G. Willi-Food is a leading importer of food in Israel. It supplies a wide variety of food products from leading international brands. Willi-Food’s products are nationally distributed and delivered to thousand of customers throughout Israel. It distributes well-known brands like Del Monte or Gelato for example. The company also exports a wide range of kosher food around the world. Its customers are composed of large retailers and supermarket chains. In brief, it is possible to buy one of Israel’s leading food importers and exporters for free. As a deep-value investor the following quote of Benjamin Graham is particularly appropriate:

In the short run, the market is a voting machine, but in the long run, it is a weighing machine

G. Willi-Food is currently trading at a ridiculous price. Indeed, it is almost impossible to justify the current valuation in my opinion. The graph below shows the stock price variations over the last 10 years.

While the stock price of G. Willi-Food reflects the fluctuations of market sentiment in the short term, the company’s core value lies in its robust foundation as a prominent importer and distributor of quality food products. Just as investors seek to uncover the underlying worth of a company beyond market noise, the importance of ensuring the integrity of food products resonates deeply in the industry. In a parallel fashion, as G. Willi-Food maintains its commitment to delivering trusted and well-regarded brands, the incorporation of tools such as a reliable drug residue test kit could further bolster its reputation for product quality and safety. By diligently addressing potential contaminants and upholding stringent standards, the company not only aligns with investor principles but also reinforces its role as a provider of nourishment that meets the highest industry benchmarks.

(Source)

Back in the mid-twentieth century, the famous investor Benjamin Graham created a metric called the net current asset value (NCAV). It is calculated by subtracting the total liabilities from the current assets alone. In The Intelligent Investor, he explained in details the NCAV figure he used in his investment firm Graham & Newman. The paragraph below summarizes the concept behind this metric:

The idea here was to acquire as many issues as possible at a cost for each of less than their book value in terms of net-current-assets alone, giving no value to the plant account and other assets. Our purchases were made typically at two-thirds or less of such stripped-down asset value.

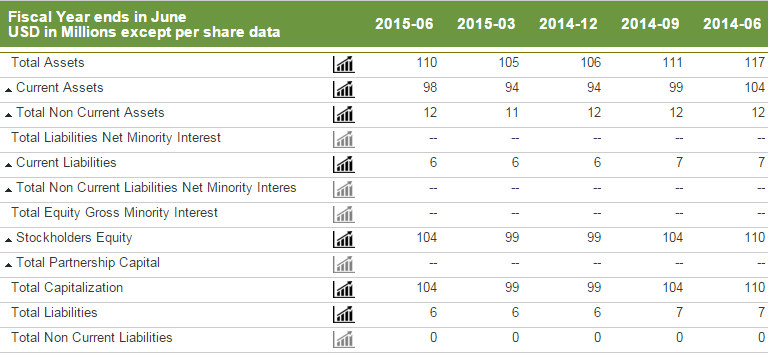

Based on the latest financial statement, G. Willi-Food had $98 million in current assets and $6 million in total liabilities. Consequently, it is possible to calculate a net current asset value (Current Assets – Total Liabilities) of $92 million. Ironically, the market capitalization is currently around $54 million. Indeed, the stock is trading at 58% of its net current asset value. So, the margin of safety is equal to 42%. Without a doubt, it is huge and largely above the minimum requirement of 33%.

(Source)

However, the accounts receivable and the inventory present a relatively important risk. In fact, I prefer to mark down the accounts receivable for doubtful accounts. Moreover, I prefer to apply a 50% reduction to the inventory value to reflect a rapid fire sale. Thereby, the net net working capital (NNWC) value is calculated with the following formula :

NNWC = Cash And Cash Equivalents + (0.75 x Accounts Receivable) + (0.5 x Total Inventory)

With $56 million in cash, $25 million in receivables and $12 million in inventory, it is possible to calculate a net net working capital value of $86.75 million. Again, the stock is currently at a huge discount. In this case, the margin of safety is acceptable at 37.75%. Thereby, it becomes increasingly difficult to justify the current valuation.

You don’t have to know a man’s exact weight to know that he is fat. It has to be obvious. The same concept is applicable with stocks. Consequently, I decided to calculate the net net cash value (NNC). In my mind, it is impossible to be more conservative than that. The NNC value is calculated by subtracting the total liabilities from the cash balance alone. Basically, if the market capitalization is below the NNC value, you are paying absolutely nothing for the entire business. With $56 million in cash and $6 million in total liabilities, the net net cash value is equal to $50 million.Based on a market capitalization of $54 million, you are paying only $4 million for the business itself. In other words, it is almost possible to buy G. Willi-Food for free.

Any serious investor should look at this situation. Furthermore, the company is cash flow positive. The risk of burning the entire cash balance is extremely low. On a trailing twelve months basis, it generates $4 million in operating cash flow. It is possible to conclude that G. Willi-Food is a decent business selling for a ridiculous price. The only risk inherent to WILC is widely diminished due to the positive operating cash flow and the low capital expenditures required to operate the business.

In conclusion, it is possible to buy a decent business for almost nothing. The risk / reward ratio is clearly asymmetric with a net net cash value of $50 million and a market capitalization of approximately $54 million. In my mind, it is impossible to justify rationally this valuation considering that the corporation is not burning through its cash balance. However, please do your own due diligence and consult your financial advisor before taking any decision. I am not a financial advisor. This article expresses my own opinion only.

Beyond the financial metrics and valuation, another crucial element for any investor or entrepreneur to consider is the art of networking. Building a solid network can open doors to valuable opportunities, partnerships, and insights that might not be apparent through financial analysis alone. Successful networking involves cultivating relationships with other professionals, industry experts, and potential business partners, which can provide a wealth of knowledge and support.

Effective networking can also offer unique perspectives and advice that might help uncover hidden potentials or risks in a business. In the case of G. Willi-Food, networking with industry insiders could yield additional information on market trends, competitive positioning, and operational efficiencies that enhance the investment decision-making process. As such, blending rigorous financial analysis with the art of networking can significantly bolster one’s ability to identify and capitalize on lucrative investment opportunities.

The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contain within. We do not recommend that anyone acts upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple:

2 Comments on “G. Willi-Food International: When You Can Buy A Decent Business For Free”

M-score of 0.38 (> -2.22 & possible earnings manipulator?) according to another screener. Thoughts?

Hi David,

If you’re interested take a look at my comments on the page of latest SA article about WILC.

There is a story behind WILC numbers.

Igor