Here’s a list of this week’s best investing reads:

Haters (Paul Graham)

OyoMFG (Scott Galloway)

The Future of Book Publishing (A Wealth of Common Sense)

Risk Is What You Don’t See (Collaborative Fund)

The Investor’s Fallacy (Of Dollars and Data)

51 Ideas from 2019 (Safal Niveshak)

Apple and Microsoft Are Dazzling Investors. That Won’t Last. (Jason Zweig)

Behavioral Economics’ Latest Bias: Seeing Bias Wherever It Looks (MSN)

Data Update 1 for 2020: Setting the table (Aswath Damodaran)

Stocks Are Discounting A Big Rebound In Earnings That May Not Materialize (Felder Report)

The 47,500% Return: Meet The Billionaire Family Behind The Hottest Stock Of The Past 30 Years (Forbes)

Nobody Feels Overpaid (The Irrelevant Investor)

Who is Accountable? (The Reformed Broker)

The Psychology of Passive (Greenwood)

Apple’s heady rise highlights perils of concentration (FT)

Stock Ownership in the USA (Barry Ritholz)

The Hidden Dangers of the Great Index Fund Takeover (Bloomberg)

Berkshire Hathaway underperformance versus the S&P 500; Scott Galloway on ‘FckdEx’ and Unremarkables; Question No. 11 to ask before you marry someone (Whitney Tilson)

12 Investment Sins (HumbleDollar)

2020: Party Like It’s 1999? (Vitaliy Katsenelson)

Bill Nygren Market Commentary | 4Q19 (Oakmark Fund)

Why own Berkshire Hathaway? Greggory Warren (Morningstar), Warren Buffett expert, gives 5 reasons (YouTube)

The Gift of Hope (Farnam Street)

The Biggest Mistake of My Career, And What l Learned From It (Validea)

Berkshire Hathaway’s Culture of Trust (The Rational Walk)

2020 Predictions You Must Know (Per Diem)

Bill Miller 4Q 2019 Market Letter (MIller Value Partners)

Markets And Preferences And Longevity (Points and Figures)

On War Risk (Aleph)

Pick Your Poison: Implicit vs Explicit Forecasts (Sean Stannard-Stockton)

Fintech On Fire…No Surprise To Us Here (Howard Lindzon)

Familiarity Breeds Success: Why Members of Congress Do Best When Buying Local Stocks (Focused Compounding)

Stocks Get Vertical & Vertigo (GMM)

It’s Been A Good Year So Far For (Most) Equity Markets (Capital Spectator)

Unexpected Companies Produce Some of the Best CEOs (HBR)

Negative Interest Rates: The Logical Absurdity (CFA Institute)

Shot, Chaser (Epsilon Theory)

On My Mind: Will the US Economy Survive the Politics in 2020? (Advisor Perspectives)

This week’s best value-investing reads:

Reports of Value’s Death May Be Greatly Exaggerated (Research Affiliates)

Value Investing: The Benjamin Graham Breakthrough (GuruFocus)

9 Reasons to Buy Value Stocks in 2020 (USNews)

The Massive Rotation Into Value Stocks And Out Of Momentum Is Not Even Halfway Done (CNBC)

This week’s best investing research reads:

Quant Tools for Private Equity and Real Assets (Alpha Architect)

What drives valuations? (Klement)

Let’s Talk About the Utility of Balance Sheet Consolidation (Prag Cap)

Integrating Discretionary Trading Skills With Quantitative Strategies (TraderFeed)

Sentiment Index Broken By This Market (UPFINA)

The Unsurprising Repo Surprise (TII)

Why I like cash (EBI)

Tesla Shorts Down $1.25 Billion in Mark-to-Market Losses (ShortSight)

Visa, Plaid, Networks, and Jobs (Stratechery)

The Credit Cycle: Opportunity Exists, but Be Selective (WisdonTree)

Let The Investor Letters Roll In (Macro Ops)

When Everything Else Fails, There is Hope of a “Puetz Window”(PAL)

Top Stock Returns of 2019 (Fat Pitch Financials)

2019 Investor Letter (Flirting with Models)

Global Pension Funds: The Coming Storm (FactorResearch)

Fundamental versus technical risk premia – Are there distinctions? (Mark Rzepczynski)

Quick Thoughts On Geopolitical Risk (Demonetized)

This week’s best investing podcasts:

The 10 Best Jobs in America (Animal Spirits)

Daniel Kahneman: Thinking Fast and Slow, Deep Learning, and AI (AI Podcast)

Gregory Zuckerman – Decoding Renaissance Medallion (EP.119) (Capital Allocators)

Reid Hoffman on Systems, Levers, and Quixotic Quests (Tyler)

58 – Investing Goals for 2020 (DIY)

The Case Against Value Stocks (Excess Returns)

Matt Clifford – Investing Pre-Company – [EP.154] (Invest Like The Best)

Episode #197: Rick Rule, “In Resources You Are Either A Contrarian Or You Are Going To Be A Victim” (Meb Faber)

Ep. 105 – Assessing Stock Performance with Probability and Not as Binary with Peter Rabover, Managing Director of Artko Capital (Planet MicroCap)

Aswath Damodaran on Valuing the Disruptors and Disrupted (Take 15)

Will Boomers Crash The Stock Market? (The Compound)

Matt Clifford – Investing Pre-Company – [EP.154] (Invest Like The Best)

#72 Neil Pasricha: Happy Habits (Knowledge Project)

TIP277: Intrinsic Value Assessment of Disney – w/ David Trainer (TIP)

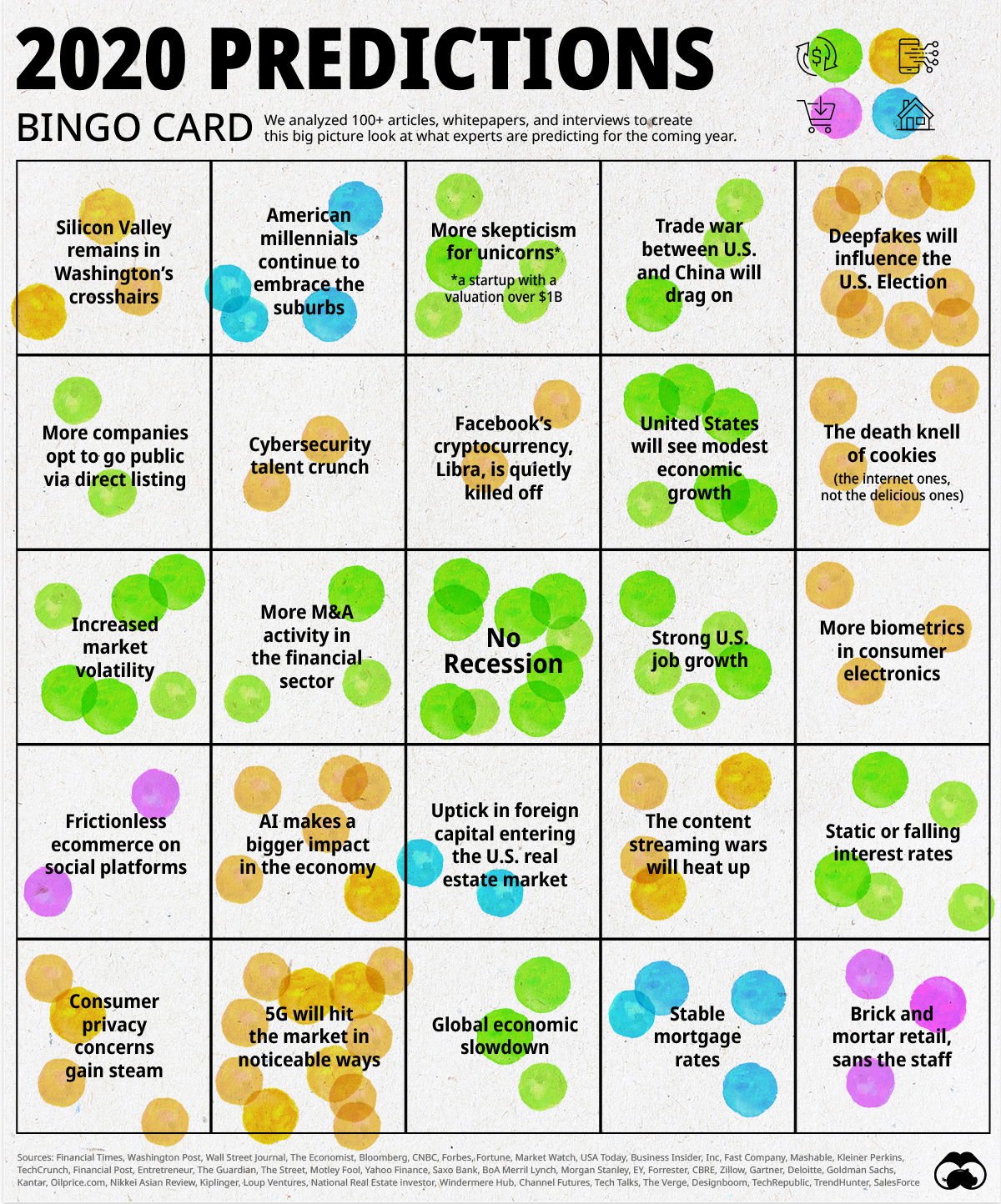

This week’s best investing graphic/video:

Prediction Consensus: What the Experts See Coming in 2020 (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: