Kulicke and Soffa Industries, Inc. (NASDAQ:KLIC) is one of the cheapest stocks in the All Investable Screener with an acquirer’s multiple of 5. It has a 10 percent FCF/EV yield, and has bought back 1 percent of its stock over the last 12 months. Long only, value investor and research analyst Arie Goren likes it for its strong, liquid balance sheet, and undervaluation:

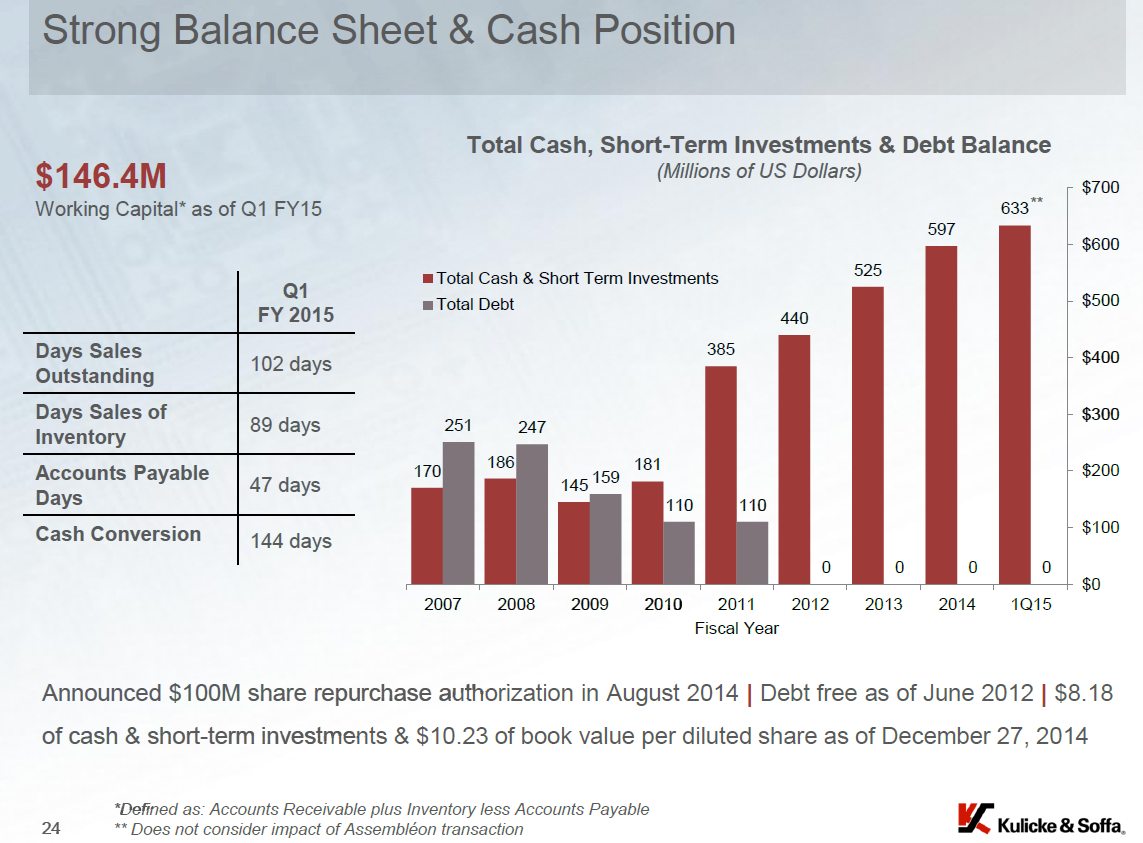

Kulicke and Soffa is taking advantage of its strong balance sheet; cash and cash equivalents of $633 million (after the acquisition) and no debt to significantly grow its markets. [The] Assembléon acquisition expands K&S served available market by nearly 60% and provides additional opportunities for growth.

In my opinion, Kulicke and Soffa has made a smart decision acquiring Assembléon. K&S is expecting to expand its served available market since Assembléon has a strong base of industry leading customers in high growth markets. Moreover, K&S is anticipating that broadening its market reach will improve performance through cyclical market behavior. According to K&S, the deal has compelling valuation, accretive already in the first year.

Valuation

KLIC’s valuation metrics are very good, the forward P/E is low at 13.42, and the price to cash ratio is extremely low at 1.96. In addition, its PEG ratio is low at 1.25, and its Enterprise Value/EBITDA ratio is very low at 5.83. According to James P. O’Shaughnessy, the Enterprise Value/EBITDA ratio is the best-performing single value factor. In his impressive book “What Works on Wall Street,” Mr. O’Shaughnessy demonstrates that 46 years back testing, from 1963 to 2009, have shown that companies with the lowest EV/EBITDA ratio have given the best return. Furthermore, KLIC’s Quick ratio is exceptionally high at 12.30, the 10th highest among the 598 tech stock traded on the Nasdaq exchange.

Summary

Kulicke and Soffa will benefit from expanding its served available market by nearly 60% through Assembléon acquisition; Assembléon has a strong base of industry-leading customers in high growth markets. Kulicke and Soffa has compelling valuation metrics and strong earnings growth prospects; its EV/EBITDA ratio is very low at 5.83. Furthermore, Kulicke and Soffa has an unusually strong balance sheet and zero debt, its price to cash ratio of 1.96 is among the lowest in the tech sector. KLIC has outperformed the market since the start of 2014, however, in my opinion, the stock still has plenty of room to go higher.

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: