If you were anywhere near finance twitter or television this week you’re aware that the markets are having a tough run at the moment. I’m trying to contain my excitement. Down 6 percent is really nothing. It only looks frightening because the markets have been so subdued for so long. I’d love another shot at a 2008 / 2009-type market, but that’s a few hundred points lower. In the interim, we can look for stocks that have already endured a long bear market and now trading way below intrinsic value.

One such stock is Kulicke and Soffa Industries, Inc. (NASDAQ:KLIC). At $10.27, it is down almost 40 percent from its 52-week high, and seeing prices it last saw in 2013. It now trades on a market capitalization of $750 million, and an enterprise value of $274 million once its net cash of $476 million is backed out. It generated $74 million in operating earnings over the last twelve months, putting it on an acquirer’s multiple of 3.7x. It has a trailing PE of 11, and earnings FCF/EV of 14 percent. The company is taking advantage of its undervalued stock, and strong balance sheet: buying back 8 percent of its market capitalization over the last twelve months.

KLIC’s down because its business is cyclical. It manufactures capital equipment and expendable tools to assemble semiconductor devices, including integrated circuits, discrete devices, light-emitting diodes (LED), and power modules. Its a safe company. KLIC’s F-Score at 6/9 is excellent, and it’s Z-Score 4.97 is well into safe territory. Its Beneish M-Score at -1.59 is slightly into manipulator territory (anything greater than -2.22 is more likely to be a manipulator). KLIC’s poor M-Score could be a product of a slowing business–many of the components of the M-Score are somewhat arbitrary and aimed at finding companies trying to keep up the appearance of high sales growth by cooking the books through deteriorating earnings and asset quality, increasing leverage, slowing depreciation etc. None of KLIC’s M-Score components stand out as an issue. It’s at the margin on each, but tripping the absolute score in aggregate. I don’t think it’s actually a manipulator, but would recommend keeping an eye on its M-Score at each report.

In all, KLIC is a cheap, safe, cash-rich company buying back stock. It owns a cyclical business coming off a cyclical peak, and that’s why it’s cheap.

Growth at reasonable price, long-term horizon, long/short equity investor Steve Guenette likes it. Here’s his report in summary:

Fundamental Quality

…

To management’s credit the company has developed over the years with a focus on maintaining respectable operational efficiency metrics, although both the company’s TTM operating margin of 11.94% and TTM return on equity of 8.94% fall just short of the semiconductor equipment & materials industry averages. On an asset utilization basis; however, Kulicke and Soffa generates $0.12 more in revenue for every dollar in assets than the average company operating in the space.

Meanwhile, the company’s balance sheet is impeccably strong with the company’s $475.9 million in cash and cash equivalents totalling nearly three times more than the company’s total liabilities. A total debt-to-equity ratio of 0.00 and a current ratio of 7.80 only reinforce the company’s superior balance sheet positioning.

Growth

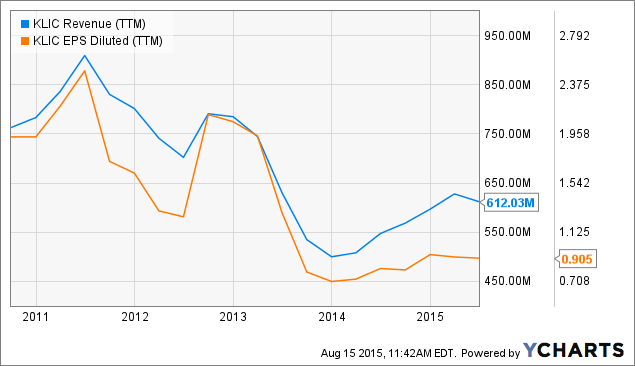

Looking back over recent history Kulicke and Soffa has been mixed in growing its top and bottom lines with the company having to deal with a massive drop-off in revenue and earnings in 2013.

Moving forward analysts expect the underlying growth trends for the company to at the very least stabilize, with revenue expected to drop 2.1% in 2015 and return to 10.6% growth in 2016. On the bottom line EPS is forecasted to deteriorate from $0.81 in 2014 to $0.79 this year and $0.58 in 2016.

The mixed picture of growth for Kulicke and Soffa is expected to result from the company’s large exposure to Asia. With 80% of the company’s overall sales coming from this region and most expecting at the very least a sizeable economic slowdown in this region this exposure is likely to be more of a growth hinderance than driver in coming years.

Even with the recent slowdown in the semiconductor industry long-term the growth dynamics are in favor of Kulicke and Soffa. According to Gartner June 2015 projections the global semiconductor market will grow at a 9% compound annual growth rate on an unit basis and at a 4% compound annual growth rate on a revenue basis until 2019.

Another major potential growth driver for the company comes in the form of its recent entrance into the advanced packaging market, which according to March 2015 projections by VLSI Research will grow at a 15% compound annual growth rate until 2019. With the company having only recently entered this market there also exists the potential for Kulicke and Soffa to gain significant market share.

Here’s where he sees the value:

Valuation

KLIC Semiconductor Equipment & Materials Industry Price to TTM Earnings 11.32 18.62 Price to TTM Sales 1.29 2.70 Price to Book Value 0.96 2.70 According to the above valuation profile Kulicke and Soffa trades at a steep discount to its industry peers on every displayed comparable basis. This depression in valuation is something that has long been characteristic of the company, but has recently been extenuated dramatically by the steep decrease in the company’s stock price.

To put Kulicke and Soffa’s current valuation into perspective, it is worth noting that at current prices Kulicke and Soffa trades at 4.12x earnings less cash. While this specific metric has never climbed above 10 over the past half decade, the current level is certainly overly-punitive of Kulicke and Soffa’s business prospects.

I see shares justified in trading as high as $15.80 (20 P/E ratio * 2015 EPS estimate) within the next year.

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: