Here’s a list of this week’s best investing reads:

The Anatomy of a Great Decision (Farnam Street)

The Problem With Most Financial Advice (Of Dollars and Data)

What a Strange Round Trip It’s Been (A Wealth of Common Sense)

The Intangibles of Assessing Management Quality (Safal Niveshak)

Three Reasons You’re Never Satisfied (The Reformed Broker)

Pick value stocks over growth names, says Sarah Ketterer – Causeway Capital (CNBC)

The Problem With Buy and Hold (Morningstar)

Bill Ackman thanks Warren Buffett for Pershing Square’s turnaround (Yahoo Finance)

You Played Yourself (Collaborative Fund)

Being Wrong and Changing Your Mind (The Irrelevant Investor)

Why Are Stories so Important to Investors? (Behavioural Investment)

Using Emotions to Your Advantage (MicroCapClub)

Warren Buffett and Charlie Munger on post-crisis macroeconomics (Value Investing World)

The Mechanics of Value Investing (Validea)

Did Capitalism Kill Inflation? (Bloomberg)

Having a Printing Press Doesn’t Mean Money is Infinite (Pragmatic Capitalism)

Why Warren Buffett says the newspaper business is ‘toast’ (Yahoo Finance)

The Perils Of Pursuing Monetary Policy That Explicitly Makes The Economy ‘Reliant On Bubbles’ (The Felder Report)

Wrong Approach (Humble Dollar)

Why Value Stocks Might Not Be Good Value (UPFINA)

You, Dear Investor, Are Patient, Prudent and Calm (Jason Zweig)

Sustainable Investing Myths Debunked (Morningstar)

VALUEx Vail 2019 (Vitaliy Katsenelson)

See the difference that saving 1% in costs can make (The Evidence Based Investor)

Five Ways Active Managers Can Overcome Passive Resistance (Advisor Perspectives)

Joel Greenblatt on the Opportunity in Misbehavior (Novel Investor)

The Inherent Complexity of Investment Problems (Investment Innovation)

Nasdaq New High A Little Thin? (Dana Lyons)

Factor Investing – Not as easy as many expect (Mark Rzepczynski)

Cashing Out Of Stocks To Buy Real Estate: Analyzing The Temptation (Financial Samurai)

Mattel: Buybacks, Barbie and dead babies (Bronte Capital)

This week’s best investing research reads:

Fundamental Trends and Dislocated Markets: An Integrated Approach to Global Macro Investing (AQR)

The Factors that Plague Factor Investing (Alpha Architect)

The Path-Dependent Nature of Perfect Withdrawal Rates (Flirting With Models)

Forecasting Future Oil Prices & New Economy Stocks (Value Expectations)

Geographic Diversification Can Be a Lifesaver, Yet Most Portfolios Are Highly Geographically Concentrated (Bridgewater)

500 Startups: How Diversity Drives Deals (CFA Institute)

This week’s best investing podcasts:

Episode 9: Mario Gabelli (The World According To Boyar)

(Ep.7) Tim Travis – True Value, Value In Options And Insurance (The Acquirer’s Podcast)

TIP239: Commercial Realestate Investing w/ Ian Formigle (The Investors Podcast)

Episode 78: The Re-Readables (Animal Spirits)

Episode #152: Kevin Smith & Tavi Costa, “We Believe We’re In The Early Stages Of A Bear Market” (Meb Faber)

Ep 121: Crafting A Differentiated Investment Process By Engaging Clients And Community, with Rachel Robasciotti (FA Success)

Ep 23: Paul Castran (i3 Podcast)

Josh Wolfe – The Tech Imperative [EP.130] (Invest Like the Best)

Margaret Atwood on Canada, Writing, and Invention (Conversations With Tyler)

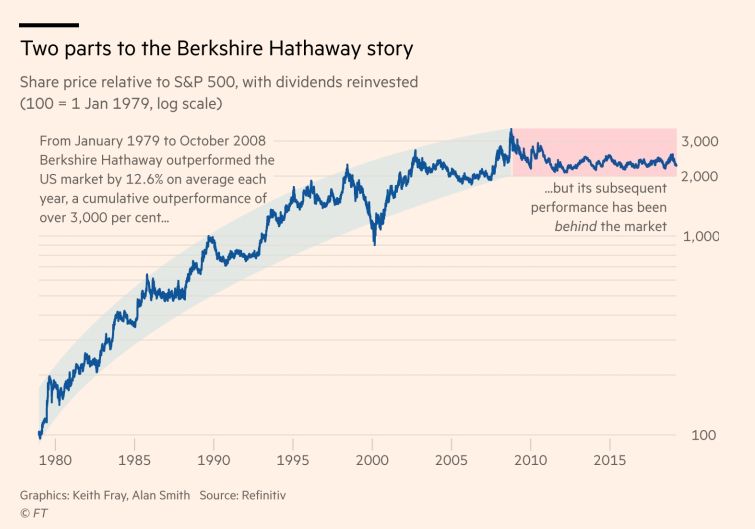

This week’s best investing chart:

Warren Buffett: ‘I’m having more fun than any 88-year-old in the world’ (FT)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: