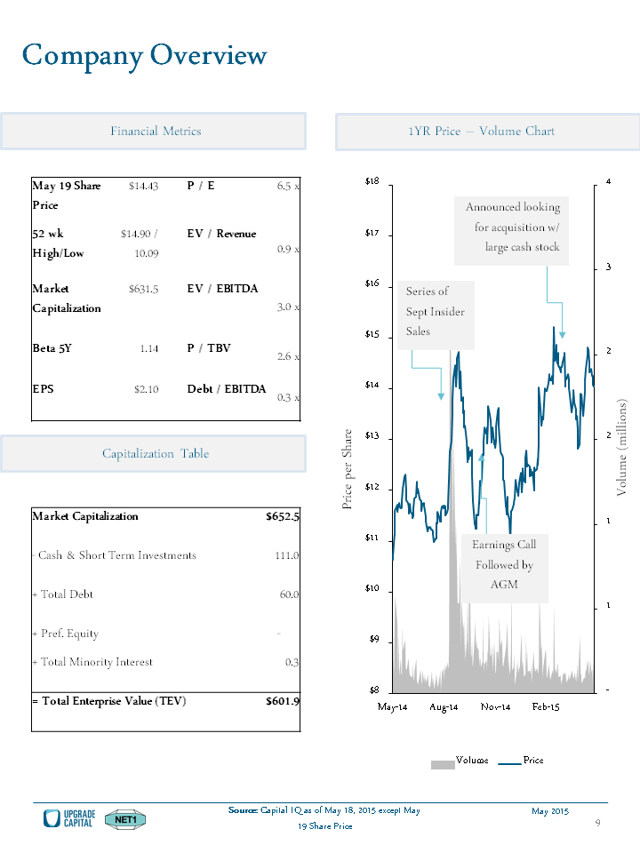

Net 1 UEPS Technologies, Inc. (NASDAQ:UEPS) has been on a tear in 2015, up almost 40 percent year-to-date. Even so, it’s still the tenth cheapest stock in the All Investable Screener with an acquirer’s multiple of 5.7, a PE of 7.7, and a FCF/EV yield of 14.7 percent. It’s bought back $7 million of stock in the last twelve months too, so management are acting on the discount.

- Unbanked population, as defined by the World Bank, has no access to financial services or transaction processing. Instead, many tend to use cash which presents many problems.

- Net1 UEPS’s technology provides much needed services to African and Asian areas that are developing.

- Growing trends in mobile use and mobile payments, coupled with organic growth opportunities provide UEPS with attractive macroeconomic tailwinds.

- Having recently elected to withdraw from RFP bid for new SASSA contract, there will be much more flexibility for the company given its past SASSA history and government regulation.

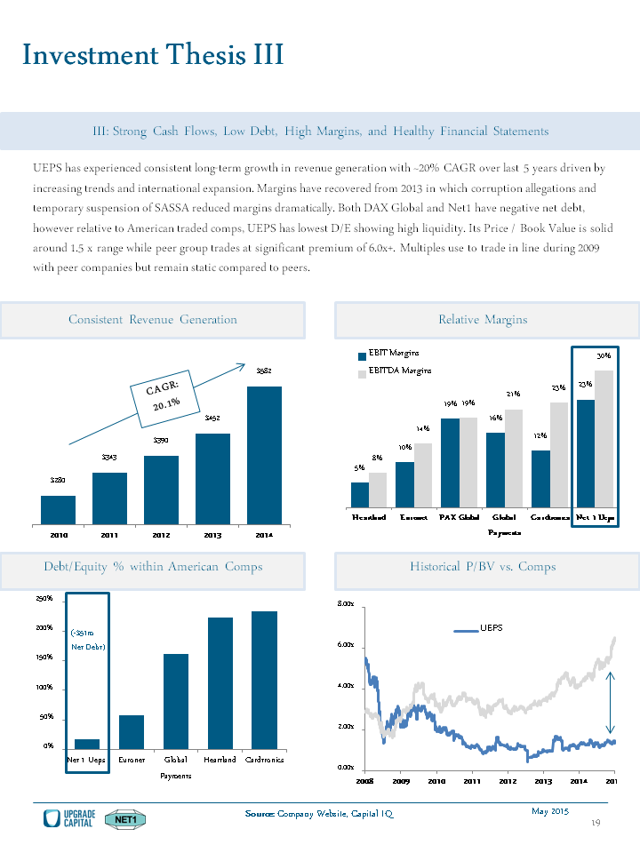

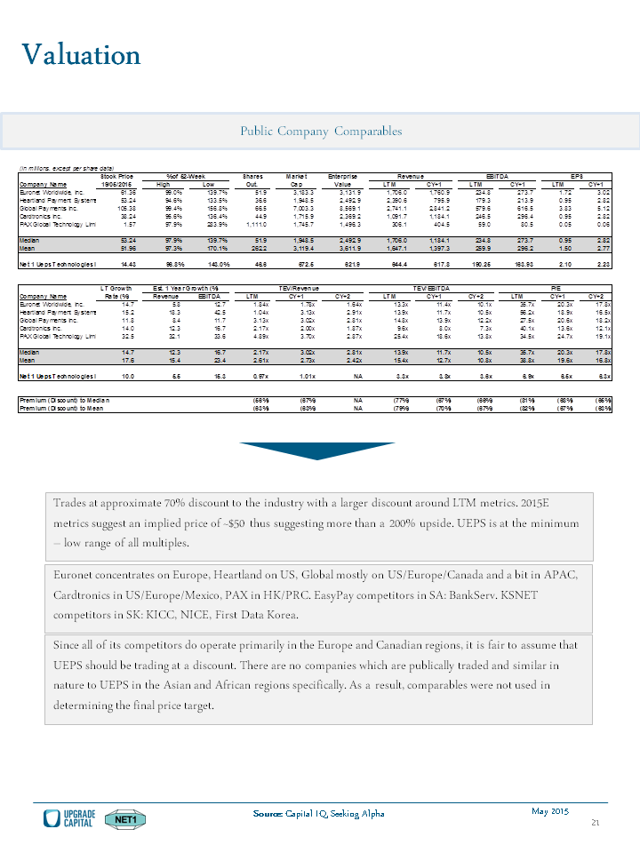

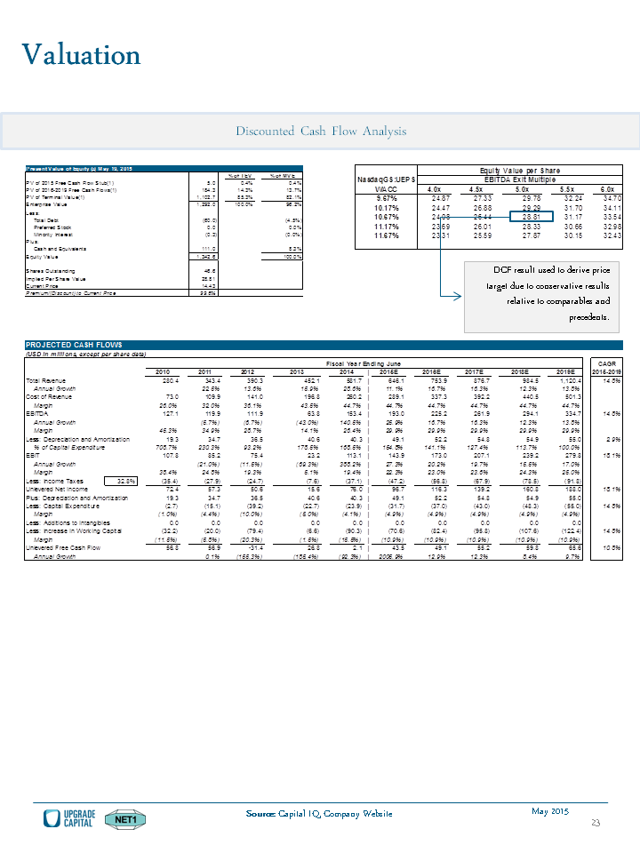

- Healthy financials with strong cash flows, low debt, high margins, high growth (20% 5YR CAGR), and large discount based on relative and intrinsic valuation. DCF implied valuation with 100% upside.

He provides three investment theses.

This is my favored thesis: It’s too cheap!

The PDF of the presentation can be found here.

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: