Here’s a great article by Barry Ritholz at Bloomberg in which he ranks the most important factors that drive portfolio returns. Here’s an excerpt from that article: What drives the returns of any investment portfolio? Specifically, from the moment someone starts saving for retirement which could be done together with … Read More

Jamie Dimon: Investors Should Not Be Surprised By The Non-Linear Nature of Companies and Markets

Jamie Dimon provides some great insights in his Annual Shareholder Letters at JPMorgan Chase. In his latest letter Dimon makes a great point regarding the non-linear nature of companies and markets. Here’s an excerpt from that letter: Volatility and rapidly moving markets should surprise no one. We are always prepared … Read More

Why A Do-Nothing Approach To Investing Is Often The Right Way To Go

Here’s a great article at The Globe And Mail which illustrates how investors are hurting their returns by actively over trading in stocks saying: “Trading is clearly the enemy of superior returns on a before-tax basis. This is doubly true in the after-tax world in which we all live.” Here’s … Read More

Philip Carret: All Stock Investors Are Speculators By Necessity

One of the best books written on investing is The Art Of Speculation, by Philip Carret. There’s one passage in particular in which Carret illustrates how all stock investors are speculators by necessity. Here’s an excerpt from that book: It is unfortunate that the word “speculation” immediately suggests the word … Read More

Mohnish Pabrai: “We can do really well in the business even if we don’t understand 98% of the markets and the companies in them”

Here’s a great recent interview with Mohnish Pabrai and the folks at ET. During the interview Pabrai provided a number of valuable insights on his value investing approach. Here are some excerpts from that interview: High-uncertainty businesses coupled with low-risk result in high returns… Pabrai: It’s very interesting because stock … Read More

Ray Dalio: “Think About How To Rotate Your Portfolio To Buy That Which Is Cheap And Sell That Which Is Expensive”

Last week Ray Dalio did a question and answer session with some folks on Reddit where he shared a number of valuable investing insights. Dalio started the conversation with the following message: “I’m Ray Dalio—founder of Bridgewater Associates and author of Principles. This is my first AMA. Ask me anything!” My … Read More

Seth Klarman Protege David Abrams Says “Value Investing Is The E = mc² Of Money And Investing”

One of our favorite investors to follow here at The Acquirer’s Multiple is Seth Klarman’s protege David Abrams. Abrams typically shuns the public limelight so it’s difficult to find interviews where he shares his investing strategy. The WSJ did a great story on him back in 2014 titled – Hedge-Fund World’s … Read More

Nassim Taleb: How Frequent The Profit Is Irrelevant; It Is The Magnitude Of The Outcome That Counts

Here’s a great investing lesson by Nassim Taleb from his book Fooled by Randomness. Similarly to Michael Mauboussin in this article, Taleb makes the point that it’s not how frequently you profit from your investments that important, it’s the magnitude of the outcome that counts. Here’s an excerpt from the book: … Read More

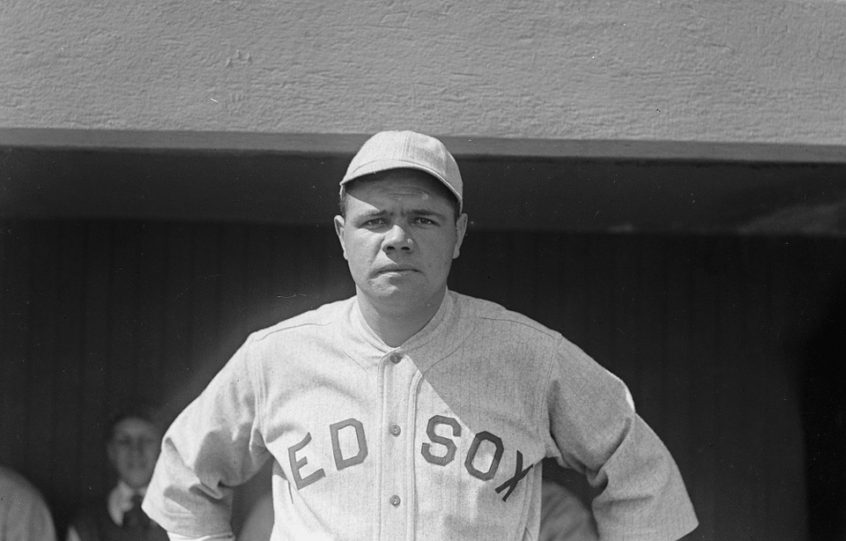

Michael Mauboussin: The Babe Ruth Effect Generates More Successful Returns

Here’s a great lesson from Michael Mauboussin’s book – More Than You Know. Mauboussin highlights the point that when it comes to successful investing it’s not about the frequency of correctness that matters in stock picking, it’s the magnitude of correctness that matters. This is called the Babe Ruth Effect. Here’s an excerpt from … Read More

George Soros: “I Believe That Market Prices Are Always Wrong In The Sense That They Present A Biased View Of The Future”

One of our favorite investing books here at The Acquirer’s Multiple is The Alchemy of Finance by George Soros. There’s one passage in particular which encapsulates Soros’ successful approach to investing and what makes him different to most other investors. Soros writes: In the first ten years of my business … Read More

TIP Mastermind Group Discussion (Including Tobias Carlisle) 2nd Qtr 2018

Every quarter the Mastermind Group from The Investor’s Podcast gets together to discuss their latest investment ideas. In this episode, each member of the group recommends a stock pick that might outperform the S&P 500. After each stock pick, the remaining members of the group pick-apart the idea. In this … Read More

James Montier: “Finance Has Turned The Art Of Transforming The Simple Into The Perplexing Into An Industry”

Some years ago James Montier wrote a great paper called – Was It All Just A Bad Dream? Or, Ten Lessons Not Learnt. Montier’s states that we can learn a great deal about investing by looking back at the mistakes that gave rise to the worst period in markets since the Great Depression … Read More

Howard Marks: The Two Main Risks In The Investment World

One of the best resources for investors are Howard Marks’ memos. One of our favorite memos here at The Acquirer’s Multiple is one he wrote called – Warning Signs in which Marks discusses the two main risks in the investment world. Here is an excerpt from that memo: For about … Read More

The One Thing All Value Investors Can Do To Get You Halfway Home – Irving Kahn

One of our favorite value investors here at The Acquirer’s Multiple is Irving Kahn. Kahn was the Chairman at Kahn Brothers Group which he founded in 1978. He began his career in the value investing business shortly before the stock market crash of 1929, and, in the 1930s, he served … Read More

The 13 Commandments of Successful Value Investing – The Art of Value Investing

One of the best books ever written on value investing is, The Art of Value Investing, by John Heins and Whitney Tilson. Bill Ackman of Pershing Square Capital Management said the following about The Art of Value Investing: “I learned the investment business largely from the work and thinking of other investors. The … Read More

Just Why Do Today’s Worst Performing Stocks Historically Outperform

One of my favorite investing books is A Mathematician Plays The Stockmarket by best selling author – John Allen Paulos. Paulos demonstrates what the tools of mathematics can teach us about the machinations of the stock market. One of my favorite parts of the book focuses on regression to the mean … Read More

Has The Price-To-Book Metric Become Redundant – O’Shaughnessy Asset Management

Just finished reading a great paper by O’Shaughnessy Asset Management that discusses whether the traditional Price-to-Book metric has become redundant because of the increase in shareholder transactions, primarily through the increase in share repurchases. Here’s an excerpt from that paper: Value has broadly been accepted as an investing style and, historically, portfolios … Read More

Investors Shouldn’t Compare Their Performance To Others – Here’s Why

Great article by Ian Cassell at MicroCapClub titled, Don’t Compare Yourself To Others. Ian covers two important issues that all investors can relate to. The first is how to sit still while others are making money, because you can’t find stocks that fit your strategy. The second is how to … Read More

5 Things to Consider Before Buying Today’s Hot Investment

The New York Times provides 5 great tips for investors that are considering buying today’s hottest stocks. Here’s and excerpt from that article: We are again nearing what appear to be all-time highs in the stock market, and when that happens, people tend to say and do strange things. This … Read More

A Very Simple Formula For Figuring Out How Many Stocks To Hold

Here at the Acquirer’s Multiple we believe your equally weighted portfolio should consist of 20-30 stocks generated from our Deep Value Stock Screens. In general terms, holding more stocks leads to greater diversification, and lower volatility, but is harder to manage and requires more purchases. Fewer stocks reduces the number … Read More