Here’s a list of this week’s best investing reads:

Howard Marks Latest Memo – Mysterious (Oaktree Capital)

Focused and Diffuse: Two Modes of Thinking (Farnam Street)

Terrible Business Plans, Wonderful Businesses (A Wealth of Common Sense)

Improving the Odds (HumbleDollar)

A Reckoning for Value Investing as Quants Gather in London (BNN Bloomberg)

Non-Ergodicity and its Implications for Businesses and Investors (Fundoo Professor)

Look Away (The Irrelevant Investor)

Small Steps to Change Your Life, Simplicity, and Living with Acceptance (Safal Niveshak)

Invest like Warren Buffett — Is this value’s time to finally shine? (CNN)

IPO Lessons for Public Market Investors (Aswath Damodaran)

Headed to the 6ix (The Reformed Broker)

Value Stocks: Drawdown Mitigators or Aggravators? (Wisdom Tree)

Interactive Brokers Shares Can Double: Portfolio Manager (Barron’s)

When God Is Your Portfolio Manager (Jason Zweig)

Active/Passive, Secured Debt, Monetary Policy, Populism (Jamie Catherwood)

The Best Predictor of Stock-Fund Performance (Morningstar)

Three Things I Think I Think – Impeachable Ideas (Pragmatic Capitalism)

Ray Dalio Says Global Economy Is in a ‘Great Sag’ (Bloomberg)

Bill Nygren Market Commentary | 3Q19 (Oakmark Funds)

Relative Values (csinvesting)

How a CEO’s Personality Affects Their Company’s Stock Price (HBR)

Tesla’s Risky Gamble & The Future of Lithium-Ion Batteries (Vitaliy Katsenelson)

Money Blinders (Of Dollars and Data)

Veterans and Finance: The Value Proposition (CFA Institute)

Why New Technology Is A Hard Sell (Collaborative Fund)

Booth and Fama: a 50-year friendship that changed investing (The Evidence Based Investor)

Dividends *Can* Lie (The Aleph Blog)

How Probabilities are Expressed Can Impact Our Investment Decision Making (Behavioural Investment)

Five Questions: Factor Timing with Nicolas Rabener (FactorResearch) (Validea)

‘Call It What It Is’: The Federal Reserve Officially Restarts “QE” (And How We Got Here) (Speculators Anonymous)

Bill Miller 3Q 2019 Market Letter (Miller Value Partners)

This week’s best investing research reads:

Yield Curve Trades with Trend and Momentum (Flirting with Models)

How Far Can The Stock Market Run? (Global Macro Monitor)

The Bear Market Checklist (UPFINA)

Momentum Versus Trend-following (Price Action Lab)

Core Earnings: New Data and Evidence (papers.ssrn)

This is not how yield curve inversions work (Klement)

AI, What Have You Done For Me Lately? (FactorResearch)

The Active Manager Paradox: High-Conviction Overweight Positions (CFA Institute)

Antifragile alternative risk premia portfolios – Not easy to structure (Mark Rzepczynski)

Using Firm Characteristics to Enhance Momentum Strategies (Alpha Architect)

Why It’s Time for a Barbell Strategy (Advisor Perspectives)

This week’s best investing podcasts:

TIP264: Mastermind Discussion 3Q 2019 (The Investors Podcast)

Nicole Boyson – Academic Outsider (EP.55) (Expotential ETFs)

Episode 123: The Biggest Bubble Ever? Live From Vegas (Stansberry Investor Hour)

Everything’s Free: The Impact of Zero-fee Trading (with Barry and Dave Nadig) (The Compound Show)

Rick Bensignor: Gold is Back in a Bull Market and Will Head Towards $1700 (Palisade Radio)

Why Governments Haven’t Learned The Lessons Of Japan (Odd Lots)

The Undies Indicator (Animal Spirits)

When the Unthinkable Becomes Reality (Take 15)

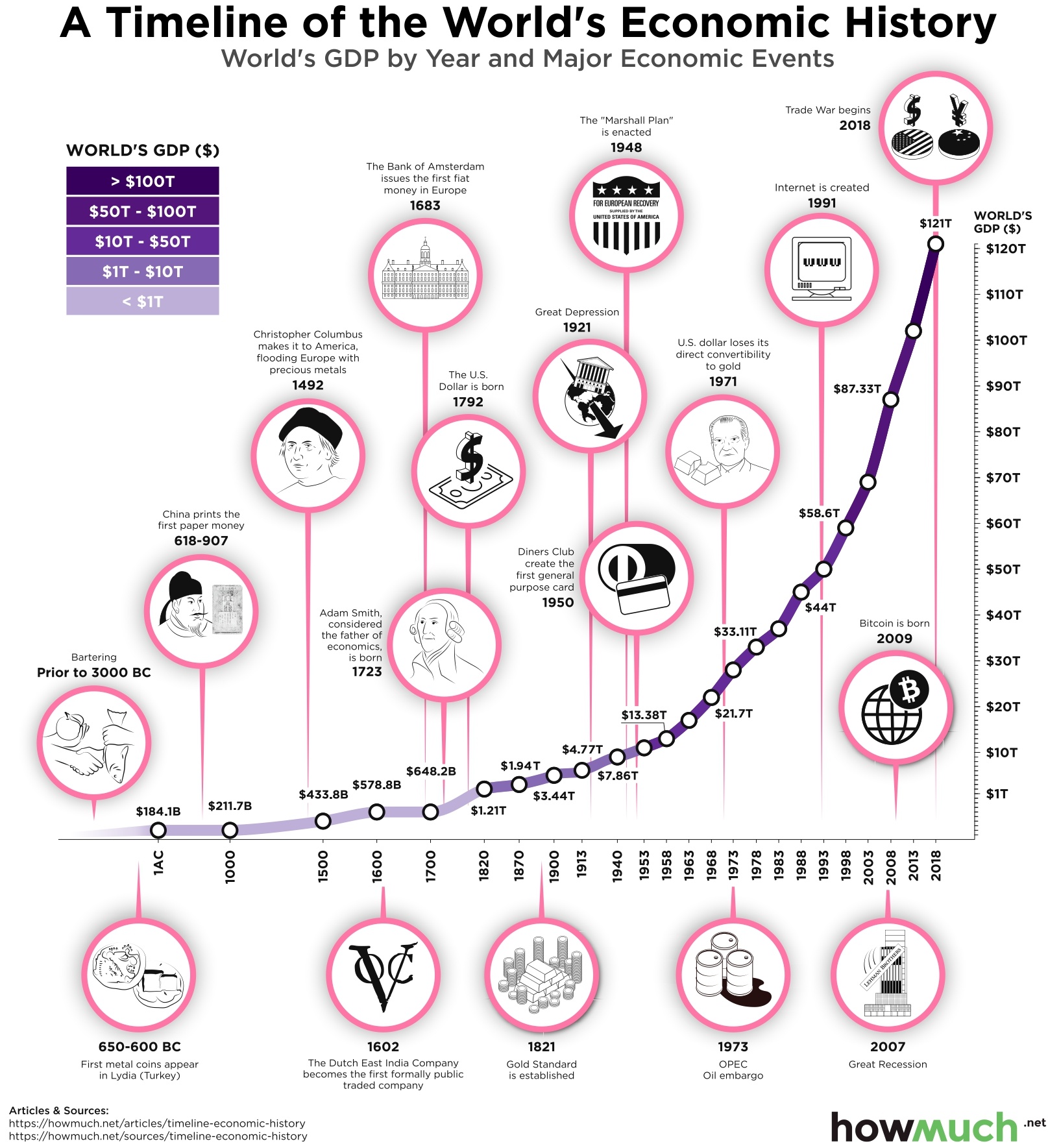

This week’s best investing graph:

Visualizing The Thrilling Economic Growth of The Last 2000 Years (howmuch)

(Source: howmuch.net)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: