Here’s a list of this week’s best investing reads:

When Is the Right Time to Buy Stocks? (Irrelevant Investor)

How I’m Managing My Own Money Through the Crisis (A Wealth of Common Sense)

Corporate Socialism: The Government is Bailing Out Investors & Managers Not You (Nassim Nicholas Taleb)

Preserving Optionality: Preparing for the Unknown (Farnam Street)

No bottom until the virus tops (The Reformed Broker)

The death of the US equity premium (FT)

OSAM Update: Blizzard, Winter, or Ice Age (OSAM)

Stock Market Valuations (Meb Faber)

Fear and Pcychology of Bear Markets (James Montier)

The Oil Glut Is Filling Up the World’s Supertankers Fast (Bloomberg)

Common Enemies (Collaborative Fund)

Do The Right Thing (Epsilon Theory)

Bill Ackman exits market hedges, uses $2 billion he made to buy more stocks including Hilton (CNBC)

What to Buy First (Verdad)

The Fate Of The Fantastic Four (Of Financial Engineering) (The Felder Report)

Ariel’s John Rogers: This is a once in a lifetime opportunity to buy stocks (CNBC)

A Viral Market Meltdown IV: Investing for a post-virus Economy (Aswath Damodaran)

Here’s Why You Should Rebalance (Again) (Morningstar)

Our Generation’s Test (Scott Galloway)

Never Let a Good Crisis Go to Waste (Vitaliy Katsenelson)

Why You Can’t Time the Market (Morningstar)

Investor David Tepper says he’s buying tech stocks, but market may have 10% to 15% more to fall (CNBC)

27 Things to Do Now (Humble Dollar)

Compaq and Coronavirus (Stratechery)

The Panic of 2020? Oh, I Made a Ton of Money—and So Did You (Jason Zweig)

Invest When There Is Blood in the Streets (Investment U)

11 Positive Things to Do Amidst the COVID-19 Crisis (Safal Niveshak)

Berkshire Hathaway and the Coronavirus Crash (The Rational Walk)

Anatomy of Fear and Greed (Frank K Martin)

Buying During a Crisis (Of Dollars and Data)

Riding out the market turbulence (EB Investor)

Themes of a Bottoming Process (Validea)

Long Toilet Paper / Short Equities – Why We Panic Buy and Sell (Behavioural Investment)

A bear market bottom checklist (Brinker)

It’s Time to Declare War on COVID-19 (Prag Cap)

Coronavirus – getting angry (Bronte Capital)

Roger G. Ibbotson: What Works in Asset Allocation (CFA Institute)

This week’s best value-investing reads:

Where Have You Gone, Warren Buffett? (Ritholz)

Why Peter Lynch Loves Volatility And Why Value Investprs Should As Well (GuruFocus)

Is There Something Wrong with the Value Premium? (Alpha Architect)

This week’s best investing research reads:

Biggest Recession Since The Great Depression? (UPFINA)

What the Trend (Flirting with Models)

Too Much Debt (Aleph)

Short Squeeze Candidates (Shortsight)

Top 5 Papers March 15 to 22, 2020 (SSRN Blog)

Thematic Investing: Thematically Wrong? (FactorResearch)

The Math & Emotion of Living Through Market Declines (Advisor Perspectives)

Cash, near-cash, and new risky assets (DSGMV)

Regulators to the Rescue? (Albert Bridge)

This week’s best investing indicator:

ICE BofA US High Yield Index Option-Adjusted Spread (10 Year) (alfred.stlouisfed.org)

This week’s best investing podcasts:

Q&A with Murray Stahl (Horizon Kinetics))

Bailout Main Street (Animal Spirits)

The Fastest Bear Market of All Time (The Compound)

Behind the Markets Podcast Special : COVID-19 Market Update w/ Experts from WisdomTree (Behind The Markets)

Michael Mauboussin – Consilient Observations in a Crisis (Capital Allocators, EP.127)

TIP288: Current Stock Market Conditions – 2020 Crash – COVID 19 (TIP)

Looking at Different Ways to Manage Risk (Excess Returns)

Dan Rasmussen: Your biggest mistake (Grant’s)

Brent Beshore – Update on Small Business and Private Equity (Invest Like The Best)

#87: Gregory Zuckerman | The Man Who Solved The Market: (Intelligent Investing)

A Conversation With the Sequoia Fund’s Managers (Long View)

Value Investing for the Long Term Guest with Francisco García Paramés (Value Investing with Legends)

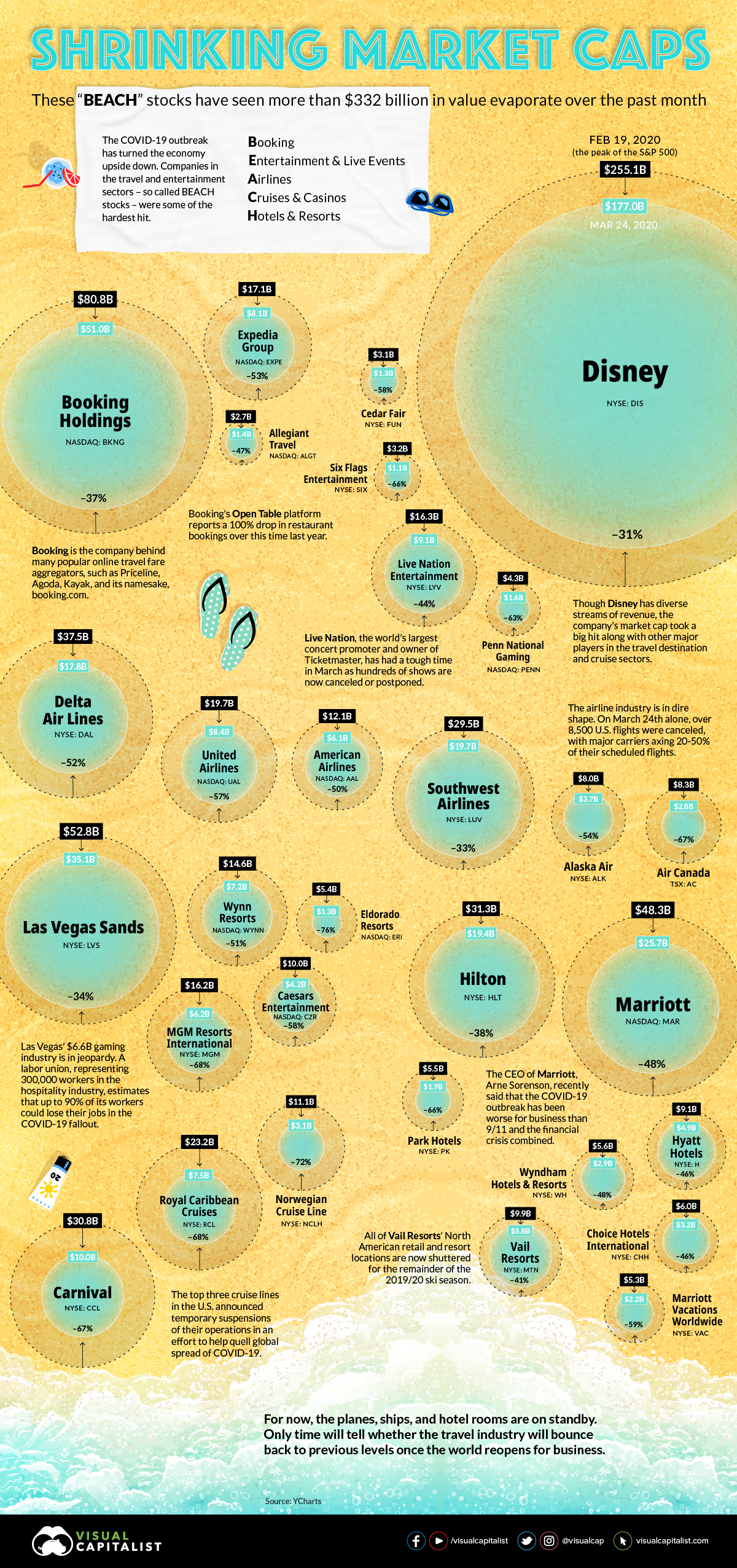

This week’s best investing graphic:

The Hardest Hit Companies of the COVID-19 Downturn: The ‘BEACH’ Stocks (Visual Capitalist)

(Source: Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: