During this recent interview with The University of Chicago Booth School, Howard Marks quotes Galbraith saying there’s nothing intelligent to be learned about managing money. Here’s an excerpt from the interview: Well, there’ll be a lot of things that you’ll learn in the investment business. then there’ll be a lot … Read More

Will Microsoft Bing With ChatGPT Destroy Google?

In their latest episode of the VALUE: After Hours Podcast, Brewster, Taylor, and Carlisle discuss Will Microsoft Bing With ChatGPT Destroy Google?. Here’s an excerpt from the episode: Tobias: I got a good one from Samson here. “Is Microsoft Bing with ChatGPT going to destroy Google?” Jake: Oh. Bill: It’s … Read More

David Abrams – Top 10 Holdings – Latest 13F

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

Pzena: The Stage Is Set For Another Powerful Value Cycle

In their latest Q4 2022 Market Commentary, Pzena explain why the stage is set for another powerful value cycle. Here’s an excerpt from the letter: Equity market performance in periods of high inflation and slow or negative GDP growth has been top of mind for many of our clients. While … Read More

Dan Loeb: Invest In Companies That Have Found ‘Religion’

In his latest Q4 2022 Letter, Dan Loeb recommends investing in companies that have found ‘religion’. Here’s an excerpt from the letter: While these results were lackluster, we used market weakness to bring up our exposures, initiate several new positions, and add to others that traded to attractive levels. Notwithstanding … Read More

VALUE: After Hours (S05 E5): Value Spread Wide, Forward Earnings Rolling Over, Soft Landings

In their latest episode of the VALUE: After Hours Podcast, Bill Brewster, Jake Taylor, and Tobias Carlisle discuss: Will Microsoft Bing With ChatGPT Destroy Google? Steve Jobs Would Not Approve Of Apple Today Is Meta Heading The Same Way As The CD-ROM? It Always Looks Like A Soft Landing Synthetic … Read More

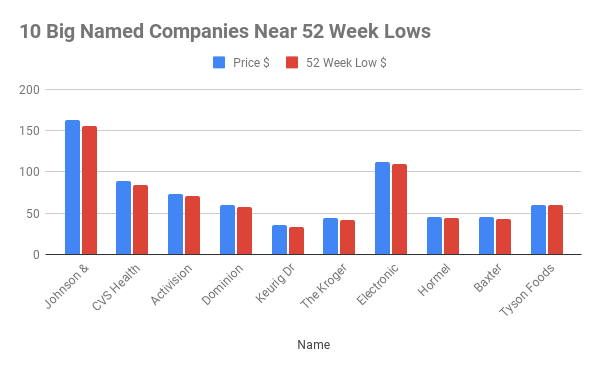

This Week’s 10 Big Named Companies Near 52 Week Lows

Over the past twelve months a number of big named companies have been near or below their 52 week low price. Each week we’ll take a look at some of the biggest names currently close to their 52 week lows: Symbol Name Price $ 52 Week Low $ JNJ Johnson … Read More

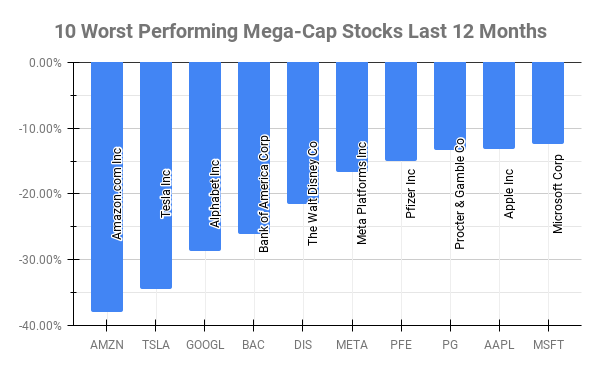

This Week’s 10 Worst Performing Mega-Cap Stocks Last 12 Months

Over the past twelve months ten Mega-Cap stocks have underperformed all others. Mega-Caps are defined by $200 Billion Market Cap or more. Here’s this week’s top 10 worst performing Mega-Caps in the last twelve months: Symbol Name 1 Year Price Returns (Daily) AMZN Amazon.com Inc -38.02% TSLA Tesla Inc -34.50% … Read More

Stock In Focus – TAM Stock Screener – West Fraser Timber Co. Ltd (WFG)

As part of our ongoing series here at The Acquirer’s Multiple, we provide this feature article titled ‘Stock in Focus‘ where we focus on one of the stocks from our Stock Screeners. One of the cheapest stocks in our Stock Screeners is: West Fraser Timber Co. Ltd (WFG) West Fraser Timber is a … Read More

This Week’s Best Value Investing News, Podcasts, Interviews (2/10/2023)

This week’s best investing news: Howard Marks on China, Risk, and Interest Rates (Motley Fool) A Brief History Of Post-Bubble Markets (Jamie Catherwood) Baupost chief Seth Klarman blames Federal Reserve for ‘financial fantasyland’ (FT) We Measure What We Can (Verdad) Terry Smith: one of the biggest mistakes I’ve made with … Read More

Why Netflix Is An Amazing Business Story

In their latest episode of the VALUE: After Hours Podcast, Brewster, Taylor, and Carlisle discuss Why Netflix Is An Amazing Business Story. Here’s an excerpt from the episode: Bill: On something like Warner Brothers, it’s not the type of thing I want to own anymore. I’m not that interested in … Read More

This Acquirers Multiple Stock Appearing In Dalio, Simons, Pzena Portfolios

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, … Read More

Terry Smith: Where To Find The Great Businesses Of The Future

In this interview with AJ Bell, Terry Smith discussed where to find the great businesses of the future. Here’s an excerpt from the interview: Smith: The same place they came from in the past actually. I will go back once again, third time in one interview, to the Warren Buffett … Read More

Charles Munger: What Makes Li Lu A Great Investor

During the 2018 Daily Journal Annual Meeting, Charles Munger was asked about the talent of Li Lu. Here’s an excerpt from the meeting: Munger: The second question was Li Lu. What was unusual about Li Lu. Li Lu is one of the most successful investors. Imagine him, he just popped … Read More

Soft Landing Or Big Flush Coming?

In their latest episode of the VALUE: After Hours Podcast, Brewster, Taylor, and Carlisle discuss Soft Landing Or Big Flush Coming? Here’s an excerpt from the episode: Tobias: I don’t want to misquote Chanos here, but he said something like he never seen a market bottom as high as this … Read More

One Stock Superinvestors Are Selling

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in superinvestors who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth … Read More

GMO: 2022 – U.S. Large Caps – The Value/Growth Spread Was A Stunning 24% In Favor Of Value

In their recent Q4 2022 Letter, GMO highlighted that in 2022 within U.S. large caps, the value/growth spread was a stunning 24% in favor of value. Here’s an excerpt from the letter: Even within at least one strategy that looks to have been perfectly JOMO – the value versus growth … Read More

Michael Burry: Investors Who Turn Over The Most Stones Will Find The Most Success

In his 2001 Scion Capital Letter, Michael Burry says investors who turn over the most stones will find the most success. Here’s an excerpt from the letter: When evaluating an options compensation program, one must weigh the net value creation from (a) the issuance of excess options-related stock at prices … Read More

Where Are All The Bankruptcies?

In their latest episode of the VALUE: After Hours Podcast, Brewster, Taylor, and Carlisle discuss Where Are All The Bankruptcies? Here’s an excerpt from the episode: Tobias: Yeah, that’s a good idea. Well, I was going to say I saw Chanos– Chanos said that the market had never bottomed this … Read More

David Herro: Value Opportunities In International Investing

During his latest presentation, David Herro discusses value opportunities in international investing. Here’s an excerpt from the presentation: Herro: When you look at the world today, we could divide it, the world outside the United States into Asia, Japan, Emerging Markets, and Europe and the UK. When you look at … Read More