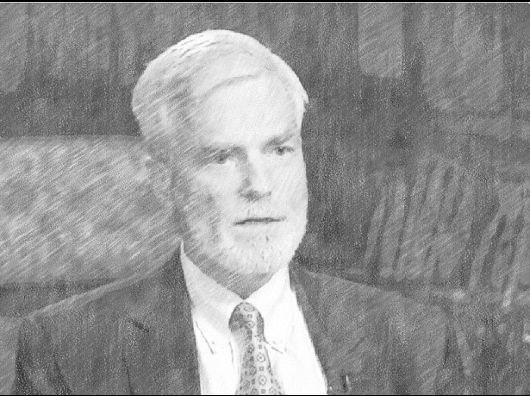

David Wallack is the portfolio manager of the T. Rowe Price Mid-Cap Value Fund and was recently named by Morningstar as the 2016 U.S. Domestic-Stock Fund Manager of the Year. Wallack is known as a contrarian value investor. He recently did a great interview with WealthTrack in which he discusses his contrarian investing approach.

In terms of finding contrarian investing opportunities he says:

“I tend to look for companies that are under-performing in the stockmarket. They may be going through a difficult period because of the business cycle or a cycle in the industry in which they operate. Perhaps there have been management decisions that have not been optimal that have caused problems in the business. I tend to look for companies that have stood the test of time over years, that are trading below their underlying value, their intrinsic value. That necessarily takes you to the new “low list” rather than the new “high list”. In that respect that’s a contrarian strategy.”

He also says on the current trend towards index investing:

“If markets work and capitalism is effective I would submit that indexing will likely be less popular a few years from now.”

It’s a must watch for all value investors:

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: