One of the cheapest stocks in our All Investable Stock Screener is Gilead Sciences Inc (NASDAQ:GILD). Gilead Sciences, Inc. (Gilead) is a research-based biopharmaceutical company that discovers, develops and commercializes medicines in areas of unmet medical need. The Company’s portfolio of products and pipeline of investigational drugs includes treatments for Human … Read More

Howard Marks – The Performance of Stocks With P/E Ratios In The Twenties Is Likely To Be Single Digit

Here’s a great piece by Howard Marks from his 2000 memo where he asks the bulls one question: What’s been the average performance of stocks bought at p/e ratios in the twenties? I don’t think the return has been in double digits. I’m not even sure it’s been positive! Here’s … Read More

Tweedy Browne – Unlike A Fruit Fly We Are All Blessed With The Ability To Take A Longer Term Perspective

One of the best resources available to value investors are the shareholder letters from Tweedy Browne. Tweedy Browne is one of the longest serving value investing firms in the United States and was founded in 1920 by Forrest Berwind “Bill” Tweedy. When Bill Tweedy founded his firm, he concentrated in … Read More

Here’s Why Pat Dorsey Would Like The Acquirer’s Multiple

One of my favorite investors is Pat Dorsey. Dorsey is the founder of Dorsey Asset Management and he’s also the author of two books, The Five Rules for Successful Stock Investing and The Little Book that Builds Wealth. Recently I was re-reading The Little Book That Builds Wealth and came across … Read More

John Neff – How To Find The Best Undervalued Stocks Using A Low P/E Strategy

One of my favorite contrarian investors is John Neff. His success using a low P/E strategy is best described in an article by Morningstar: His wager on Ford Motor Company in 1984 was said to be one of his best. When many feared that the company’s sales were due to … Read More

Undervalued Foot Locker Inc, FCF/EV Yield 9%, Shareholder Yield 8% – Large Cap 1000 Stock Screener

One of the cheapest stocks in our Large Cap 1000 stock screener is Foot Locker Inc (NYSE:FL). Foot Locker Inc. (Foot Locker) is a retailer of shoes and apparel. The company operates through two segments: Athletic Stores and Direct-to-Customers. The company is an athletic footwear and apparel retailer, with businesses that … Read More

How To Develop A Superinvestor Mindset Like Buffett, Munger, Neff, Loeb, Lynch and Soros

One of my favorite investing books is How To Think Like Benjamin Graham and Invest Like Warren Buffett, by Lawrence A Cunningham. One of the best pieces in the book looks at the principles applied by some of the greatest superinvestors of all time. Here’s an excerpt from the book: The … Read More

Sam Zell – How To Find Great Investment Opportunities When Others See Distress

One of my favorite investors is Sam Zell. According to Forbes, Zell is one of America’s most prolific real estate investors, Sam Zell is the son of a Polish grain merchant. His parents and sister escaped Poland by train hours before Hitler’s army bombed the tracks that ran through their … Read More

Undervalued InterDigital Inc FCF/EV Yield 16% – All Investable Stock Screener

One of the most undervalued stocks in our U.S. All Investable stock screener is InterDigital Inc (NASDAQ:IDCC). InterDigital, Inc. (InterDigital) designs and develops technologies for wireless communications. The company is focused on three technology areas: cellular wireless technology, Internet of things (IoT) technology, and, through its Hillcrest Laboratories, Inc. (Hillcrest … Read More

Charlie Munger Says The Investment Management System Is Bonkers – Here’s Why

One of my favorite investing tomes is Poor Charlie’s Almanack by Charles Munger. As an investor, it’s the one book you need to read on ‘rational’ investing strategy. A quick look on Amazon shows that there are fourteen used copies selling for $162.01 and one new copy for $50,000. That … Read More

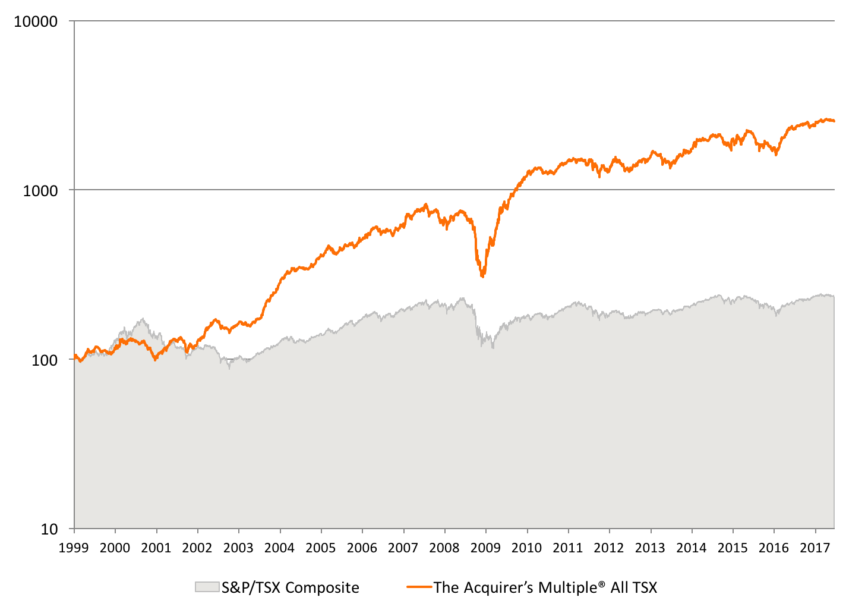

Our New Canadian Deep Value Stock Screener – (CAGR) 19.1% per year

Big news this week with the release of our new Canadian All TSX deep value stock screener, and the backtest results are astounding! Backtesting Results Canada All TSX Stock Screen We backtested the returns to a theoretical portfolio of stocks selected by The Acquirer’s Multiple® from the Canada All TSX stock screen. … Read More

Seth Klarman – The Definitive Guide On Why Bottom-Up Investing Trounces Top-Down Investing

There’s a lot of discussion on which is the better investing strategy, bottom-up investing or top-down investing. The definitive guide can be found in Chapter 7 of Seth Klarman’s book, Margin of Safety. Here’s an excerpt from that book: There is no margin of safety in top-down investing. Topdown investors are … Read More

Mohnish Pabrai – How To Calculate Intrinsic Value

I’ve just been re-reading one of my favorite investing books of all time, The Dhando Investor, written by Mohnish Pabrai. In Chapter 7, Dhandho 102: Invest in Simple Businesses, Pabrai provides a very simple example of how to calculate intrinsic value using the real life example of Bed Bath & Beyond Inc … Read More

The Acquirer’s Multiple® Canada All TSX Stock Screen Backtest

Chart 1. Returns from January 2, 1999 to June 16, 2017 (Log.) We backtested the returns to a theoretical portfolio of stocks selected by The Acquirer’s Multiple® from the Canada All TSX stock screen. The backtest assumed the screen bought and held for a year 30 stocks selected from the All TSX universe … Read More

Howard Marks – Anticipate – And Avoid – Pitfalls That Others Will Rue After The Fact

With the stock market reaching all time highs, maybe it’s a good time to revisit Howard Marks’ memo of 2005 in which he discusses market trends being taken to excess – and the painful consequences that become clear in hindsight. Here’s an except from that memo: “The farther backward you … Read More

So Value Investing Is Not Dead According To Goldmans

I had to smile when I read this article on Bloomberg titled, Goldman Sachs Mulls the Death of Value Investing. The article states: There isn’t much value in value investing these days. The value-factor strategy of buying stocks with the lowest valuations and selling those with the highest, pioneered by Eugene … Read More

Bill Nygren – How To Apply A Private-Equity Approach To Public-Equity Investing

Great interview with Bill Nygren and Win Murray from Oakmark Capital in last month’s Value Investor Insight Newsletter. On the subject of passive vs active investing Nygren says, “I think it’s ironic that an increase in the number of dollars invested without thought as to where value is and isn’t would make … Read More

A Very Simple Formula For Figuring Out How Many Stocks To Hold

Here at the Acquirer’s Multiple we believe your equally weighted portfolio should consist of 20-30 stocks generated from our Deep Value Stock Screens. In general terms, holding more stocks leads to greater diversification, and lower volatility, but is harder to manage and requires more purchases. Fewer stocks reduces the number … Read More

Athanassakos Rebukes Another Bogus Study That ‘Proves’ Value Investing Doesn’t Work

George Athaassakos recently wrote a great article that illustrates why most studies that ‘prove’ value investing doesn’t work, are not entirely accurate. Here’s an excerpt from that article: A new study from Arizona State University, titled Do Stocks Outperform Treasury Bills?, is turning heads and gives ammunition to those who … Read More

Alio Gold Jumps 19% Last 5 Days – TAM Deep Value Stock Screener

One of the cheapest stocks in our All Investable Deep Value Stock Screener is Alio Gold Inc (NYSEMKT:ALO). Alio Gold Inc (Alio), formerly Timmins Gold Corp, is a Canada-based gold producer engaged in the operation, development, exploration and acquisition of resource properties in Mexico through its subsidiaries, Timmins Goldcorp Mexico, S.A. de … Read More