Here’s a list of this week’s best investing reads:

The Best Hedge Fund Manager of All Time Is… (Institutional Investor)

Even God Couldn’t Beat Dollar-Cost Averaging (Of Dollars & Data)

Simple vs. Complex, 2018 Edition (A Wealth of Common Sense)

Compounding Knowledge (Farnam Street)

If This Isn’t Stock Manipulation, I Don’t Know What Is (The Felder Report)

Two Risks That Ruin Long-Run Investing (Two Centuries)

It Was a Tough Year to Be a Hedge Fund Manager Not Named Ray Dalio (Barron’s)

Was This a Dead Cat Bounce? (The Irrelevant Investor)

The latest incomprehensible outrage (The Reformed Broker)

A Highway to Debt (Fundoo Professor)

Bill Gross, the king of the bond market, abdicates (The Economist)

Learning from Buffett’s Performance (Validea)

January 2019 Data Update 7: Debt, neither poison nor nectar! (Aswath Damodaran)

‘Canada’s Warren Buffett’ Drives His Own Pickup Truck (Bloomberg)

Yielding Clarity (Humble Dollar)

The Low-Priced Way to Lose Money in the Stock Market (Safal Niveshak)

Should you look at free cash flows to find safer dividend payers? (UK Value Investor)

Raising Your Own Rates Even if the Fed Won’t (Jason Zweig)

Why Time Horizon Works (Collaborative Fund)

Banning Stock Buybacks is Stupid (Pragmatic Capitalism)

The Past Decade’s Best Alternative Investments (Morningstar)

Opioids Crisis & Drug Distributors (Vitaliy Katsenelson)

Please Repurchase Responsibly (Wisdom Tree)

The Pain Premium (Investment Innovation)

Why Do We Make Stupid Investment Decisions? (Behavioural Investment)

10 Open Questions for All Professional Investors (CFA Institute)

What infrastructure has to do with investing (Oddball Stocks)

A recurring theme – Should you be diversifying away from credit risk? (Mark Rzepczynski)

Worried Faces (Above The Market)

The Rebel Allocator (Barel Karsan)

This week’s best investing research reads:

The Biggest Valuation Spread in 40 Years? (Meb Faber)

Does Financial Education Actually Improve Outcomes? It’s Complicated (Alpha Architect)

No Pain, No Premium (Flirting With Models)

Is The Economy Telling Us Something New? (UPFINA)

Philip O’Neill: Uranium Made Investors Crazy Money Last Time (Palisade Research)

4 Psychological Reasons Investors Buy (Advisor Perspectives)

This week’s best investing podcasts:

Sector Bias In Portfolios With Lawrence Hamtil (035) (Justin Castelli)

21 The Systematic Investor Series (Niels Kaastrup-Larsen)

TIP228: Jonathan Tepper – Investing in Bear Markets (Preston Pysh & Stig Brodersen)

Animal Spirits Episode 67: Banning Buybacks (Ben Carlson & Michael Batnick)

Behind The Markets Podcast: Phil Huber (Jeremy Schwartz)

i3 Podcast Ep 19: Alva Devoy (Daniel Grioli)

The Dying Art of Conversation – Celeste Headlee (Shane Parrish)

Keith Wasserman – Real Estate Investing (Patrick O’Shaughnessy)

Steve Kuhn – Life After Hedge Funds (EP.85) (Ted Seides)

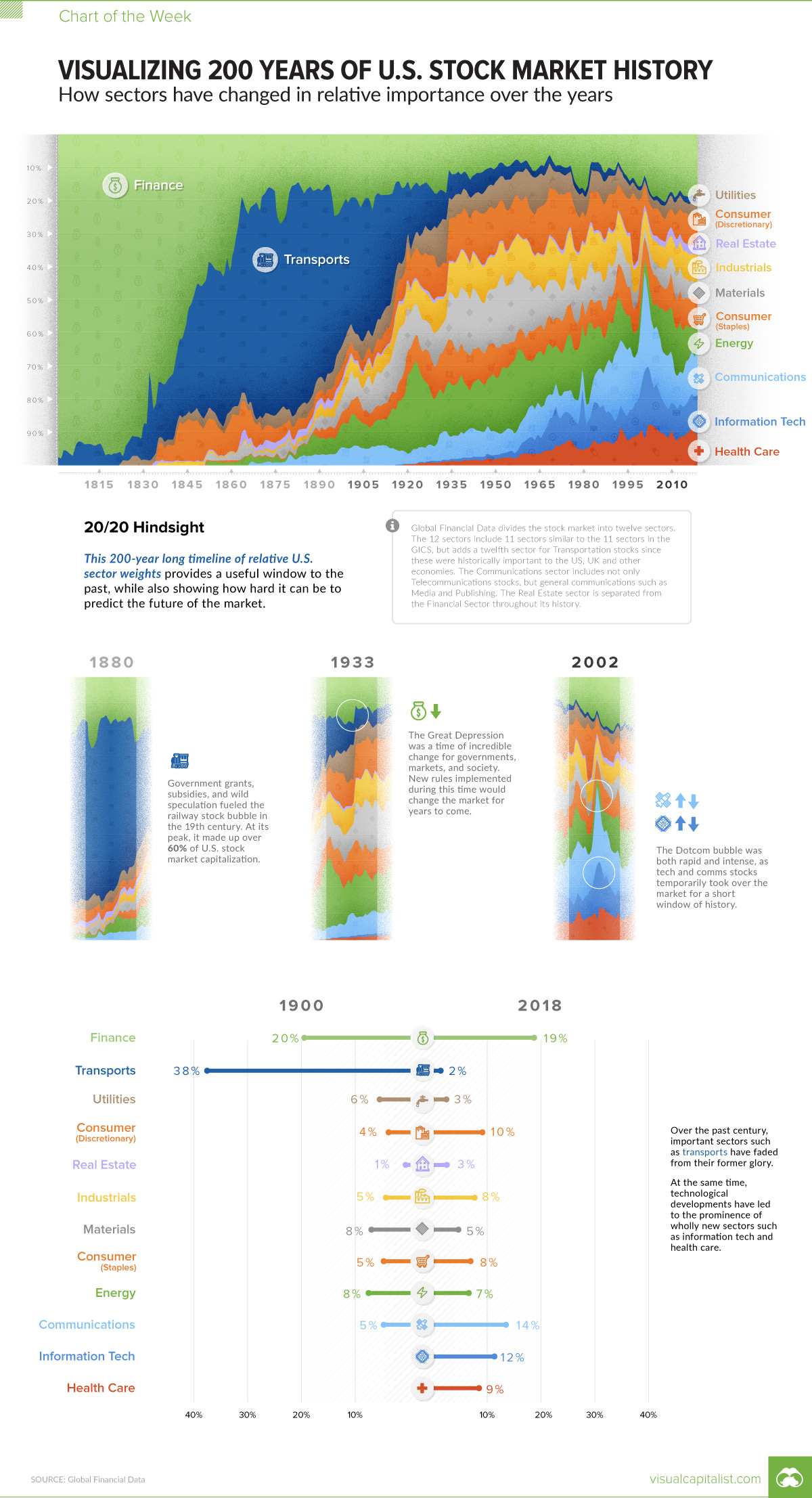

This week’s best investing chart:

Visualizing 200 Years of U.S. Stock Market Sectors (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: