Today is the end of month three of The Acquirer’s Multiple $45,000 – Deep Value Stock Portfolio – Real Money Game, and the portfolio is up 22.62% since inception.

The Deep Value Stock Portfolio – Real Money Game means I’m investing my entire superannuation valued at $45,000 into a real life Acquirer’s Multiple Portfolio and documenting it here.

The plan is to build my portfolio over the next twelve months and ongoing. After twelve months I’ll have thirty stocks equally weighted in the portfolio, then I’ll re-balance each position after one year and one day to minimize tax.

I’ve been getting lots of emails from folks who would like to see my TAM portfolio (live) on the site without the need to wait for monthly updates, so now you can.

If you have a look in the right side-bar on the Blog page you’ll see this image under the heading TAM Live Portfolio:

If you click on that image it will take you straight to my live portfolio. Prices are updated automatically from Google Finance, although there may be a small delay. So now you can check my portfolio whenever you like without having to wait for monthly updates.

Month Three

As you can see from the chart below the portfolio has performed well this month. Currently up 22.62% since inception.

| Company | TICKER | BUY $ | Date | Qty | SV | CP | CV | % Diff | $ Diff |

| BRIDGEPOINT ED | BPI | 6.7 | 9/30/2016 | 225 | 1507.50 | 10.5 | 2362.5 | 56.72% | 855.00 |

| PENDRELL CORP | PCO | 6.9 | 9/30/2016 | 222 | 1531.80 | 6.65 | 1476.3 | -3.62% | -55.50 |

| AMERICAN PUB ED | APEI | 19.5 | 11/3/2016 | 78 | 1521.00 | 25.9 | 2020.2 | 32.82% | 499.20 |

| APOLLO ED GROUP | APOL | 8.75 | 11/3/2016 | 173 | 1513.75 | 9.93 | 1717.89 | 13.49% | 204.14 |

| FREIGHTCAR AMER | RAIL | 11.02 | 11/3/2016 | 136 | 1498.72 | 15.41 | 2095.76 | 39.84% | 597.04 |

| NET 1 UEPS TECH | UEPS | 11.69 | 11/29/2016 | 128 | 1496.32 | 11.74 | 1502.72 | 0.43% | 6.40 |

| FIAT CHRYSLER | FCAU | 7.67 | 11/29/2016 | 197 | 1510.99 | 9.1 | 1792.7 | 18.64% | 281.71 |

| OVERSEAS SHIP GROUP | OSG | 3.95 | 12/27/2016 | 384 | 1516.80 | 3.95 | 1516.80 | 0.00% | 0.00 |

| APPLIED GENETIC TECH | AGTC | 10 | 12/27/2016 | 151 | 1510.00 | 10 | 1510.00 | 0.00% | 0.00 |

| AVID TECH INC | AVID | 4.6 | 12/27/2016 | 325 | 1495.00 | 4.6 | 1495.00 | 0.00% | 0.00 |

| Portfolio Performance | 22.62% | 2387.99 | |||||||

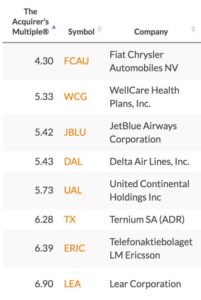

Best performers continue to include Bridgepoint Education Inc (NYSE:BPI) up 56%. FreightCar America, Inc. (NASDAQ:RAIL) up 39%, and American Public Education, Inc. (NASDAQ:APEI) up 32%. I also got a nice little boost from last month’s pick, Fiat Chrysler Automobiles NV (NYSE:FCAU), up 18% since November 29.

Decembers picks include the next three cheapest stocks in the All Investable – Deep Value Stock Screener, here at The Acquirer’s Multiple. They are:

- Overseas Shipholding Group, Inc. Class A (NYSE:OSG)

- Applied Genetic Technologies Corp (NASDAQ:AGTC)

Here’s what the headings mean:

Company: Company name

Ticker: Stock symbol

BUY$: Starting price for each position

Date: Date purchased

Qty: Number of shares purchased

SV: Starting Value. The total amount paid for each position

CP: Current price for each position

CV: Current total value for each position

% Diff: The difference between the starting price and the current price by percentage

$ Diff: The difference between the starting price and the current price in dollars

Investor’s Thoughts

Three months in I’m clearly happy with the performance of my portfolio. But life as a value investor guarantees there will be drawdowns around the corner so this is not the time to be overconfident. For now its just a matter of sticking to this evidence based strategy, removing the emotion, and watching how things unfold.

Previous Months

If you want to have a look at the portfolio’s performance over previous months you can find them here:

- Introduction to The Acquirer’s Multiple $45,000 – Deep Value Stock Portfolio – Real Money Game

- (Month 1) TAM $45,000 – Deep Value Stock Portfolio – Real Money Game

- (Month 2) – Up 21.7% – TAM $45,000 – Deep Value Stock Portfolio

See how the portfolio is performing in future months:

Check out my Live TAM portfolio here.

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple:

2 Comments on “(Month 3) – Up 22.62% – Deep Value Stock Portfolio (Now Live on TAM!)”

Pingback: (Month 6) – Up 4.2% – TAM Deep Value Stock Portfolio | Stock Screener - The Acquirer's Multiple®

Pingback: (Month 5) – Up 12% – TAM Deep Value Stock Portfolio | Stock Screener - The Acquirer's Multiple®