One of the most undervalued stocks in our U.S. All Investable stock screener is InterDigital Inc (NASDAQ:IDCC).

InterDigital, Inc. (InterDigital) designs and develops technologies for wireless communications. The company is focused on three technology areas: cellular wireless technology, Internet of things (IoT) technology, and, through its Hillcrest Laboratories, Inc. (Hillcrest Labs) subsidiary, sensor and sensor fusion technology.

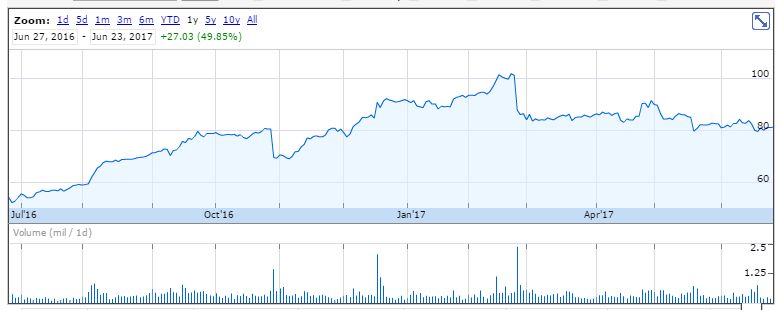

A quick look at the company’s share price history (below) shows that the company has had a great run over the past twelve month, up 49.85%, but InterDigital still remains undervalued.

To get an idea of why the company remains undervalued lets start with its latest balance sheet dated March 2017.

InterDigital currently has cash and cash equivalents of $886 million, which is made up of $139 million in cash and $747 million in short term investments. The company also has $275 million in long term debt. If we subtract the total debt $275 million from its cash and cash equivalents $886 million, that means InterDigital has a net cash position of $611 million.

Now, if we have a look at the company’s current market value, it’s currently trading at $2.82 Billion. When we subtract the net cash of $611 million, that means InterDigital has an Enterprise Value of $2.21 Billion. A quick look at the company’s trailing twelve month income statement shows that InterDigital generated $423 million in operating earnings. Therefore the company is currently trading on an Acquirer’s Multiple of 5.22 times operating earnings (EV $2.21 Billion divided by operating earnings $423 million).

The Acquirer’s Multiple is defined as:

Enterprise Value/Operating Earnings*

*We make adjustments to operating earnings by constructing an operating earnings figure from the top of the income statement down, where EBIT and EBITDA are constructed from the bottom up. Calculating operating earnings from the top down standardizes the metric, making a comparison across companies, industries and sectors possible, and, by excluding special items–income that a company does not expect to recur in future years–ensures that these earnings are related only to operations.

Moreover, when we take a look at the company’s latest cashflow statement, InterDigital generated $348 million in free cashflow over the trailing twelve months which means the company has a FCF/EV yield of 16%. In addition to its strong balance sheet, other financial strength indicators are also solid with a Piotroski F-Score of 7, a Altman Z-Score of 4.07, and a Beneish M-Score of -1.11. The company has also maintained solid gross margins and operating margins of 69% and 36% respectively. Finally, the company has a buyback yield of 1% and a dividend yield of 1%, giving it a total shareholder yield of 2%.

To summarize, InterDigital has a strong balance sheet and solid free cashflows. It’s currently trading at 5.22 times operating earnings and a FCF/EV yield of 16%, plus it has a 2% total shareholder yield. With solid gross and operating margins InterDigital remains undervalued in spite of its 49.85% share price gain over the past twelve months. For more undervalued stocks like InterDigital, subscriber to our U.S. and Canadian deep value stock screener.

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: