesting)

86,400 Seconds (Safal Niveshak)

US shareholders brace for nine-year squeeze on dividends (FT)

Box of Letters: What Shape Will the Recession/Recovery Take? (Schwab)

Jamie Dimon 2019 Letter To Shareholders (JP Morgan Chase)

Exclusive Interview: Masayoshi Son Talks WeWork, Vision Fund And SoftBank Under Siege (Forbes)

Near-Retirement Target-Date Investors Show Signs of Stress (Morningstar)

Managing the Liquidity Crisis (HBR)

How Long-Term Thinking Protects Short-Term Profits (investment U)

The Itch for Action (Your Brain On Stocks)

Apple, Amazon, and Common Enemies (Stratechery)

Chamath Palihapitiya: US needs to let hedge funds, billionaires fail during coronavirus pandemic (CNBC)

Contrarian analysts (Klement)

Should You Sell? (Humble Dollar)

Post Corona: Higher Ed (Scott Galloway)

Has the Dust Settled Yet? (Of Dollars and Data)

The World Has No Pause Button (The Rational Walk)

Berkshire’s exposure to business interruption insurance (Whitney Tilson)

This Isn’t the Next Great Depression (Prag Cap)

Catching Our Breath and Repositioning…And The Big Get Bigger (Howard Lindzon)

How good an investment is private equity (honestly)? (EB Investor)

Fastest Bull Chases Fastest Bear (Aleph)

Corporate Leadership in a Time of Crisis (Intrinsic Investing)

Market Highlights 1Q 2020 (Miller Value)

Our Finest Hour (Epsilon Theory)

Should I Really Just Automatically Ignore High P/E Growth Stocks Even if they Are Amazing Businesses? (Focused Compounding)

Finding Confidence in Crisis (bps and pieces)

Alpha and the .400 Hitter (CFA Institite)

Stocks Bounce Even as Economic Uncertainty Remains (Advisor Perspectives)

Life is Beautiful (Compound Advisors)

Different types of liquidity crises – Defining the problem (DSGMV)

10 Questions ESG Investors Must Consider (Behavioural Investments)

How To Transfer Assets In Volatile Markets (Betterment)

The Outsiders by William Thorndike (Clearing the Fog)

Is it time to re-enter the world stock market? (Nucleus Wealth)

Overcoming fear (Brinker Capital)

No Mistakes, Just Happy Accidents (Ramp Capital)

This week’s best investing research reads:

A L-U-V-Wy Recovery (Flirting with Models)

Stocks Bottom Before Jobless Claims Peak (UPFINA)

Daily vs. Monthly Trend-Following Rules…Plus Some DIY Tools! (Alpha Architect)

Profit & Loss Driven Short Squeeze Candidates (Shortsight)

Pandemics Depress the Economy, Public Health Interventions Do Not: Evidence from the 1918 Flu (ssrn)

Classic Bear Market Bounce (GMM)

Time To Start Reloading Shorts? (Macro Ops)

Massive Stock Market Gains But Repeat of 2008 Pattern Highly Probable (PAL)

Factor Olympics Q1 2020 (FactorResearch)

Black Swan Events (Alexdanco)

High Low Friday – 3/20/2020 (Dana Lyons)

The 10-Month Moving Average Strategy (All Star Charts)

This week’s best investing tweet:

A lot of people in NY and Washington, when they think of the stock market and the Fed, they think that’s pretty much everything. But there is so very much more to America. pic.twitter.com/t0qNIuNhro

— michaeljburry (@michaeljburry) April 9, 2020

This week’s best investing podcasts:

Ep. 18: Interview: Value Investing with Tobias Carlisle (Excess Returns)

Ruby Huang & Art Berman (Behind The Markets)

Sarah Tavel – Consumer & Marketplace Investing (Invest Like the Best)

Some Good News (Animal Spirits)

TIP290: Current Market Conditions 4 April 2020 (TIP)

How Will This Crisis End? | Animal Spirits Episodes 135/136 (The Compound)

Dan Fuss: It’s Too Early to Relax (The Long View)

C.T. Fitzpatrick: Value Investing in times of deep distress (Value Investing with Legends)

Ep. 115 – There’s Your Edge with Jim O’Shaughnessy (Planet MicroCap)

Jonathan Miller on Real Estate After the Coronavirus (MIB)

Episode #210: Jonathan Treussard “Be Aware Of The Cracks Under Your Feet” (Meb Faber)

Steve Nelson – Assisting Private Equity Allocators Through Turbulent Times at ILPA (Capital Allocators)

S8 E7 Market and Macro Update (The Sherman Show)

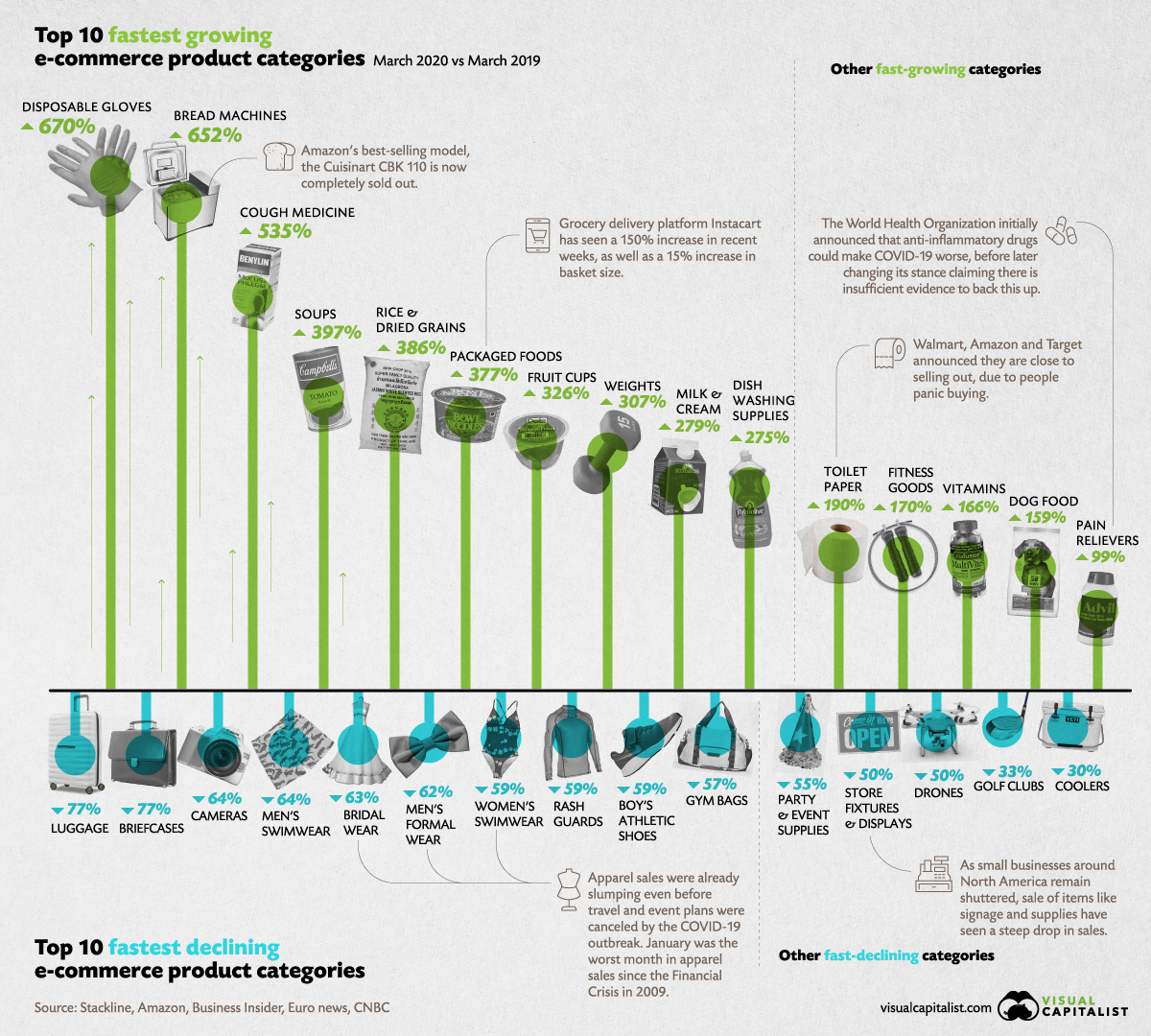

This week’s best investing graphic:

The Pandemic Economy: What are Shoppers Buying Online During COVID-19? (VIsual Capitalist)

(Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: