Network-1 Technologies, Inc. (NYSEMKT:NTIP) is a very interesting stock in the Small and Micro Cap Screener. With a market cap of $42 million and net cash of $15 million, it has an enterprise value of just $27 million. It generated $4 million in operating income last year, which gives it an acquirer’s multiple of 6.5. It generates a 16 percent FCF/EV yield and has bought back more than 13 percent of its stock over the last year.

It’s engaged in the development, licensing and protection of the intellectual property assets. It owns 24 patents that relate to various technologies, including patents covering the delivery of power over Ethernet cables for the purpose of remotely powering network devices, such as wireless access ports, Internet Protocol (IP) phones and network-based cameras; foundational technologies that enable unified search and indexing, displaying and archiving of documents in a computer system; enabling technology for identifying media content on the Internet and taking further action to be performed-based on such identification, and systems and methods for the transmission of audio, video and data in order to achieve quality of service (QoS) over computer and telephony networks.

Long/short equity, special situations, deep value, tech investor Tom Shaughnessy likes it for the reasons below:

Summary

- With $21M+ in cash, no debt, consistent share repurchases of $7.5M+, a $23M NOL carryforwards and a proven multi-million dollar revenue stream with 16 licensees, NTIP is financially rock solid.

- The company’s IP is extremely stable with its key Remote Power Patent overcoming two USTPO re-exams, an IPR, and being licensed (validated) by industry giants such as Cisco.

- The company has two additional avenues of growth which have the potential to provide hundreds of millions in revenue – its Mirror Worlds and Cox patent portfolios.

- 25%+ insider ownership by the company’s impressive CEO Corey Horowitz aligns his interests perfectly with shareholders.

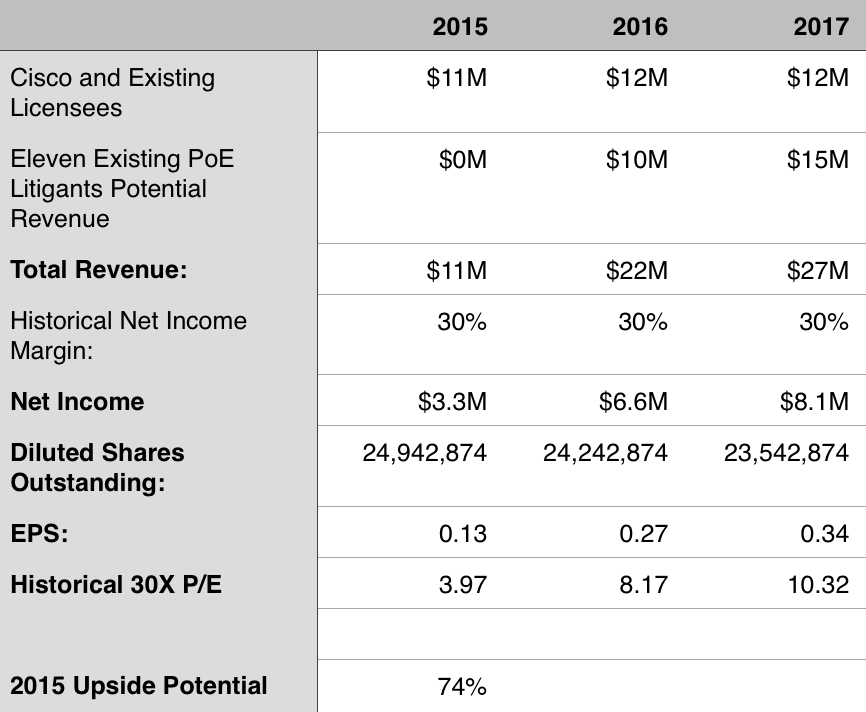

- NTIP’s shares could see a conservative 75% upside growth in 2015 with far greater returns possible for 2016 and beyond.

Purchasing The Company For Free:

As a $56M microcap company, investors have an opportunity to purchase shares, in a way, for free. When subtracting the $21.2M in cash from the company’s market cap, we are left with a $34.8M company.Looking to the near $53M still owed to NTIP potentially from Cisco, we can assume it will amount to roughly $9M per year for the next 6 years (assuming 2015-2020). This is the remaining life of the patent. With a ten percent discount rate, assuming annual payments and a 6 year time period, the present value of these cash flows amounts to just over $39M.Thus, NTIP’s market capitalization minus cash minus the present value of future Cisco royalties yields a negative ~$4.2M. As such, investors are retroactively purchasing NTIP’s shares for free.Further, this does not even take into account any other licensees, potential other royalty streams, or NTIP’s aggressive repurchase plan which is increasing shareholder value.

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: