This week’s best investing news:

Howard Marks Memo: The Illusion of Knowledge (OakTree)

Pandemic, Recession, Roaring Twenties… Repeat? (Jamie Catherwood)

Billionaire investor Bill Ackman: The Fed has to raise rates to 4% or more (CNBC)

Warren Buffett’s Berkshire Offloads More Shares in Chinese EV Giant BYD (Yahoo)

How to Invest (Verdad)

Mohnish Pabrai speaks with Lauren Templeton on Women Investors and Global Investing (Chai with Pabrai)

Turn off your tape recorders (Rudy Havenstein)

Cliff Asness, Interview Goldman Sachs (GS)

Jeffrey Gundlach: The Period of Abundance Is Over (The Market)

Good Enough (Collab Fund)

Ray Dalio: How the Patterns of History are Playing out Right Now (Ray Dalio)

Fill Them Up (Humble Dollar)

Alibaba And JD.com: Market Absurdity Clashes Against Munger Sanity (Seeking Alpha)

Companies Haven’t Paid Dividends Since 2020 (Validea)

Business Dudes Need to Stop Talking Like This (The Atlantic)

Jim Rogers: When Things Go Wrong, I Want Gold in the Closet and Silver Under the Bed (Commodity Culture)

GMO: Investing For Retirement III: Understanding and Dealing with Sequence Risk (GMO)

Unicorn Accounting: Aswath Damodaran (Solution Nation)

Jeffrey Gundlach says yield curve inversions are ‘reliable signals of economic trouble’ (CNBC)

Transcript: Lynn Martin (Barry Ritholz)

Be Willing to Endure Short Term Pain for Long Term Gain l Vitaliy Katsenelson (MWIE)

Equities Start Month in Deeply Undervalued Territory After Latest Pullback (Morningstar)

Major Asset Classes | August 2022 | Performance Review (Capital Speculator)

Fed should only raise another 100 bps through year-end, says Wharton’s Jeremy Siegel (CNBC)

The Tiger That Was a Wolf: Lessons From Julian Robertson (Neckar)

Dr. Malone, Slow Your Roll on the Levered Share Repurchase (Compounding Capital)

Metals of the Future Drive Opportunities in Frontier Markets (William Blair)

The Stock Market’s Real Inflation Fighters Might Surprise You (WSJ)

Quant funds snap up shares in Warren Buffett’s Berkshire Hathaway (FT)

This week’s best value Investing news:

Is a new golden age of value coming? (Klement)

An Advisor’s Guide to Current Markets and the Reemergence of Value (Nasdaq)

Sarah Ketterer: ‘Forget Value, Think Valuation’ (Morningstar)

Warren Buffett, Graham and Dodd and Now, Sound Shore Management: Classic Value Investors are Happy Investors (Wall Street Transcript))

Marlena Lee, DFA – Value, Fama & Weathering Bear Markets (Meb Faber)

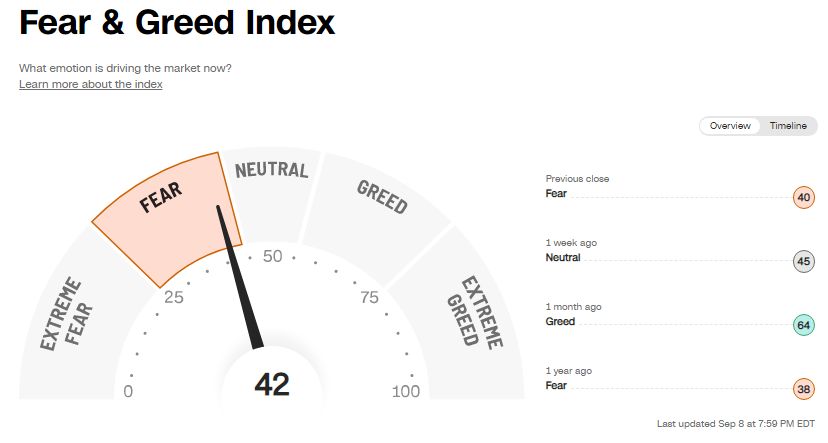

This week’s Fear & Greed Index:

This week’s best investing podcasts:

The Illusion of Knowledge (Howard Marks)

John Rogers, Co-CEO of Ariel Investments (Boyar)

Classic 21: Inflation or Deflation w/ Jeff Booth (TIP)

Ep. 241 – Lessons from Working with Investment Legends like Peter Lynch, Michael Price (Planet MicroCap)

Mitch Lasky – The Business of Gaming (Invest Like The Best)

#146 Barbara Tversky: Action Shapes Thought (Knowledge Project)

Ted Seides – Insights on investing and podcasting (Capital Allocators)

Show Us Your Portfolio: Ryan Krueger (Excess Returns)

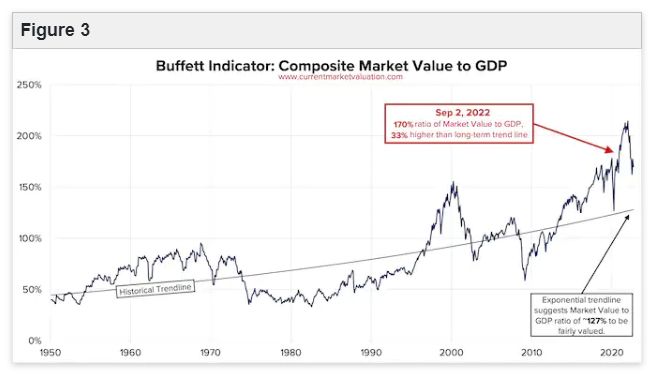

This week’s Buffett Indicator:

Fairly Valued.

This week’s best investing research:

Global Factor Performance: September 2022 (AlphaArchitect)

Equity Risk Premium Forum: The Stock/Bond Correlation Switch-Up (CFA)

How to Overhaul the Tried-and-Tested Investment Portfolio When Inflation Soars (AllAboutAlpha)

When in a slowdown ,take sector beta risk off the table (DSGMV)

This week’s best investing tweet:

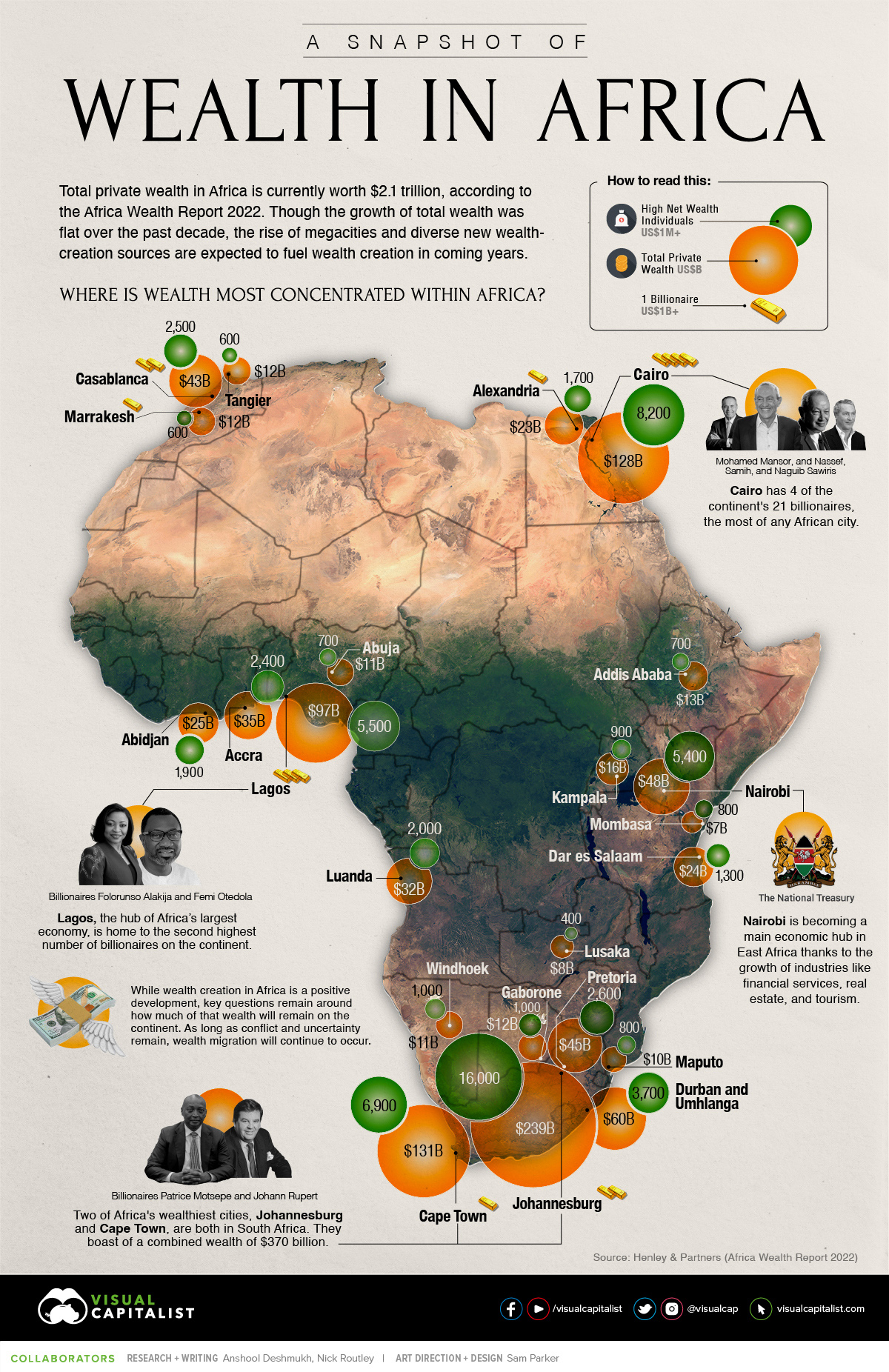

This week’s best investing graphic:

Mapped: A Snapshot of Wealth in Africa (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: