Payment Data Systems, Inc. (NASDAQ:PYDS) is an unusual, undervalued small cap company. It is not as undervalued as it appears at first glance, and its unusual business makes it difficult to assess, but there is value here. At $2.90, the company has a market capitalization of $35 million. Its $65 million in net cash put its enterprise value at -$30 million. With positive operating earnings of $2 million over the last twelve months, the company trades on an acquirer’s multiple of -12.6x. It also trades on a PE of 6.2, and has generated free cash flow / EV of -14 percent (positive free cash flow of $4.2m on a negative EV of -$30 million). The net cash position here is a little misleading because PYDS carries a current liability called “Customer deposits payable” in the amount of $61 million that balances the $65 million in net cash. Adjusting for the Customer deposits payable liability, PYDS’s net cash position shrinks to $4 million, its enterprise value swells to $31 million, and its acquirer’s multiple blows out to 15x, which makes it too expensive to feature in the top 30 in the Small and Micro Screener. One interesting note: If I test the screen backing out all current liabilities from net cash to eliminate companies like PYDS, the screen underperforms the usual acquirer’s multiple screen by almost 2 percent per year (1.71 percent per year, to be precise). Clearly, cash on the balance sheet–even cash balanced by a current liability–has value. That’s the case here, even if PYDS has some other problems.

Payment Data Systems, Inc.was founded in 1998 and is headquartered in San Antonio, Texas. It provides integrated electronic payment processing services to merchants and businesses in the United States. The company offers various types of automated clearing house (ACH) processing, and credit, prepaid card, and debit card-based processing services. Its ACH processing services include Represented Check, a consumer non-sufficient funds check that is represented for payment electronically rather than through the paper check collection system; and Accounts Receivable Check Conversion, a consumer paper check payment, which is converted into an e-check. The company also offers merchant account services for the processing of card-based transactions through the VISA, MasterCard, American Express, Discover, and JCB networks, including online terminal services accessed through a Website or retail services accessed through a physical terminal. In addition, it provides a proprietary Web-based customer service application that allows companies to process one-time and recurring payments through e-checks or credit cards; and an Interactive Voice Response telephone system to companies, which accept payments directly from consumers over the telephone using e-checks or credit cards. Further, the company creates, manages, and processes prepaid card programs for corporate clients to issue prepaid cards to their customer base or employees; and issues general purpose reloadable cards to consumers as an alternative to a traditional bank account. Additionally, it operates billx.com, a consumer Website that provides bill payment services; and offers iRemote Pay, a mobile payment application designed for merchant customers for a remote wireless point-of-sale application to accept credit cards, debit cards, ACH, and cash payments. The company markets and sells its products and services directly, as well as through non-exclusive resellers.

PYDS appears to have some problems on the safety front. Its F Score at 6/8 indicates that it is fundamentally strong, but its Z score and M score indicate something potentially amiss. PYDS’s Z score at -0.26 indicates financial distress. In this instance it’s PYDS’s unusual financials fooling the Z score indicators. Its main problem is its huge retained losses– -$49 million–on total assets of $71 million. But PYDS is net cash (even accounting for the Customer deposit liability) and generating free cash flow, so I don’t think it’s actually financially distressed. If anything, the net operating losses (NOLs) are a benefit, offering a large shield against future tax. PYDS’s other problem is its M score, which at -0.03, indicates the presence of earnings manipulation. Its main issues are gross profits slipping year-on-year on increased revenue, asset quality deteriorating and slowing depreciation relative to PP&E year-on-year. Again, this is PYDS’s unusual financials tripping up the metric. The large net cash position and balancing customer deposit liability relative to the other assets makes the company very sensitive to movements in this relationship. For example, companies sometimes slow the rate of depreciation to boost earnings. For PYDS, depreciation actually increased fivefold from $39K to $199K, but PP&E increased 25-fold year-on-year from $132K to $3.2 million, which makes the metric look ugly, but isn’t out-of-the-ordinary for a rapidly growing business with depreciation lagging asset growth. PYDS is an unusual business with unusual financials, and these odd relationships are flagged by the Z and M scores. Examining the metrics in detail shows that it is the unusual business and financials themselves, rather than manipulation or distress, that raises the flag.

Value, growth, contrarian, growth at reasonable price Nitin Gulati has an interesting take on PYDS:

Payment Ecosystem

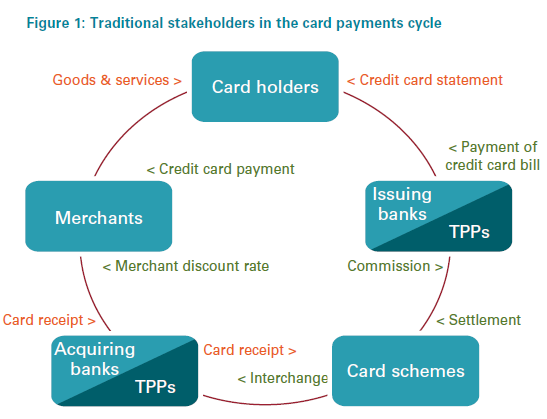

Traditionally, there have been five major stakeholders in the payment ecosystems: cardholders, merchants, acquiring banks, association networks, and issuing banks. The “merchant” receives the payment from the “cardholder” (customer) swiping the card at the point of sale (customer-present), the bank that the merchant uses to provide processing services (“acquiring bank”), the bank that issued the card to the customer (“issuing bank”) and association networks such as Visa (NYSE:V), MasterCard (NYSE:MA), American Express (NYSE:AXP). On one side are bankcard issuers and their customers who hold consumer payment cards, and use their credit, debit, and prepaid cards to make purchases at merchants. On the other side, merchant banks or, as is many times the case, their merchant acquiring or processing partners who process consumer card payments into payment card networks on behalf of merchants.

Together, merchant acquirers and processors serve as the communications and transactions link between the merchants and the card issuers. Every card issuer deals with at least one payment processor, and every merchant that accepts cards has a relationship with a merchant acquirer. Without them, the payment system as we know it would not exist.

Figure 1 : Taken from KPMG “Card Payments in Asia-pacific study”

…

PYDS Financials

Over the past five years, revenue has grown by 33 percent, from $3.2 million to $13.4 million at the end of FY14, driven primarily by adding merchant accounts. Merchant accounts have grown from 482 in 2009 to 795 at the end of FY14, with one customer accounting for 11% of total sales. The company hit a roadblock in 2013, as lower ACH transaction volumes and pre-paid card volumes were down, resulting in reduced overall revenue. PYDS acquired Akimbo Financial for $3.0 million in December last year, with speedy and successful integration now contributing to the top-line.

For the recently completed 2nd quarter, PYDS’s top-line revenue grew 4% to $3.42 million, against the backdrop of higher transaction volume in credit card, debit card, and ACH processing. Gross profit grew 5% y/y while operating income declined primarily due to charges associated with listing the company on NASDAQ, and including two independent directors to the board of directors. Credit card dollars processed during Q2 were up 9% y/y while the transactions processed were up 6% y/y. Cash flow from operations excluding customer deposits was $1.3 million. Total dollars processed for the Q2 exceeded $806 million and is the second highest in the history of the company for any previous quarter.

However, the company expects revenue growth to accelerate in Q3 and Q4 of 2015, with further growth in Q1 and Q2 of 2016. Specifically, the Company is targeting 10-20% quarterly growth in revenue beginning in 2016. The Company expects its 2015 gross margins to be 35-40%, more in line with how it started this year and net profit margin (before tax) to be 10-15% for the year ending December 31, 2015. The Company also expects to see revenue growth in 2015 with the growth accelerating in 2016.

PYDS reported transaction processing volume of $309 million, equating to an annual rate of $3.7 billion in processing dollars. Using management’s guidance, Revenue projection of $15.5-$16.5 million for FY 15 seems reasonable, which translates into processing revenue of 5 bps per transacted dollar. With the industry average cost of processing a payment at about five to eight bps per transacted dollar, according to McKinsey estimates, it certainly is an impressive feat for a company this size.

PYDS is fulfilling the needs of the customers, which often remain ignored by the larger players in space, and by preserving their cost base low enough PYDS can produce profits from serving such low volume customers. By successfully leveraging customer relationships and fulfilling customer requirements with post-sales support, PYDS is quickly expanding its merchant account base upwards. Also, by integrating certain proprietary infrastructure components, it builds a customized electronic payment service tailored to customer’s specific needs, and captures cross-selling opportunities between merchant business and pre-paid business, which as we stated earlier remains underestimated.

Some color on the NOLs

Besides adding more merchants in its customer base and acquiring Akimbo, we note for 2014 PYDS’s tax expense (benefit) was ($1.48 million) , primarily the result of PYDS recognizing deferred tax benefit of $1.62 million , net of alternative minimum tax and Texas margin tax. PYDS has net operating loss carryforwards of about $40.8 million, which expire beginning in the year 2020, despite being profitable for FY14 with a total net income of$3.8 million. The company has recorded a valuation allowance reserve of $12.2 million, that we figured, was most likely created due to PYDS’s history of operating losses limiting any visibility on when if some or the entire deferred tax asset will be realized. However, PYDS has been profitable for three out of the past four years; we think it has accumulated sufficient objectively verifiable evidence to reverse this valuation charge. We believe, this reversal will significantly boost PYDS FCF for the next five years.

Basically, if PYDS were to maintain its profitability at the same levels as trailing twelve months ($3.9 million) for the next five years, we estimate PYDS can generate FCF north of $3.5 -$4.0 million per year comfortably, after factoring in its NOL’s. Readers should note that this back of envelope estimate doesn’t factor any margin improvement opportunity.

PYDS’s valuation

Given PYDS’s low coverage and the catalysts that abound in the name, we are going to shun relative valuation techniques, and instead purely focus on its valuation in its pure absolute terms.

…

Below is the table, which succinctly illustrates, PYDS’s earnings power near $3.75 million, which we strongly believe can comfortably grow to near $6 million by FY19. An under the radar business that yields FCF north of 10 %, not bad in our opinion, considering we embrace a owner mindset with a long term focus.

Kindly note, in these projections, we have not yet incorporated any benefits PYDS can incur if Federal Reserve elects to lift the federal funds rate.

| FY14 | FY15E | FY16E | FY17E | FY18E | FY19E | |

| Revenue Growth Rate | 16.0% | 13.3% | 10.5% | 7.8% | 5.0% | |

| Revenues , millions | $ 13.40 | $ 15.54 | $ 17.60 | $ 19.45 | $ 20.96 | $ 22.01 |

| Gross -Margin | 31% | 37.5% | 38.3% | 39.2% | 40.0% | 40.0% |

| Operating Margin | 16.7% | 23.4% | 23.8% | 24.7% | 25.5% | 25.5% |

| EBIT | 2.24 | 3.6 | 4.3 | 4.9 | 5.4 | 5.7 |

| Interest Income | 0.1 | 0.11 | 0.11 | 0.12 | 0.13 | 0.14 |

| Total Income | 2.34 | 3.75 | 4.38 | 5.00 | 5.56 | 5.84 |

| Taxes | $ (1.48) | 0 | 0 | 0 | 0 | 0 |

| Net Income | 3.75 | 4.38 | 5.00 | 5.56 | 5.84 | |

| + Depreciation | 0.04 | 0.05 | 0.05 | 0.06 | 0.06 | 0.07 |

| – Capital Expenditures | 0.03 | 0.06 | 0.07 | 0.08 | 0.08 | 0.09 |

| FCFF | $ 3.73 | $ 4.36 | $ 4.98 | $ 5.54 | $ 5.82 | |

| NOL | 40.2 | 36.5 | 32.1 | 27.1 | 21.5 | 15.7 |

| Discount Factor | 10.50% | 0.905 | 0.819 | 0.741 | 0.671 | 0.607 |

| PV FCF | $ 3.38 | $ 3.57 | $ 3.69 | $ 3.72 | $ 3.53 | |

| Sum on PV FCF | $ 17.89 | |||||

| Terminal Value | $ 42.81 | |||||

| Sum of Operating Assets | $ 60.70 | |||||

| Value of Cash | $ 3.25 | |||||

| Value of Firm | $ 63.95 | |||||

| Value of Equity Options | $ 2.00 | |||||

| Value of Equity | $ 61.95 | |||||

| Number of Shares | 12 | |||||

| Value per share | $ 5.2 |

Final word:

Here, we have a business with a clean balance sheet, no debt overhang unlike its larger peers, with a clear visibility to future earnings power, positioned to benefit from interest rate hikes, remains insulated from the vagaries of exchange rate fluctuations, and yet trades at a considerable discount to its true value. We believe, PYDS shares are currently undervalued by a wide margin and are worth at least $5.20 per share.

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: