One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

Jim Chanos: “Being Short With A Good Short Seller Who’s Producing Nominally Minor Positive Returns In A Bull Market Enables You To Be More Long”

One of our favorite Jim Chanos interviews is one he did with FT Alphachatterbox in which he explained how short selling provides ‘long-side’ investors with an insurance policy saying: “Being short with a good short seller who’s producing nominally minor positive returns in a bull market enables you to be … Read More

Howard Marks: Going To Cash Under Almost All Circumstances Is Stupid!

Here’s a great interview with Howard Marks at Goldman Sachs in which Marks discusses why going to cash under almost all circumstances is stupid, and why market timing is impossible. Here’s an excerpt from the interview: Interviewer: Now that Oaktree is now $120 billion, and I understand not all pools … Read More

Charlie Munger: Moral Investing – We Could See It Was Like Putting $100 Million In A Bushel Basket And Setting It On Fire As We Walked Away

Here’s a great video with Charles Munger and Warren Buffett at the 2005 Berkshire Hathaway shareholder meeting in which they discuss the moral distinction between buying a stock and a company. Here’s an excerpt from the video: CHARLIE MUNGER: Yeah. I think he’s asking in part, are there some businesses … Read More

John (Jack) Bogle: 6 Books That Every Investor Should Read

We recently started a series called – Superinvestors: Books That Every Investor Should Read. So far we’ve provided the book recommendations from: Charles Munger: 32 Books That Every Investor Should Read Seth Klarman: 32 Books That Every Investor Should Read Warren Buffett: 35 Books That Every Investor Should Read Bill … Read More

TAM Stock Screener – Stocks Appearing in Cohen, Griffin, Simons Portfolios

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, … Read More

This Week’s Best Investing Reads 11/02/2018

Here’s a list of this week’s best investing reads: The Surprising Power of The Long Game (Farnam Street) The Relative Anchor in Rates (A Wealth of Common Sense) A Top or The Top? (The Irrelevant Investor) Shiller: Stocks Could Rise Higher Before They Fall (Validea) Tax-Loss Selling: A Silver Lining in Volatile Markets (Morningstar) … Read More

Stephen Mandel: Top 10 Holdings, New Buys, Sold Out Positions

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

Jim Simons: Investing Is a Very ‘Gut Wrenching’ Business But You Can Find Things That Are Predictive

Here’s a great video interview with Jim Simons in which he discusses how his early success came more from luck than strategy. He also discusses how gut wrenching investing can be, how the efficient market theory is wrong, and how machine learning is only as good as the humans operating … Read More

Joel Greenblatt: Redefining ‘Traditional’ Value Investing So That It Never Goes Out Of Favor

Here’s a great interview with Joel Greenblatt at Bloomberg in which he discusses the types of businesses he’s currently looking for and how he’s redefined the ‘traditional’ value investing strategy so that it never goes out of favor’ Here’s an excerpt from the interview: We try to stick to companies … Read More

Charlie Munger: That Decision Has Cost Me Now About $5 Billion

Here’s a great recent interview with Charlie Munger & Li Lui in which Munger recalls one of his greatest investment mistakes that cost him $5 Billion. Here’s his recollection: Munger: Let’s take a simple question. As I said in that book. They offered me three hundred shares in Belridge Oil, which … Read More

A Value Investor’s Reading List: 26 Books

We recently started a series called – Superinvestors: Books That Every Investor Should Read. So far we’ve provided the book recommendations from: Charles Munger: 32 Books That Every Investor Should Read Seth Klarman: 32 Books That Every Investor Should Read Warren Buffett: 35 Books That Every Investor Should Read Bill … Read More

Dan Loeb: Top 10 Holdings, New Buys, Sold Out Positions

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

This Week’s Best Investing Reads 10/26/2018

Here’s a list of this week’s best investing reads: And now…a reality check (The Reformed Broker) Hemingway, a Lost Suitcase, and the Recipe for Stupidity (Farnam Street) DotCom Deja Vu (The Felder Report) Can the Stock Market Predict The Next Recession? (A Wealth of Common Sense) Value Investing Claims Another Casualty as $5 Billion … Read More

TAM Stock Screener – Stocks Appearing in Dalio, Greenblatt, Griffin Portfolios

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, … Read More

Bruce Greenwald: How Smart Investors Can Take Advantage Of Overconfident Investors – Which Is Most Of Us!

We’ve just been watching Bruce Greenwald’s 2014 presentation at the International Post Keynesian Conference in which he illustrates how smart investors can take advantage of overconfident investors, which is most of us, saying: Human beings are constituted and cannot stop themselves from believing they know what they know with a … Read More

Joel Greenblatt: Today’s Opportunity Set Is Significant

We’ve just finished reading Joel Greenblatt’s Q318 market commentary in which he says: U.S. Equity Markets Remain Very Expensive (based on our 28 year valuation history) Valuations are high Markets are speculative The Large Disparity Between Growth & Value has continued Outperformance of growth and momentum driven indexes over value … Read More

Murray Stahl: “Perhaps A Superior Method To Reduce Portfolio Risk Could Be To Have No Diversification. If You Had Only One Holding”

We’ve just been reading the latest Q318 market commentary by Murray Stahl which discusses the possible benefits of concentrating ones portfolio to achieve outperformance. His article illustrates how this concentrated approach led to some serious outperformance by three of the greatest investors of all time, Warren Buffett, Charles Munger, and … Read More

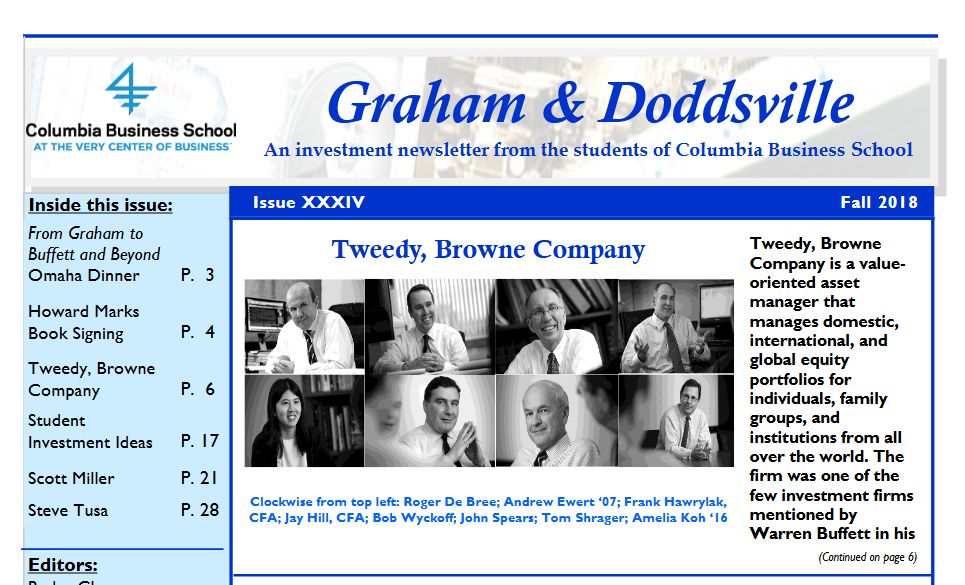

Graham & Doddsville Fall Newsletter 2018

The Graham & Doddsville Fall Newsletter has recently been released featuring interviews with the team at Tweedy Browne Company, Scott Miller at Greenhaven Road Capital, and JP Morgan’s Steve Tusa. Of particular interest to value investors is the interview with the folks at Tweedy Browne who discuss how Ben Graham’s … Read More

Charlie Munger On Telsa and Elon Musk

We’ve just been watching a great recent interview with Charlie Munger in which he was asked his thoughts on Telsa and Elon Musk. Here’s his response: Munger: Well it’s already created more significance than anybody would have predicted and its founder is bold and brilliant and swings for the fences. … Read More