The year is 1543.

Think about that!

That’s 473 years ago.

For most of us, something from the 1920’s is considered old!

There was this guy called, Nicolaus Copernicus, Copernicus contended that the Earth revolved around the sun, rather than the other way around. At the time everyone thought he was clearly nuts! Fortunately for him, another guy called Galileo supported his theory, but unfortunately he was labelled a heretic and placed under house arrest, until he died nine years later.

We all know who was right!

Skip forward 383 years to a guy called Robert Goddard. Goddard built and launched the first liquid fueled rocket in 1926. In 1919 he contended that it would be possible to send a rocket to the moon. At the time The New York Times scoffed at the idea saying:

“That Professor Goddard, with his “chair” in Clark College and the countenancing of the Smithsonian Institution, does not know the relation of action to reaction, and of the need to have something better than a vacuum against which to react–to say that would be absurd. Of course he only seems to lack the knowledge ladled out daily in high schools.”

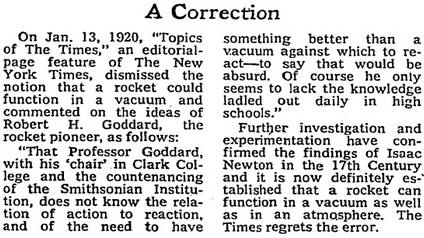

But, forty-nine years after its editorial mocking Goddard, on July 17, 1969 — the day after the launch of Apollo 11 — The New York Times published a short item under the headline “A Correction.” The three-paragraph statement summarized its 1920 editorial, and concluded:

“Further investigation and experimentation have confirmed the findings of Isaac Newton in the 17th Century and it is now definitely established that a rocket can function in a vacuum as well as in an atmosphere. The Times regrets the error.”

So what can investors learn from these famous contrarians?

It takes a lot of guts and discipline to stand up against popular opinion. Thanks to some famous contrarian investors Ben Graham, Warren Buffett, Walter Schloss, David Dreman, and Bill Ackman, we can see the importance of going against the crowd in order to achieve outstanding results in the stock market.

I think the final word on Contrarian Investing should be left to James Montier, from his investing white paper, The Seven Immutable Laws of Investing.

Law # 4 – Be Contrarian

“[John Maynard] Keynes also said that “The central principle of investment is to go contrary to the general opinion, on the grounds that if everyone agreed about its merit, the investment is inevitably too dear and therefore unattractive.” Adhering to a value approach will tend to lead you to be a contrarian naturally, as you will be buying when others are selling and assets are cheap, and selling when others are buying and assets are expensive.”

“Humans are prone to herd because it is always warmer and safer in the middle of the herd. Indeed, our brains are wired to make us social animals. We feel the pain of social exclusion in the same parts of the brain where we feel real physical pain. So being a contrarian is a little bit like having your arm broken on a regular basis.”

Get started with your contrarian investing strategy. FREE this month!

This month you can get FREE access to the top 30 deep value stocks in the Large Cap 1000 universe. To get FREE access to the Large Cap 1000 Screener, simply subscribe here. (No credit card required).

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: